UPI hits over 3,700 transactions per second, up 58% yearly

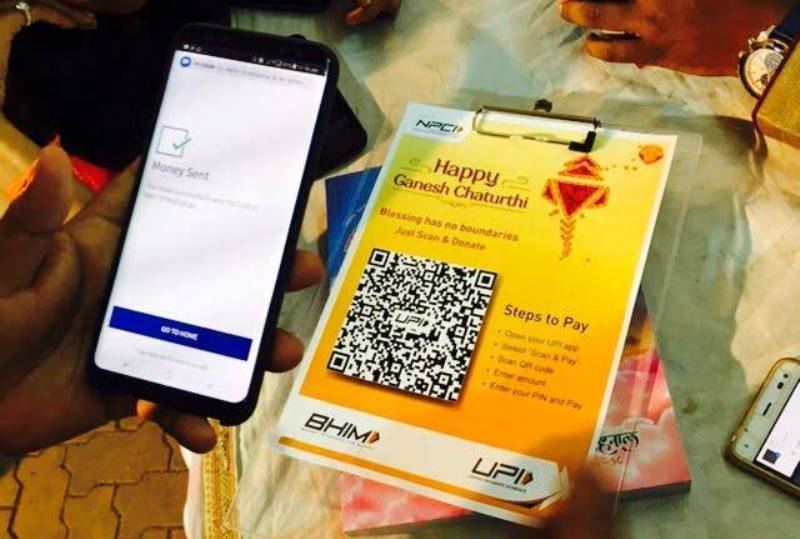

New Delhi: The Unified Payments Interface (UPI) has become the world's most popular alternative payment method, handling 3,729.1 transactions per second in 2023, media reports said.

This represents a 58% increase from 2,348 transactions per second in 2022. UPI, a real-time payment system regulated by India’s central bank since its launch in 2016, allows instant bank transfers, according to data analyzed by global payments hub Paysecure.

India currently leads the world in digital transactions, with more than 40% of all payments made digitally, and UPI accounting for the majority.

Between April and July 2024, UPI processed transactions totalling Rs 80.8 lakh crore ($964 billion), marking a significant 37% increase compared to the same period in the previous year.

In July alone, UPI transactions reached Rs 20.64 lakh crore (approximately $247 billion), maintaining a value above Rs 20 lakh crore for three consecutive months.

According to the National Payments Corporation of India (NPCI), UPI recorded a 41% year-on-year growth in volume and a 31% increase in transaction value in August.

In June, UPI transactions reached 13.89 billion in volume and Rs 20.07 trillion in value.

Skrill has emerged as the second most popular alternative payment method globally, processing 1,553.8 transactions per second and 49 billion transactions in 2023.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.