UnionBudget2024

UnionBudget2024

Sitharaman's Budget 2024 eyes jobs creation, sets aside big pie for Andhra-Bihar political priorities, pleases salaried class

New Delhi/IBNS: While focusing on employment generation and rural development, the two components that supposedly cost the Narendra Modi government an absolute majority in its third consecutive term, the historic seventh Union Budget by Finance Minister Nirmala Sitharaman spent a considerable pie for Andhra Pradesh and Bihar, the two states ruled by major allies of the Bharatiya Janata Party (BJP)-led NDA, which returned to power with coalition strings attached.

Delivering the Union Budget 2024, Sitharaman announced Special Financial Support for Andhra Pradesh, where Rs 15,000 crore have been directed with additional amounts in coming years.

Our government has made concerted efforts to fulfill the commitments in Andhra Pradesh Reorganization Act. Recognizing the state's need for a capital, we will facilitate special financial support through multi-lateral development agencies.

— PIB India (@PIB_India) July 23, 2024

In the current financial year,… pic.twitter.com/spsF0RTVZG

For Bihar, Sitharaman announced support for the development of an industrial node in Gaya on the Amritsar-Kolkata industrial corridor.

The government will, as the Finance Minister said, support the several road connectivity projects, Patna Purnea Expressway; Buxar Bhagalpur Expressway; Bodh Gaya, Rajgir, Vaishali and Darbhanga spars.

An additional tooling bridge over River Ganga at Buxar at a total cost of 26,000 crore was announced.

#Budget2024 | FM Nirmala Sitharaman says, "On the Amritsar-Kolkata industrial corridor we will support the development of an industrial nod at Gaya in Bihar. It will catalyse the development of the easter region. We will also support the development of road connectivity projects-… pic.twitter.com/ifc7t81YJs

— ANI (@ANI) July 23, 2024

Receipts for FY25 have been estimated at Rs 32.07 lakh crore and Expenditure for the same period at Rs 48.21 lakh crore, according to the FM.

Focus on employment and skilled education

In a bid to ward away the Opposition's allegation over job losses and unemployment, Sitharaman announced the Prime Minister's package of five schemes and initiatives.

"I am happy to announce the Prime Minister's package of 5 schemes and initiatives to facilitate employment, skilling and other opportunities for 4.1 crore youth over 5 years with a central outlay of Rs 2 lakh crores.

"This year we have made a provision of Rs 1.48 lakh crores for education, employment and skilling...," she said.

The Modi government will launch a comprehensive scheme for providing internship opportunities for youths in top companies. This will be the 5th scheme under the Prime Minister’s package.

While presenting the Union Budget 2024-25 in Parliament Tuesday, Union Finance Minister Nirmala Sitharaman announced that the scheme will provide internship opportunities in 500 top companies to one crore youth in 5 years. They will gain exposure for 12 months to real-life business environments, varied professions and employment opportunities, she said.

I am happy to announce a new Centrally Sponsored Scheme, as the fourth scheme under the Prime Minister's package for skilling and collaboration with state governments and Industry

— PIB India (@PIB_India) July 23, 2024

➡️20 lakh youth will be skilled over a 5 year period

➡️1000 ITIs will be upgraded in Hub and… pic.twitter.com/rlz3lkJWeB

An internship allowance of Rs 5,000 per month along with a one-time assistance of Rs 6,000 will be provided to the youth.

Companies will be expected to bear the training cost and 10 percent of the internship cost from their CSR funds, the Finance Minister added.

To facilitate higher participation of women in the workforce, working women hostels and crèches will be established with industrial collaboration while women-specific skilling programmes will be organized besides promoting market access for women SHG enterprises.

New centrally sponsored scheme for Skilling under Prime Minister’s Package for 20 lakh youth over a 5-year period.

Financial support for loans upto Rs 10 lakh for higher education in domestic institutions will be provided to youth who have not been eligible for any benefit under government schemes and policies.

Sitharaman has announced a financial aid for loans upto Rs. 10 lakh for higher education in institutions of the country.

Union Finance Minister Nirmala Sitharaman announced special measures for the MSME sector. “This budget provides special attention to MSMEs and manufacturing, particularly labour-intensive manufacturing,” stated Nirmala Sitharaman.

The Union Finance Minister said that the Government has formulated a package that covers financing, regulatory changes and technology support for MSMEs to help them grow and also compete globally, as mentioned in the Interim Budget.

Productivity and resilience in Agriculture

The budget allocated Rs 1.52 lakh crore for agriculture and allied sectors. New 109 high-yielding and climate-resilient varieties of 32 field and horticulture crops to be released for cultivation by farmers, the FM said.

One crore farmers across the country will be initiated into natural farming, with certification and branding in next 2 years.

A total of 10,000 need-based bio-input resource centres to be established for natural farming.

Digital Public Infrastructure (DPI) for Agriculture to be implemented for coverage of farmers and their lands in 3 years.

The FM announced socio-economic development of tribal families in tribal-majority villages and aspirational districts, covering 63,000 villages for the benefit of 5 crore tribal people.

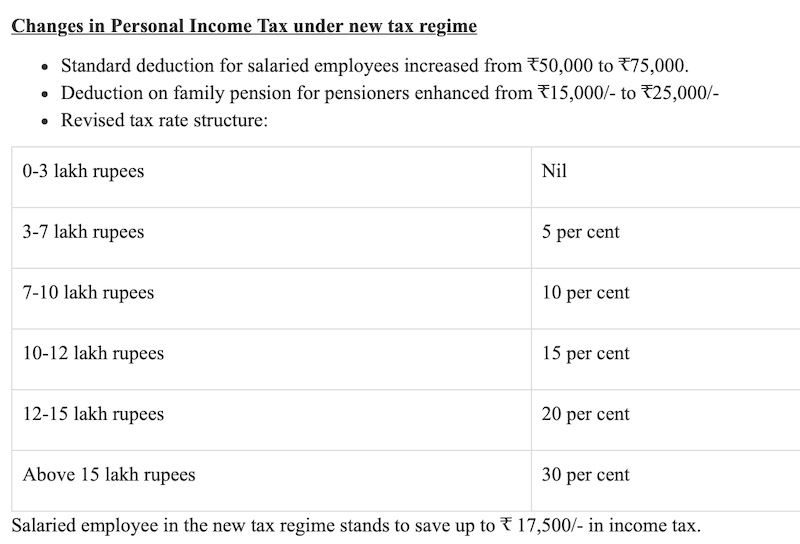

No tax on income below Rs. 3 lakh

In new tax regime tax rate structure to be revised as follows: Income from Rs 0 to Rs 3 lakh tax is Nil, from Rs 3lakh to Rs 7 lakh tax at 5 pc, from Rs 7 lakh to Rs 10 lakh at 10 pc, from Rs 10 lakh to 12 lakh at 15 pc, Rs 12 lakh to Rs 15 lakh lakh at 20 pc and above Rs 15 lakh at 30 pc. A salaried person will now save upto Rs 17500 in IT annually as a result.

"As a result of these changes, a salaried employee in the new tax regime stands to save up to Rs 17,500. Apart from these, I am also making some other changes.

"Revenue of about Rs 37,000 crore will be forgone while revenue of about Rs 30,000 crore will be additionally mobilised. Thus, the total revenue foregone is about Rs 7,000 crores annually," the Finance Minister said.

New Tax Regime

— PIB India (@PIB_India) July 23, 2024

In the new tax regime, the tax rate structure is proposed to be revised, as follows:

▪️ 0-3 lakh rupees - Nil

▪️ 3-7 lakh rupees - 5 percent

▪️ 7-10 lakh rupees - 10 percent

▪️ 10-12 lakh rupees - 15 percent

▪️12-15 lakh rupees - 20 percent

▪️ Above 15 lakh… pic.twitter.com/h14v3RThkn

The corporate tax for foreign companies has been reduced from 40 to 35 percent.

"Monetary limit for filing Tax appeals increased to Rs 60 lacs for ITAT, Rs 2 crores for High Courts and Rs 5 crores for Supreme Court...I propose to abolish the Angel tax abolished for all classes of investors. Corporate tax rate to be reduced on foreign companies from 40 to 35 per cent...," she said.

Mobile phones to cost less, gold duty cut

Holding that the Indian mobile phone industry has matured, the FM said Basic Customs Duty (BCD) on mobile phones and charges, etc will be reduced by 15 percent.

Customs duty on gold and silver will be reduced to 6 percent and of platinum to 6.4 percent from 15.4 percent, said the FM

“I propose to reduce customs duties on gold and silver to 6 per cent and that on platinum to 6.4 per cent to enhance domestic value addition in gold and precious metal jewellery in the country,” Sitharaman said in her Budget speech.

Market in red

In an immediate response to the budget, the stock market has looked south.

Both Sensex and Nifty are in red. The BSE Sensex is down by over 600 points and Nifty is tumbling by over 200 points (as per last update).

Opposition's response

In a prompt response, Congress MP Shashi Tharoor said, "I am afraid it's an underwhelming budget. The government simply didn't mention key issues. MGNREGA wasn't even mentioned. People have no reason to be happy."

I am afraid it's an underwhelming budget. The government simply didn't mention key issues. MGNREGA wasn't even mentioned.

— Congress (@INCIndia) July 23, 2024

People have no reason to be happy.

: @ShashiTharoor ji pic.twitter.com/yyQQMpIgSH

Samajwadi Party (SP) chief Akhilesh Yadav said, "People won't benefit until the farmers' issues are resolved and youth get employment."

#WATCH | Post Budget 2024: Samajwadi Party chief Akhilesh Yadav says, "Till the farmers' issues are resolved and employment is ensured for the youth, the people will not benefit..." pic.twitter.com/xSK8pO0i2V

— ANI (@ANI) July 23, 2024

In a dig at the government, the Trinamool Congress has called the Budget "Andhra-Bihar Budget!"

U̶n̶i̶o̶n̶-̶B̶u̶d̶g̶e̶t̶ 2̶0̶2̶4̶

— All India Trinamool Congress (@AITCofficial) July 23, 2024

Andhra-Bihar Budget!#Budget2024

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.