November 23, 2024 10:07 (IST)

Economic Survey indicates Indian economy likely to see fastest growth in 2016

New Delhi, Feb 25 (IBNS) India’s economy is stable and it continues to be the land of opportunity said Union finance minister Arun Jaitley while presenting the Economic Survey 2015-16 at the Parliament on Friday.

The Survey states that India’s macro-economy is robust, and it is likely to be the fastest growing major economy in the world in 2016, a reflection of the implementation of meaningful reforms like bringing transparency in regulatory decisions, liberalizing FDI, major crop insurance programmes, financial inclusion via Jan Dhan Yojana, JAM and power sector reforms.

But the Survey also indicated that India is also facing huge challenges in areas of exploiting demographic dividend through major investments in health and education, addressing the challenges of climate change and agriculture.

A review of major developments mentioned in the Survey state that --

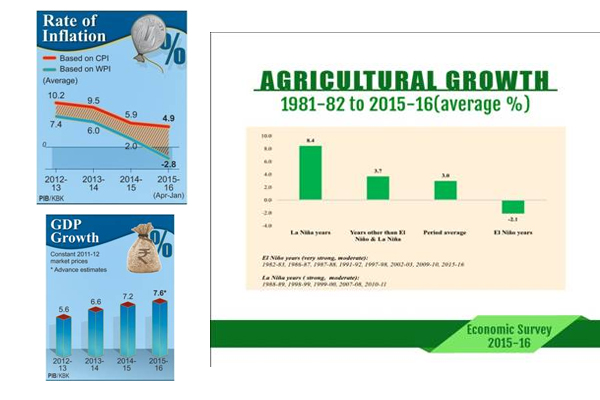

The growth rate of GDP at constant market prices is projected to increase to 7.6% in 2015-16 from 7.2% in 2014-15(CSO)

The CPI- New series inflation has fluctuated around 5.5% while the WPI has been in negative territory since November 2014.

Foreign exchange reserves have risen to US $ 351.5 (Feb-2016)

Net FDI inflows have risen to US $ 27.7 Billion (April-December 2015-16)

The fiscal sector registered three striking successes: ongoing fiscal consolidation, improved indirect tax collection and improved quality of spending at all levels of government. The government will be able to meet its fiscal deficit target of 3.9% of GDP. Direct tax revenue grew by 10.7%, while indirect tax revenue showed the growth by 10.7% (without Additional Revenue Measures). Also, a shift in the quality of spending from revenue to investment and towards social sectors has been observed.

India stands out internationally as an investment proposition. India’s Rational Investor Ratings Index (RIRI) shows that India compares favorably with peer countries in the BBB investment grade and almost matches the performance of A-grade countries.

External Challenges

As per Economic Survey India is facing an unusually challenging and weak external environment. India needs to prepare itself for a major currency readjustment in Asia in the wake of a similar adjustment in China. Also it needs to address low growth in emerging markets due to capital controls to curb outflows of capital. To balance weak foreign demand, India needs to activate its domestic sources of demand to maintain growth momentum.

The Twin Balance Sheet Problem

The Twin Balance Sheet (TBS) problem implies the impaired financial positions of the public sector banks along with some large corporate houses. It is a major impediment to private investment and so to a full-fledged economic recovery. As per economic Survey, Non performing assets (NPA) has been rising since 2010. The situation is not sustainable; a decisive solution is needed.

Economic survey points out that resolving the TBS challenge comprehensively would require 4R’s: recognition, recapitalization, resolution and reform. Banks must value their assets close to true value (recognition). Their capital position must be safeguarded via infusions of equity (recapitalization). The NPA’s in the corporate sector must be sold (resolution). And future incentives for the private sector and corporate must be set right to avoid repetition of the problem (reform).

Some steps have already been taken. The government launched the Indradhanush scheme for phased recapitalization of banks. The RBI also initiated the 5:25 and SDR schemes to incentivize banks to rehabilitate stressed assets. Most importantly, such moves need to be initiated jointly and cooperatively between the government and the RBI.

Recalibrating growth expectations

India’s long run potential GDP growth is substantial, about 8 to 10%. Since india’s exports of manufactured goods and services now constitute about 18% of GDP, its actual growth will depend upon global growth and demand. Reflecting India’s growing globalization, a 1 percentage point decrease in the world growth rate is now associated with a 0.42 percentage point decrease in Indian growth rates. So, if the world economy remains weak, India’s growth will face considerable headwinds. Hence Economic survey points out that in the current global environment, there needs to be a recalibration of growth expectations and consequently of the standards of assessment.

Positive Impact of La-Nina

El Nino, an abnormal warming of the Pacific waters near Ecuador and Peru affects agricultural production in India. The 2015 El Nino has been the strongest since 1997. But if it is followed by a strong La Nina, there could be a much better harvest in 2016-17.An extended and strong El Nino explains why India had a deficient south monsoon and dry winters impacting both Kharif and Rabi crops. As per the data given in Economic Survey, some of the strongest El Nino years were followed by La Nina episodes resulting in bumper harvests. This kind of possibility cannot be ruled out in 2016 as well. La Nina conditions are expected to develop before June- September. So La Nina is unlikely to deliver its full bounty until late in Kharif season.

Charts: Economic Survey 2015-16

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.

Support objective journalism for a small contribution.

Latest Headlines

Mahindra teases sketches of BE 6e, XEV 9e Fri, Nov 22 2024

Ather Energy Limited unveils ‘Eight70 Warranty’ for the battery of its electric scooters Fri, Nov 22 2024

Bitcoin soars to all-time high, nearing the $100,000 milestone Fri, Nov 22 2024

Mukesh Ambani's Jio loses nearly 80 lakh subscribers in just 30 days; BSNL emerges as a gainer Fri, Nov 22 2024

Kenya cancels Adani airport and energy deals following US bribery indictment: Report Fri, Nov 22 2024

Why is US probing Gautam Adani over allegations of bribery in India? Thu, Nov 21 2024