RBI | Policy Rates

RBI | Policy Rates RBI policy rate hike: Experts react

Mumbai: Reserve Bank of India's hike in repo rate by 50 basis points (bps) to 4.90 percent is an expected move amid the current inflationary pressures and more hikes can follow in the subsequent months, said experts.

The repo rate is the rate at which the banks borrow from the RBI against security.

RBI said the real GDP growth for 2022-23 is estimated at 7.2 percent.

Following the hike in repo rate, the standing deposit facility (SDF) rate stands adjusted to 4.65 percent and the marginal standing facility (MSF) rate and the bank rate to 5.15 percent.

Amid the elevated inflation, crude price volatility and geo-political crisis, economists and market-watchers had expected RBI to hike the repo rate in the range of 25-50 basis points.

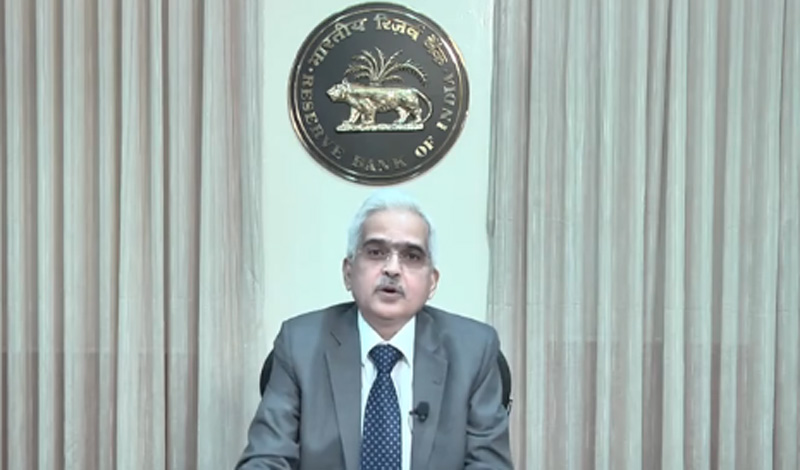

Governor Shaktikanta Das had earlier hinted that more rate hikes were in the pipeline, saying that expectations of increase in the repo rate were a 'no-brainer'.

The RBI hiked CPI inflation forecasts by 100bps to 6.7 percent (vs earlier forecast of 5.7 percent).

According to HDFC Securities MD & CEO Dhiraj Relli, a revisit of the pre-Covid repo rate of 5.15 percent over the next 1-2 MPC meets is a given (vs 4.90% currently), but most economists expect this to go above 5.15 percent.

"A lot in this regard will depend on how soon the inflation peaks out and begins to fall and when do the global Central Banks feel that they are done with the rate hikes for now," said Relli.

The MPC policy actions’ impact on inflation will only materialise after a couple of quarters, said Relli.

The RBI governor has hoped for more fiscal measures from the Govt to bring inflation under control faster.

The real GDP growth projection for FY23 is retained at 7.2 percent but may come up for some downward revision in the forthcoming MPC meets, according to Relli.

"The growth projection has been made based on the fact that drivers of domestic economic activity are getting stronger but they face headwinds from global spillovers in the form of protracted and intensifying geopolitical tensions, elevated commodity prices, COVID-19 related lockdowns or restrictions in some major economies, slowing external demand and tightening global financial conditions on the back of monetary policy normalisation in advanced economies," he noted.

"The bond markets and equity markets reacted well to the MPC outcome being relieved that the MPC did not sound more hawkish than most expectations. Absence of a CRR hike also was a relief. Stock prices of rate sensitive sectors including Auto, Banks, Finance, Durables, Realty have reacted well to the MPC outcome due to the above. However, this upmove may need more triggers to continue," he said.

Bank of India MD & CEO Atanu Kumar Das said “Policy announcement is on expected lines, reflecting the Central Banker’s continued focus on a non-disruptive trade-off between growth and price stability, in a calibrated manner.”

Reacting to RBI's shift in stance from accommodative to withdrawal, Operating Partner (Infrastructure), Essar and Managing Director, Essar Ports Rajiv Agarwal said the move will ensure inflation remains within targets going ahead, however that could hamper some business opportunities.

The economic growth of our country requires support from RBI and the strengthening of the banking system will further boost economic recovery.

He felt that RBI's projections of GDP growth rate of 7.2 percent and inflation of 6.7 percent for FY23 have continued to be realistic.

J Sagar Associates (JSA), Partner, Anjana Potti said the May 4 off-cycle repo rate hike has had an impact on the housing sector which had started picking up after two years of a lull, and today's increase is going to dampen the spirits of homebuyers.

The manufacturing sector will also see a pull back on the numbers as the retail purse strings tighten, according to Potti.

"An impact on the stock market is also inevitable. In May, after the surprise increase, the markets also saw a sharp downfall with the BSE falling more than 1,400 points and the NSE settling below 16,700, recording a fall of 391 points, leaving investors poorer by almost 6.27 lakh crores. However, one hopes that the investors are better prepared for the increase this time,” she said.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.