Credit Cards

Credit Cards

Proven Techniques for Successfully Applying for the Best Credit Cards

In a very short time, credit cards have become an intrinsic aspect of every household in India, offering liquidity in their times of need. However, successfully applying for a credit card in the Indian market requires a strategic approach. There are several parameters that credit card companies place as their eligibility criteria. Moreover, not every credit card company may be the best pick for your financial needs.

In this article, we will explore proven ways to increase your chances of approval on a credit card application. We will delve into the importance of credit card applications in establishing creditworthiness and managing personal finances effectively. By following these practical tips, you can confidently navigate the application process and secure the best credit cards suited to your needs. As a bonus, OneCard will also introduce the all-new free credit card and why you should apply today!

Why are Credit Card Applications Hard to Crack?

You may have seen many people sharing their experiences of getting rejected by a credit card company due to an improper application. Credit card applications play a crucial role in establishing your creditworthiness. Lenders and financial institutions use your credit card history to evaluate your financial responsibility and determine your creditworthiness for future borrowing. A well-managed credit card can help you build a strong credit profile, providing opportunities for loans, mortgages, and other financial products.

It is essential to approach the applications strategically to make the most of the advantages of credit cards.

Assessing Your Creditworthiness

Creditworthiness is a measure of your ability to repay borrowed funds. Start by checking your credit score, which reflects your credit history and financial behaviour. It provides insights into your creditworthiness and helps lenders assess the risk associated with granting you a credit card. Reviewing your credit report is equally important, as it contains detailed information about your credit accounts, repayment history, and any defaults or late payments.

Paying bills on time, reducing outstanding debt, and keeping credit utilisation low are effective strategies. Dispute any errors or inaccuracies on your credit report and maintain a healthy credit mix.

Researching the Best Credit Cards

Finding the best credit card for your needs requires thorough research. Start by evaluating the interest rates, fees, rewards programs, and credit limits different companies offer. Look for cards that align with your spending habits and provide benefits relevant to you. Consider whether you prefer cashback rewards, travel perks, or discounts on specific categories.

Comparing credit card options offered by various banks is essential. Go beyond the initial promotional offers and assess each card's long-term value and benefits. Read customer reviews and seek recommendations to gain insights into the card's features and customer service.

Prepare a Strong Application

Completing a credit card application accurately and honestly is crucial for a successful outcome. Double-check your personal details, contact information, and employment history. Be prepared to provide the necessary documents, such as proof of identity, address, income, and employment.

Additionally, if an application letter is required, take the opportunity to showcase your financial responsibility and demonstrate why you are a suitable candidate for the credit card. Highlight your stable income, good payment history, and responsible credit utilisation. Keep the tone professional and concise, focusing on your financial strengths and commitment to responsible credit card usage.

Increase Your Chances of Approval

- Read the lender's eligibility criteria: To enhance your chances of credit card application approval, focus on factors that lenders consider important. Firstly, maintaining a stable income and employment history reflects your ability to repay credit card dues. Lenders prefer applicants with a consistent and reliable source of income.

- Strive to maintain a good credit utilisation ratio: This ratio is the percentage of your available credit that you are currently using. Aim to keep it below 30% to demonstrate responsible credit card usage and financial discipline.

- Pay your credit card bills on time: Timely payments indicate your commitment to meeting financial obligations and can positively impact your creditworthiness. Set up automatic payment reminders or consider enrolling in automatic bill payments to avoid missing due dates.

OneCard: Free Credit Card with Premium Security

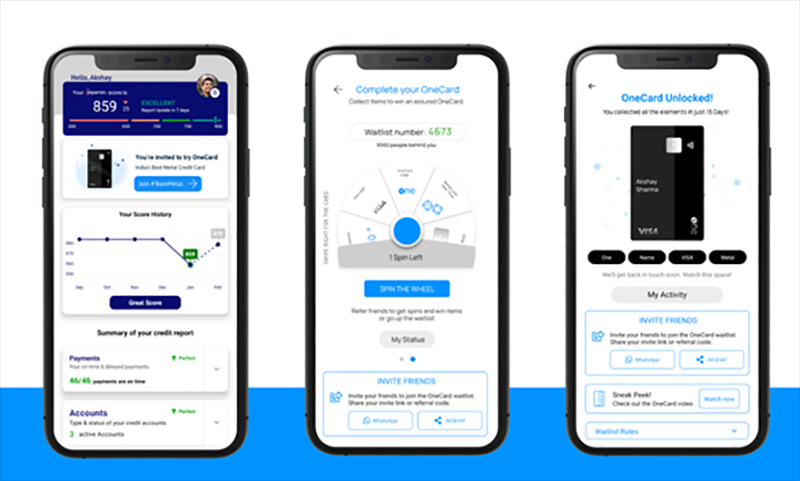

When researching credit card options, a standout choice in the market is OneCard, which offers free credit cards. OneCard aims to make credit card ownership accessible and affordable for individuals. You only need to find the credit card online application section at One

Card's official portal. Here are four key benefits of choosing OneCard that will make you click the apply button immediately!

- No Annual Fees: OneCard offers credit cards without any annual fees. It means you can enjoy the perks and convenience of a credit card without incurring additional costs, making it an attractive option for those seeking financial flexibility.

- Rewards and Cashback: From earning points on dining, shopping, and travel to enjoying cashback on specific categories, OneCard ensures that your credit card usage is rewarding and beneficial.

- Easy Application Process: With an online application platform, you can conveniently apply for a credit card from the comfort of your home. The streamlined process ensures you can obtain your credit card swiftly and enjoy its benefits.

- Enhanced Security and Convenience: With secure chip technology and robust encryption, you can have peace of mind when making online or offline purchases. Additionally, OneCard provides seamless integration with digital payment platforms, making it convenient to manage your card and make payments on the go.

Final Word

Successfully applying for the best credit cards in the Indian market requires a strategic approach and careful consideration. Remember to emphasise accuracy, provide all required documents, and showcase your financial strengths. By implementing these proven techniques, you can confidently navigate the application process and get the credit cards that offer the most benefits and rewards.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.