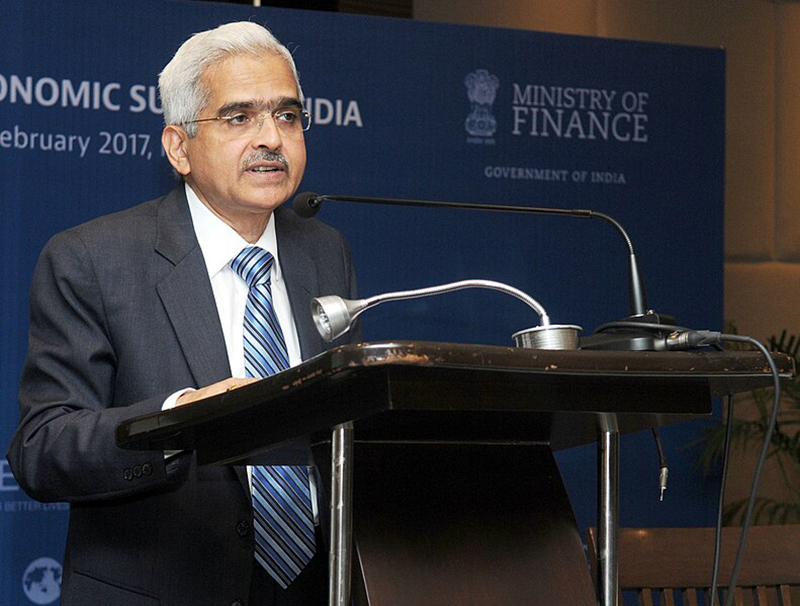

Shaktikanta Das

Shaktikanta Das

Inflation has moderated but we still have a ‘distance to cover’: RBI Governor signals no policy change

Singapore/IBNS: Even as consumer price index (CPI) inflation has softened to the 2-6 percent tolerance band, there is still a ‘distance to cover’, Reserve Bank of India (RBI) Governor Shaktikanta Das said on Friday (Sept. 13), signaling the central bank is in no hurry to cut interest rates despite the inflation dip in the world’s fastest-growing major economy.

The RBI Governor’s statement follows a report from the National Statistical Office (NSO) showing that Consumer Price Index (CPI) inflation, or retail inflation, edged up slightly to 3.65 percent in August, up from the five-year low of 3.60 percent recorded in July.

Shaktikanta Das said in his address at the Future of Finance Forum 2024 organised by the Bretton Woods Committee, Singapore, “Inflation has moderated from its peak of 7.8 percent in April 2022 into the tolerance band of +/- 2 percent around the target of 4 percent, but we still have a distance to cover and cannot afford to look the other way.”

The statement by the RBI chief signals that the central bank was not in a hurry to cut rates till inflation is aligned with the 4 percent target on a sustainable basis, according to reports.

Under the flexible inflation targeting framework, the government has tasked the RBI with maintaining CPI inflation within a band of 4 percent, +/- 2 percent.

Governor Das noted that the Reserve Bank's projections suggest a decrease in inflation from 5.4 percent in 2023-24 to 4.5 percent in 2024-25, and further down to 4.1 percent in 2025-26.

Despite a highly uncertain global environment, the Indian economy has rebounded robustly from the severe contraction caused by the Covid-19 pandemic, achieving an average real GDP growth of over 8 percent from 2021 to 2024, according to the Governor.

For 2024-25, the RBI forecasts real GDP growth at 7.2 percent, with risks evenly balanced around this estimate.

“This growth outlook highlights the strength of India’s macroeconomic fundamentals, driven significantly by domestic factors such as private consumption and investment,” Das said.

He also pointed out that the growth trajectory benefits from a stable macroeconomic and financial environment.

Das added that fiscal consolidation is progressing, with public debt on a declining path over the medium term.

Corporate performance has improved significantly, leading to deleveraging and increased profitability.

Additionally, the balance sheets of banks and non-banking financial intermediaries regulated by the RBI have also strengthened.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.