February 21, 2026 01:31 am (IST)

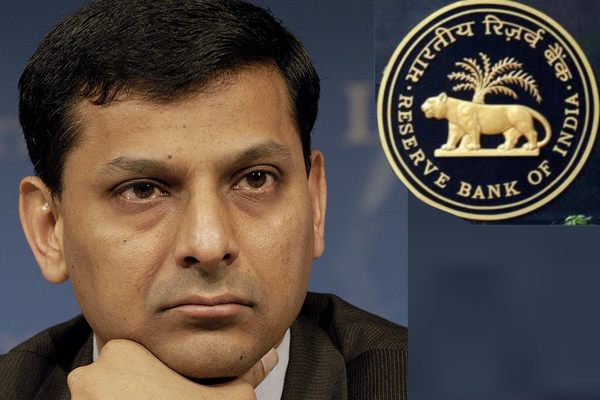

Brexit: RBI governor Rajan says India will overcome the impact

Basil, Switzerland, June 24 (IBNS): Reserve Bank of India (RBI) Governor Raghuram G Rajan on Friday said India will survive the impact of Brexit or Britain exiting from the European Union owing to its strong fundamentals and sizeable foreign reserves.

"The Indian economy has good fundamentals, low short term external debt, and sizeable foreign reserves. These should stand the country in good stead in the days to come," he said.

"It looks increasingly clear that the United Kingdom has voted to exit the European Union. Markets are trying to factor the consequences of this development and this has already led to sharp corrections in financial markets around the world," he said.

"Reserve Bank is continuously maintaining a close vigil on the market developments, both domestically and internationally, and will take all necessary steps, including liquidity support (both dollar and INR), to ensure orderly conditions in financial markets," he said.

He said there will not be any dramatic effect on trade immediately.

He said if there is any area of liquidity crisis immediately, all central banks of countries can inject liquidity.

Earlier, Indian Finance Minister Arun Jaitley said the country is prepared well to deal with the short and medium term consequences of Briton leaving the European Union in a historic referendum.

"As regards, the Indian economy, we are well prepared to deal with the short and medium term consequences of Brexit. We are strongly committed to our macro-economic framework with its focus on maintaining stability," said Jaitley.

"Our macro-economic fundamentals are sound with a very comfortable external position, a rock-solid commitment to fiscal discipline, and declining inflation. Our immediate and medium-term firewalls are solid too in the form of a healthy reserve position," he said.

True to the prediction of a financial market shock that the Brexit will cause, stock markets across the globe remained bearish after Britons voted for the leave EU motion.

Despite a close battle, Britain has voted to leave the European Union in a historic referendum on Thursday as results were declared on Friday, thus severing a tie of decades and dealing a blow to the European unity.

On Friday morning the BSE Sensex in India was down 1,039.11 points or 3.85 per cent at 25,963.11. National Stock Exchange’s NIFTY 50 was also trading down.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.

Support objective journalism for a small contribution.

Latest Headlines

Big boost for India! PM Modi announces major India–France aviation skills hub in Kanpur

Fri, Feb 20 2026

Which International ETF Belongs in Your Portfolio?

Thu, Feb 19 2026

No more tax payment hassles! Bandhan Bank unlocks instant challan and 24×7 payment access in Assam

Thu, Feb 19 2026

Tata Group joins hands with OpenAI in massive AI push to transform India and global industries

Thu, Feb 19 2026

Affordable and aggressive! Nissan launches Gravite at Rs. 5.65 Lakh

Wed, Feb 18 2026