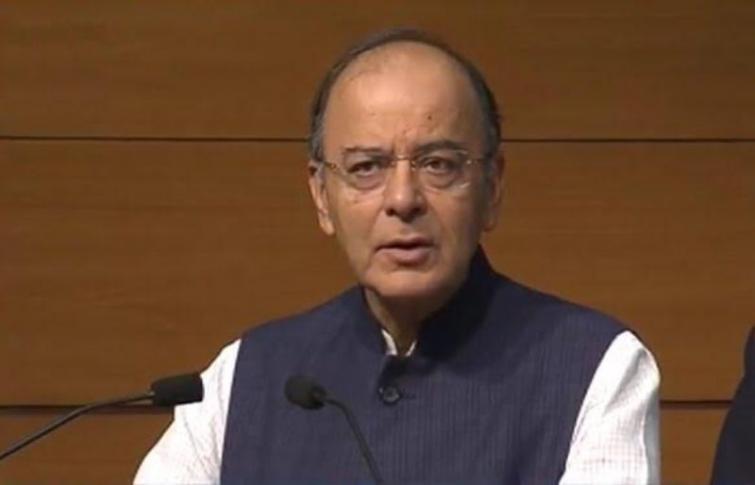

New Delhi, Jul 1 (UNI) Calling the goods and services tax (GST) “consumer and assessee friendly”, former Union Minister Arun Jaitley on Monday said the taxation process was one of the smoothest transformation in India and settled down within few week of its implementation.

“Many warned us that it may not be politically safe to introduce the GST. In several countries, governments lost elections because of the GST. India had one of the smoothest transformation. Within the first few weeks of the implementation, the new system settled down,” Jaitley wrote a blog on the second anniversary of the GST today.

He said earlier there were issues in Gujarat which have been resolved amicably. The BJP, in fact, had won all Assembly seats in Surat during Gujarat election and even won the Surat Parliamentary seat with the highest margin in 2019.

Making a scathing attack on Congress for demanding a single slab GST, Jaitley said a single slab is possible only in extremely affluent countries where there are no poor people. It would be inequitable to apply a single rate in countries where there are a large number of people below the poverty line.

“In the pre-GST regime, the rich and the poor, on various commodities, paid the same tax. The multiple slab system not only checked inflation, it also ensured that the Aam Aadmi products are not exorbitantly taxed.

“Illustratively, a Hawai chappal and a Mercedes car cannot be taxed at the same rate,” he added.

He said except on luxury and sin goods, the 28 per cent slab has almost been phased out. Zero and 5 per cent slabs will always remain. As revenue increases further, it will give an opportunity to policy makers to possibly merge the 12 per cent and 18 per cent slab into one rate, thus, effectively making the GST a two rate tax.

Jaitley said with the tax, the assessee base in the past two years has increased by 84 per cent. In the July to March 2017-18, the average revenue collected per month was Rs 89,700 crore. In the next year (2018-19), the monthly average has increased by about 10 per cent to Rs 97,100 crore.

The former Minister said the GST has merged all 17 different laws and created one single taxation. The pre-GST rate of taxation as a standard rate for VAT was 14.5 per cent, excise at 12.5 per cent and added with the CST and the cascading effect of tax on tax, the tax payable by the consumer was 31 per cent. The entertainment tax was being levied by the States from 35 per cent to 110 per cent.

He said: “The GST changed this scenario completely. Today, there is only one tax, online returns, no entry tax, no truck queues and no inter-state barriers.”

On the role of the GST Council, the former Union Minister said the Council worked on the principle of consensus. This has added to the credibility of the decision making process. “I am sure this trend will continue in future.”

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.