RBI Repo Rate

RBI Repo Rate Mumbai: As widely expected, the Reserve Bank of India (RBI) on Friday increased the repo rate by 50 basis point to 5.40 per cent in a bid to tame inflation which has been above its comfort level for the past six months in a row.

Consequently, the Standing Deposit Facility (SDF) rate stands adjusted to 5.15 per cent and the Marginal Standing Facility (MSF) rate and the Bank rate stand revised to 5.65 per cent.

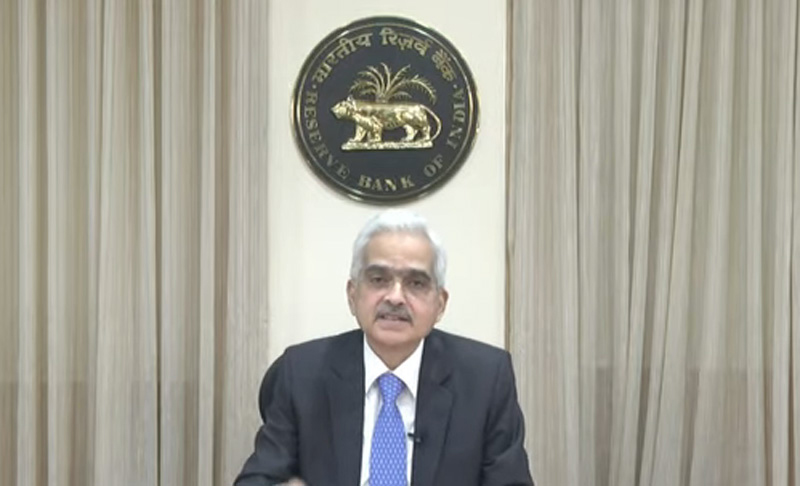

"The MPC (Monetary Policy Committee) also decided to remain focussed on withdrawal of accommodation to ensure that inflation remains within the target going forward while supporting growth," RBI Governor Shaktikanta Das said while announcing the bi-monthly monetary policy.

The MPC unanimously decided to increase the repo rate. This is the third hike in repo rate during the current financial year.

Repo rate is the interest rate RBI charges commercial banks for borrowing cash.

If RBI raises the repo rate, banks will increase its lending rate for its borrowers.

So, the interest rates for borrowers will go up.

Hence interest cost for doing business will go up.

Central banks world over have been grappling with high inflation driven primarily by Russia-Ukraine conflict, supply chain disruptions and high volatility in global crude prices.

In order to check spiralling prices, the RBI has raised the benchmark lending rate by 140 basis points in the current financial year so far. One basis point is equivalent to 0.01 per cent.

"The MPC decisions have been in line with our expectations. Given the increasing external sector imbalances and global uncertainties the need for frontloaded action was imperative. We continue to see 5.75% repo rate by December 2022," said Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank.

The RBI has retained its inflation projection at 6.7 per cent in 2022-23, higher than its upper tolerance band of 6 per cent.

Announcing the monetary policy, Governor Das said that successive shocks to the world economy are taking their toll in terms of globalised inflation surges, tightening of financial conditions, sharp appreciation of the US dollar and lower growth across geographies.

"The Indian economy has naturally been impacted by the global economic situation. We have been grappling with the problem of high inflation," Das said.

He further said that financial markets have remained uneasy despite intermittent corrections.

"We have witnessed large portfolio outflows to the tune of US$13.3 billion during the current financial year so far i.e. till 3rd of August. Nevertheless, with strong resilience and fundamentals India is expected to be amongst the fastest-growing economies during the financial year 2022-23, according to IMF projections," the Governor said.

The RBI has retained its real GDP growth projection for 2022-23 at 7.2 per cent.

The central bank said that demand for contact-intensive services and the improvement in business and consumer sentiment should bolster discretionary spending and urban consumption. Further, it said that investment activity is expected to get support from the government’s capex push, improving bank credit and rising capacity utilisation.

The RBI, however, said that elevated risks emanating from protracted geopolitical tensions, the upsurge in global financial market volatility and tightening global financial conditions continue to weigh heavily on the outlook.

(With UNI inputs)

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.