Nirmala Sitharaman

Nirmala Sitharaman

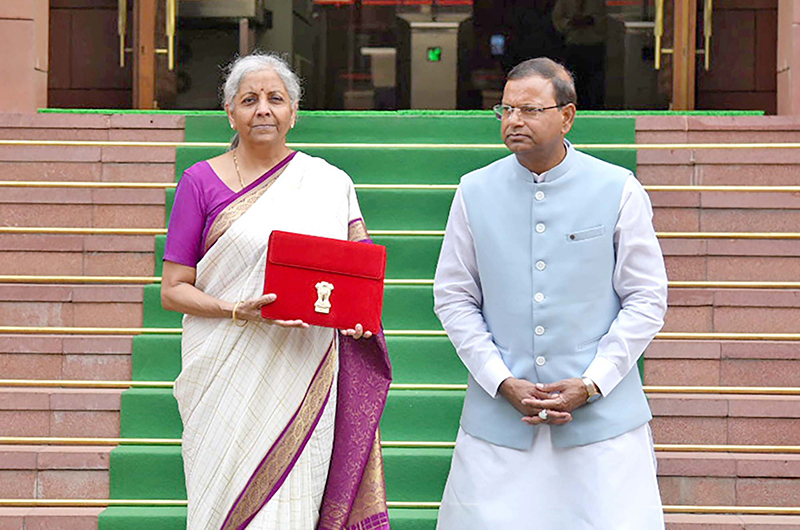

Nirmala Sitharaman proposes abolishment of angel tax to bolster Indian start-up eco-system

Union Finance Minister Nirmala Sitharaman proposed to abolish ‘angel tax’ for all classes of investors while presenting the Union Budget 2024-25 in Parliament on Tuesday.

She added that this move is aimed at bolstering the Indian start-up eco-system, boosting the entrepreneurial spirit and supporting innovation.

Sitharaman announced to bringing out a financial sector vision and strategy document to meet financing needs of the economy and prepare the sector in terms of size, capacity and skills.

She added that this would set the agenda for the upcoming five years and guide the work of the government, regulators, financial institutions and market participants.

The Minister further proposed to develop taxonomy for climate finance. This is expected to enhance the availability of capital for climate adaptation and mitigation, which can help achieve India’s climate commitments and green transition.

“Our government will seek the required legislative approval for providing an efficient and flexible mode for financing leasing of aircrafts and ships, and pooled funds of private equity through a ‘variable company structure’,” said Sitharaman.

To facilitate foreign direct investments, nudge prioritization, and promote opportunities for using Indian Rupee as a currency for overseas investments, the Finance Minister announced that the rules and regulations for Foreign Direct Investment and Overseas Investments will be simplified.

To promote the development of diamond cutting and polishing industry which employs a large number of skilled workers, the Finance Minister proposed to provide for safe harbor rates for foreign mining companies selling raw diamonds.

Further, Sitharaman proposed a simpler tax regime for foreign shipping companies operating domestic cruises in the country.

This will help in realizing the tremendous potential of cruise tourism and give a fillip to this employment generating industry in the country.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.