February 20, 2026 03:38 am (IST)

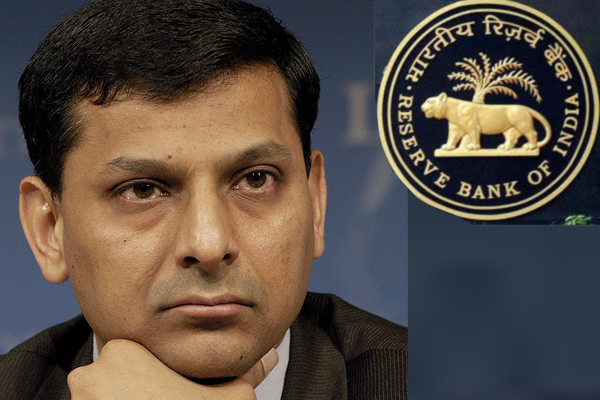

RBI keeps key rates unchanged at 6.75 pc

Mumbai, Feb 2 (IBNS) On expected lines, the Reserve Bank of India (RBI) kept its policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.75 per cent, announced RBI Governor Raghuram G. Rajan on Tuesday.

Repo rate is the rate at which the central bank of a country (RBI) lends money to commercial banks in the event of any shortfall of funds.

RBI said it has decided to keep the cash reserve ratio (CRR) of scheduled banks unchanged at 4.0 per cent of net demand and time liability (NDTL).

It will continue to provide liquidity under overnight repos at 0.25 per cent of bank-wise NDTL at the LAF repo rate and liquidity under 14-day term repos as well as longer term repos of up to 0.75 per cent of NDTL of the banking system through auctions; and continue with daily variable rate repos and reverse repos to smooth liquidity.

Consequently, the reverse repo rate under the LAF will remain unchanged at 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 7.75 per cent.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.

Support objective journalism for a small contribution.

Latest Headlines

Which International ETF Belongs in Your Portfolio?

Thu, Feb 19 2026

No more tax payment hassles! Bandhan Bank unlocks instant challan and 24×7 payment access in Assam

Thu, Feb 19 2026

Tata Group joins hands with OpenAI in massive AI push to transform India and global industries

Thu, Feb 19 2026

Affordable and aggressive! Nissan launches Gravite at Rs. 5.65 Lakh

Wed, Feb 18 2026