Atal Pension Yojana reaches subscriber base of 53 lakh

The Ministry said that at present 235 banks and Department of Post are involved with the implementation of the scheme.

Besides the branches of the banks and CBS-enabled offices of India Post, quite a few banks are sourcing subscribers through their internet banking portals in a paperless environment.

The APY Scheme follows the same investment pattern as applicable to the NPS contribution of central government employees.

During the year 2016-17, it has earned a return of 13.91%, the release said.

With a view to empower the APY subscribers, new functionalities have been developed where under a subscriber can view and print the ePRAN card and Statement of Transactions.

Further, the subscriber can register complaints/ grievance by providing his/ her PRAN details on https://npslite-nsdl.com/CRAlite/grievanceSub.do.

Presently males account for 62% of the subscribers and female for about 38%.

Most of the subscribers have opted for monthly contribution; about 97.5% of the subscribers are contributing at monthly intervals, about 0.8% at quarterly intervals and about 1.7% at half yearly intervals, according to the release.

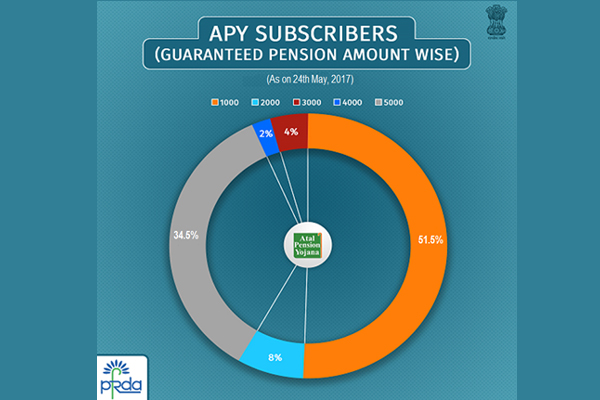

A majority of the subscribers have opted for a monthly pension of Rs. 1000.

Presently 51.5% subscribers have opted for a monthly pension of Rs.1000 and 34.5% of the subscribers have opted for a monthly pension of Rs.5000.

The Atal Pension Yojana became operational from June 1, 2015 and is available to all the citizens of India in the age group of 18-40 years.

Under the scheme, a subscriber would receive a minimum guaranteed pension of Rs.1000 to Rs. 5000 per month, depending upon his contribution, from the age of 60 years.

The same pension would be paid to the spouse of the subscriber and on the demise of both the subscriber and the spouse, the accumulated pension wealth is returned to the nominee.

Image: PIB

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.