Critical Minerals

Critical Minerals Critical minerals exploration key to meet India's net-zero target amid China's production monopoly, say experts

Kolkata/IBNS: Exploration and mining of critical minerals are at the core of India’s journey to net-zero by 2070 with 50 percent of its energy requirements from renewable energy, as the manufacture of green technologies for climate change mitigation requires minerals and metals, whose production is dominated by China, according to experts.

In 2021, at COP 26, India announced that it will meet 50 percent of its energy requirements from renewable energy and will be net zero by 2070.

The non-fossil target for 2030 has been set at 500 GW, which may include around 140 GW of wind, 70 GW of hydro (large and small) and 300 GW of solar.

Minerals like chromium, manganese, molybdenum, nickel, lithium, cobalt, and rare earth elements or REEs are key to reaching the net zero goal and put India on a path to sustainable economic growth, noted Sunil Duggal, CII national committee chairman on mining & group CEO, Vedanta Ltd at a panel discussion in IMME and Global Mining Summit on Wednesday.

Image: Wikimedia Commons

Image: Wikimedia Commons

However, India has fewer identified resources and reserves of critical minerals as priority was given to the exploration of major and bulk minerals in the past, he added.

The significance of critical metals and minerals, including rare earths, is obvious from their core position in the manufacturing of items like photo voltaic cells, wind turbines, EVs, noted Duggal.

For instance, an EV requires six times more mineral input than a conventional car, while onshore wind requires nine times more mineral than a gas-fired plant, he pointed out.

Therefore, the clean energy transition is going to be mineral intensive implying a significant rise in demand for critical minerals, he underscored.

Duggal opined that the progress on a clean energy future may become slower or costlier. “To just meet the projected demand in 2030 in STEP (State Policies Scenario), additional 30 lithium mines, 41 nickel mines, and 11 cobalt mines are needed in 2030,” he noted.

Production in all stages of the EV battery supply chain is highly concentrated geographically with China dominating the entire downstream EV battery supply chain, he said.

Lack of focus on the exploration and mining of deep-seated and critical minerals has made India highly dependent on imports

.jpg)

Deep Seated Minerals (DSM), including copper, lithium, cobalt, and other non-bulk ores, constituted 14 percent of India’s total imports, according to Ministry of Commerce and Industry estimates.

In 2021, the total value of DSM imported stood at $3.5 billion, which is expected to swell to $12 billion.

The import value of DSM and CM in 2021 was $86 billion but with the exponential rise in demand, this is estimated to multiply 3.2 times to $280 billion in 2030, the ministry data shows.

The Ukraine War has reinforced the urgency to increase the share of renewable energy in the energy basket, said Rajesh Chadha, senior fellow CSEP.

He noted that the extended Covid-19 lockdown in China that created major supply chain hurdles should be a wake-up call for India to build up its resources.

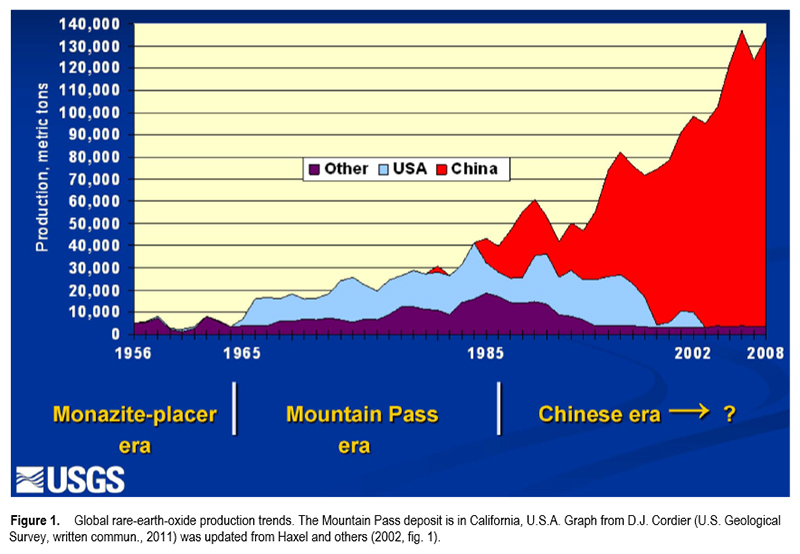

Arvind Kumar, Director Technical, MECL, underlined how China dominates in clean energy metals and minerals. With huge resources of CMs, China controls 72 percent of the world's solar modules, 69 percent of lithium batteries, and 45 percent of wind turbines.

Image: Wikimedia Commons

Image: Wikimedia Commons

Being a leading producer, it also controls the refining of minerals that are critical for clean energy as well as stockpiling minerals like cobalt, lithium, neodymium and other rare earth to make powerful magnets for effective batteries, charged quickly.

China also dominates value chains across mining, processing and producing magnet and has a major role in the global supply chains of rare earths.

In 2010, China suspended exports of rare earth to Japan for almost two months. Recently it has passed a law requiring case-by-case scrutiny of the export of REE and other critical minerals.

The supply of these critical minerals can be disrupted easily due to trade wars, conflict or civil unrest, the panellists noted.

In the absence of processing and refining units for strategic minerals (except IREL), India can cover the gap with strategic acquisition of mines by its private or public sector companies in line with ONGC which has already acquired some oil and gas assets overseas, they said.

Forming informal alliances of countries namely strategic minerals and metal producing countries like Australia, Argentina, Chile, Brazil, Bolivia, and Africa and signing diplomatic and trade agreements for ensuring long-term availability.

Development of new methods for exploration and efficient extraction, and technology development for mining the so-called low-grade minerals as most of India’s critical mineral resources come under this category.

The panellists also stressed on setting up of refining and processing units for critical minerals, “Strategic Reserves for Critical Minerals” in line with Strategic Petroleum Reserve (SPR), incentives for recycling to extract critical minerals.

The panel appreciated government measures like mining sector reforms including auctioning of the mineral blocks, 100 percent FDI in mining, encouraging notified exploration agencies for exploration of critical minerals, setting up of Khanij Bidesh India Limited (KABIL) for acquisition, exploration, mining and processing of strategic minerals in foreign lands among others.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.