SEBI member hails consensus on UPA and NDA economic policies

“As the government is going to be more and more oriented towards fiscal rectitude, we talked a lot about political lack of homogeneity in thoughts, the previous government of UPA left with a fiscal target of 3.2 per cent and this government took over with the same fiscal target in mind,” said whole time member of the Securities and Exchange Board of India (SEBI) G. Mahalingam said while addressing an ASSOCHAM conference on Bond Market.

“So despite all the difference of opinion on political horizon, the good thing that we need to celebrate in the country is as far as economic things are concerned, there is a broad consensus emerging and that is what is demonstrated by the fact that even this year’s current budget is swearing by 3.2 per cent as fiscal target with three per cent being reached in the immediate horizon,” said Mahalingam.

He added that in such a scenario the government borrowing program is going to come down and the space is going to be taken over by corporate bonds and commensurate with that the Reserve Bank of India (RBI) is reducing both SLR (statutory liquidity ratio) and held to maturity portfolio of the overall portfolio of banks.

“All this is going to augur very well for the corporate bond market,” said Mahalingam.

He informed that in the current year, the amount of bonds that have been raised is actually surpassing the bank credit. “This is something which is happening perhaps first time in the history of the country that slowly and steadily the bond market is growing and perhaps none of us is aware that it is growing.”

He said that today the bond market is developing not simply only on its own legs but also because the government has yielded a lot of space to the bonds.

“The government is borrowing around Rs 5.80 lakh crores, just about a couple of years back. Looking at the current budget, the government is budgeting to borrow just about Rs 3.48 lakh crores, where does this Rs 2 lakh crore space get filled up, this is where the corporate bond market has to play a very important role,” said the whole time member of India’s capital markets regulator.

He said the reason for this is that people generally think growth in bond market is associated with secondary market trading and unless it is vibrant nobody recognises this market at all.

Stressing upon the need to look at ways of developing secondary market trading, Mahalingam said, “While on tone hand we have been successful in the primary market, we have not been so successful in the secondary market that we need to really put our minds together and do something about it.”

He said that though a lot of ecosystems have been developed in the country, but they have not gone full distance. “We still have to cover little bit of distance where a person should be able to get a government bond with just about five minutes notice, unfortunately, that is not happening and once it happens, perhaps we can think of the next is corporate bonds availability which will become as simple as government bond.”

The top SEBI official also said that apart from creating an ecosystem where the primary market acquisition becomes simpler, there is need to create a secondary market equivalent to that of equities. “We have done a lot in equity as far as secondary market is concerned and we can say with a fair sense of conviction, no country in the world could match with us in terms of the progress we have made in equities in terms of - dematerialisation, default pre-settlements, trading with ease and every other thing.”

“So, the question that all stakeholders need to address is about how to create an ecosystem, where acquiring a government security either in the primary or secondary market is going to be simple,” added Mahalingam.

He informed that while the bank deposits today are Rs 105 lakh crores, the total amount of investments in bonds (leaving apart government bonds) is about one-fourth of it. “We need to go a long way, perhaps the coming days belong to the bond market and less to other markets, people are going to realise the value of bonds.”

He also said that both RBI and SEBI have put in place several measures in the last about 3-5 years, which would actually lend greater amount of attractiveness to the bonds, particularly to the secondary market trading in bonds.

However, the regulators have to bear in mind that over a period of time there would be the need to move towards what the world is moving i.e. perhaps the corporate bonds have to be included as part of high-quality liquid assets (HQLA).

Other speakers included M Narendra, Chairman - ASSOCHAM's National Council for Banking and Finance; D.S. Rawat, Secretary-General- ASSOCHAM; Samar Banwat, Executive Vice-President - NSDL; Dr Arvind Mayaram, former Union Finance Secretary and Chairman, CUTS Institute for Regulation & Competition; Nagarajan Narasimhan, Senior Director & Business Head, CRISIL Research; Ashvin Parekh, Managing Partner, Ashvin Parekh Advisory Services; and Ashish Kumar Chauhan, MD & CEO, BSE.

Other speakers included M Narendra, Chairman - ASSOCHAM's National Council for Banking and Finance; D.S. Rawat, Secretary-General- ASSOCHAM; Samar Banwat, Executive Vice-President - NSDL; Dr Arvind Mayaram, former Union Finance Secretary and Chairman, CUTS Institute for Regulation & Competition; Nagarajan Narasimhan, Senior Director & Business Head, CRISIL Research; Ashvin Parekh, Managing Partner, Ashvin Parekh Advisory Services; and Ashish Kumar Chauhan, MD & CEO, BSE.

The speakers primarily dwelt on the role of the bond market in creating a vibrant economy in India, the global bond market ecosystem, and the bond market perspective - its size, participants, dynamics and changing scenario in India.

There were two technical sessions after the tea-break which had a bevy of topics ranging from the the importance of debt market in the economy, to the importance of intermediaries distributors in investor education and penetration.

(Additional reporting by Sagar Ghosh)

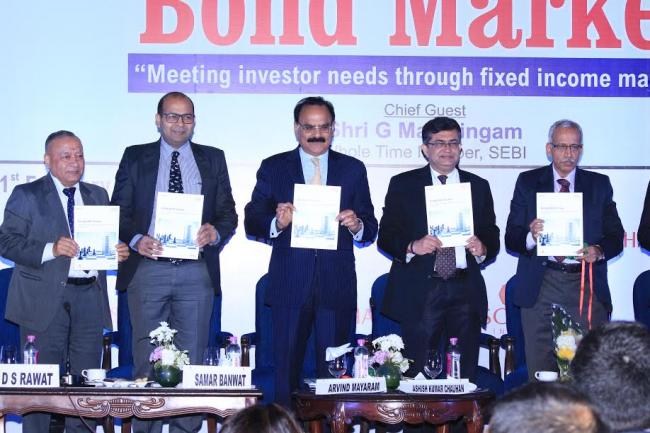

Image Captions: SEBI whole-time member Mahalingam (extreme right) releasing summit background paper at an ASSOCHAM conference on Bond Market held in Kolkata today. Also seen in the picture are (L-R) Mr D.S. Rawat, secretary general, ASSOCHAM; Mr Samar Banwat, executive vice-president, NSDL; Dr Arvind Mayaram, former union finance secretary and chairman, CUTS Institute for Regulation & Competition and Mr Ashish Kumar Chauhan, MD & CEO, BSE.

Caption: IMG_6777: SEBI whole-time member, G. Mahalingam addressing an ASSOCHAM conference on Bond Market held in Kolkata today.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.