February 20, 2026 08:58 am (IST)

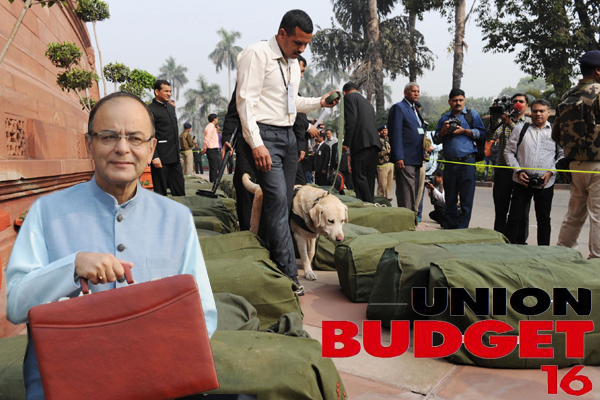

Union Budget 2016: Announcement of relief for small tax payers and others

New Delhi, Feb 29 (IBNS) Union Finance Minister Arun Jaitley on Monday presented the Union Budget 2016 where he said he would like to give relief to small tax payers and proposed to raise the ceiling of tax rebate under Section 87A of IT Act to Rs 5,000 from Rs 2,000 for individuals with income less than Rs 5 lakhs.

The minister said that taxation is a major tool available to the government for removing poverty and inequality and it has to be cautiously exercised.

He said that more than two crore tax payers would get a relief of Rs. 3,000.

The limit of deduction of house rent paid under section 80GG has also been raised to Rs 60,000 from the existing Rs 24,000 per annum to give relief to employees who live in rented houses.

Under the presumptive taxation scheme under Section 44AD of the Income tax Act, the limit of turnover or gross receipts has been raised to two crore rupees from the existing one crore rupees to benefit about 33 lakh small business people.

It frees a large number of such assesses in the MSME category from maintaining detailed books of account and getting audit done.

The presumptive taxation scheme is to be extended to professionals with gross receipts up to Rs 50 lakh with the presumption of profit being 50% of the gross receipts.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.

Support objective journalism for a small contribution.

Latest Headlines

Which International ETF Belongs in Your Portfolio?

Thu, Feb 19 2026

No more tax payment hassles! Bandhan Bank unlocks instant challan and 24×7 payment access in Assam

Thu, Feb 19 2026

Tata Group joins hands with OpenAI in massive AI push to transform India and global industries

Thu, Feb 19 2026

Affordable and aggressive! Nissan launches Gravite at Rs. 5.65 Lakh

Wed, Feb 18 2026