Stock Market

Stock Market

Stock market opens in red, Kotak Mahindra Bank shares plunge 10% on RBI curbs

Mumbai/IBNS: The Indian benchmark indices opened on a negative note on Thursday (Apr 25), following global peers down as a rout in tech stocks dragged the US benchmark indices down after disappointing forecasts by Facebook's parent Meta.

At the opening bell, Nifty was down 53.50 points (0.24 percent) at 22,348.90 and Sensex was down 181.27 points (0.25 percent) at 73,671.67. About 1,272 shares advanced, 865 shares declined, and 144 shares remained unchanged.

Some major gainers on Nifty 50 were Axis Bank, Eicher Motors, HCLTech, Sun Pharma and Nestle India, while Kotak Mahindra Bank, Tata Consumer Products, LTIMintree, HUL, and Titan, were among the top drags.

Meanwhile, Axis Bank, HCLTech, HDFC Bank, Sun Pharma, and IndusInd Bank were the top gainers on Sensex, while Kotak Mahindra Bank, HUL, Titan, Asian Paints, and Mahindra & Mahindra were among the biggest drags.

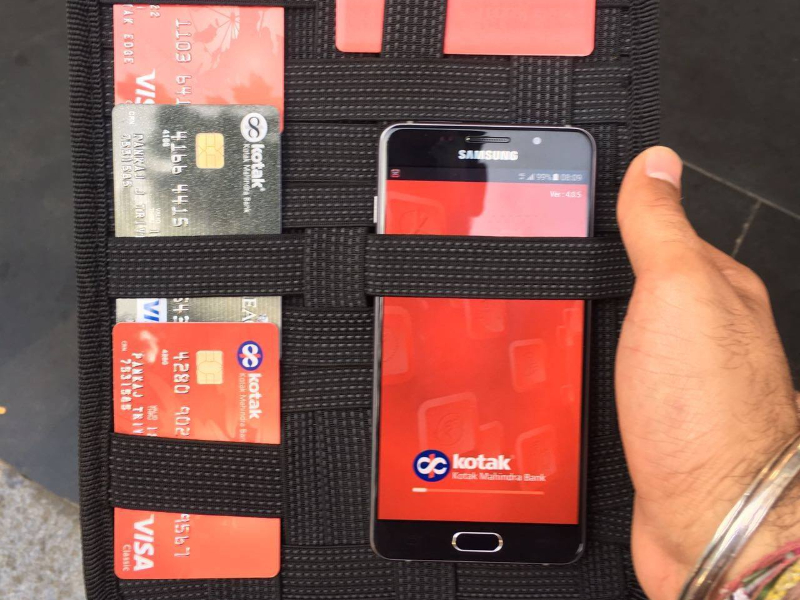

The share price of Kotak Mahindra Bank plunged 10 percent in early trade on Thursday (Apr 25) after the Reserve Bank of India (RBI) barred the country's third largest private sector bank from onboarding new customers through its online and mobile banking channels and issuing fresh credit cards, citing "absence of a robust IT infrastructure and IT Risk Management framework".

File image: Facebook/Kotak Mahindra Bank

File image: Facebook/Kotak Mahindra Bank

The private sector bank's shares declined as much as 10 percent to ₹1,658.75 apiece on the BSE.

On Apr 23 (Tuesday), the NSE Nifty closed at 22,402.40, up 34.40 points (0.15 percent), while the BSE Sensex settled the day at 73,852.94, up 114.49 points (0.16 percent).

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.