Why Provident Funds may not be sufficient for Retirement?

Throughout the life, we work hard to meet requirements of our family. Many things are sidelined to make the life of our family easy, and retirement planning is one of them.Nothing comes easily, and as time passes, things become more difficult with age— both physically and financially. As a result, for most of the salaried professionals, retirement planning revolves around provident fund(PF) only. Well, there is nothing wrong with the provident fund. In fact, the contribution is linked to the salary and increases with an increment. But by itself, PF is not sufficient for retirement because of the following reasons:

- With the inflation rate hovering between 7% and 8%, provident fundsalone barely beat the inflation rate. For instance, a35-year old, whose monthly basic salary is Rs50,000, contributesRs6000/month in his PF account. His employer is also contributing the similar amount in his PF account. He expects an average annual increase of 10% in his salary and current EPF balance is Rs 10,000.By the time he retires at the age of 60, his provident fund balance will be close to Rs1.6 crores, assuming the PF interest rate as 9%. While Rs1.6 crores may look huge but it may not be enough to secure his retirement life. If his current monthly expenses are 30,000, 8% inflation rate would increasehis monthly expenses requirements to roughly Rs2.05 lakhs/month after 25 years from now. It meansRs1.6 crores from PF would be wiped out in a little over six years, and he would be left with no money in his retirement corpus after the age of 66years.

- The power of compounding works over a longer tenure, and therefore, to build a huge corpus, you need to stay invested for a longer time. However, many people withdraw their provident fund amount when they change their jobs, and thus, losing out a lot of substantial amount.

- Healthcare is increasingly becoming unaffordable for people owing to high medical treatment costs in the recent years. A single hospitalization can wipe out your life’s savings. Further, with an increase in age, a person becomes more susceptible to ailments and needs frequent medical treatment. A simple cataract surgery can cost you somewhere between Rs 20,000 and Rs 40,000. Your provident fund amount may not be able to deal with the soaring medical inflation rate.

- The rising cost of living has increased in the country. In the last five years, the prices of essential commodities, such as milk, pulses, and oil have increased by over 70%. Your provident fund amount will not be sufficient to beat the high cost of living which will only increase in the near future.

- In India, life expectancy ratio has increased over the years. As per the statistics released by the Union Ministry of Health and Family Welfare, life expectancy ratio has increased by five years, from 62.3 years for males and 63.9 years for females in 2001-05 to 67.3 years and 69.6 years respectively in 2011-15. The longer you live, the more your expenses are; and which means, you need more money to sustain your living. Your provident fund may fail to deal with the rising money requirements.

- Only salaried professionals have the option of contribution in the provident fund. It means, self-employed professionals, such as lawyers, and doctors, have to look out for some other retirement planning options.

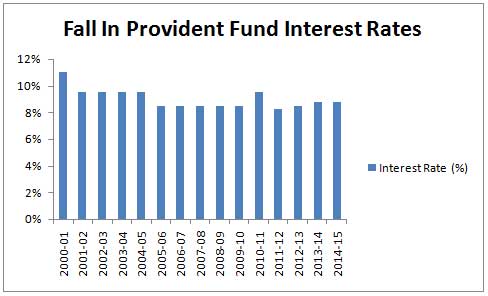

The following graph shows how PF interest rates have been declining in the past few years. It meansnet returns from provident funds will not be sufficient to meet your post-retirement needs.

Now, where to invest

The financial market is flooded with various investment products whose makers put all their convincing powers to make you believe that their plan is the best retirement solution. However, as an investor, you should ensure that you do not carried away by high-pitched marketing tactics and choose an investment product that takes care of your retirement needs.

Here, Unit-Linked retirement plans fit well in the picture.These plans build a huge retirement corpus, which can be further channelized to generate regular income through annuity plans. Here are some other benefits of ULIP retirement plans:

- Assured Benefits:Various ULIP retirement plans offer assured benefits to safeguard the lifetime saving of pensioners from the market volatility. These guaranteed maturity benefits have made ULIPs an attractive investment option. Some insurance plans, such as ICICI Pru Easy Retirement offer assured benefit or fund value, whichever is higher, at the time of maturity. Here, assured benefit is 101% of the sum of all premiums paid. Also, you can increase your retirement corpus through pension boosters.

- High returns in the long run: A part of the premium is invested in equity funds to generate high returns. Asa result, ULIP retirement plans have the potential to generate better returns over the long run as compared to provident funds.

Let’s understand it with an example.

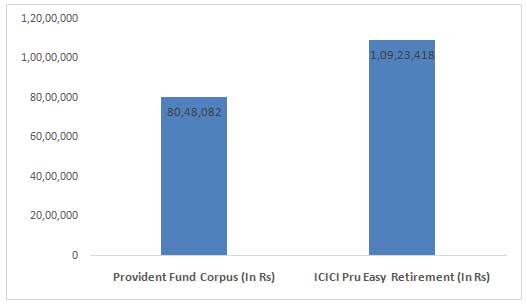

Mr. Suresh, a 35-year old IT professional,contributes 12% of his basic salary,i.e., Rs3000, to the provident fund. If he also invests15% of his annual income, which is Rs12,00,000, for his retirement in a ULIP retirement plan, he would be able to build a much bigger corpus than what he will get from the provident fund account at the age of 60, as shown below:-

- We have assumed provident fund rate as 9%, current EPF balance as Rs 10,000 and growth rate as 10%for doing the calculationonEmployee Provident Fund Calculator.

- Great flexibility: ULIPs are flexible products that let you invest as per your risk appetite and age. It means, if there is a long time before your retirement, you can take more risk and invest in equities. Similarly, when you are near to your retirement, you can invest in low-risk debt funds. Further, it is not a onetime approach. You can use fund switching options to alter your fund mix during the policy tenure.

- Transparent structure: ULIP plans have transparent structure, which means, all commissions and charges are explicitly detailed in the policy document. Also, all charges are evenly distributed throughout the policy tenure. It is better than the other investment products which are front-loaded, and the entire first-year premium goes towards in charges only.

- Regular pension for life: With ULIP retirement plans, you can get a regular pension for life. In the case of your death, your spouse would be entitled to get the pension amount. For instance, if you invest Rs 15,000 in ICICI Pru Easy Retirement Plan for ten years, you will get Rs 1.5 lakhs (if the assumed rate of return is 8%). After your death, the pension continues for your spouse.

- Insurance coverage for the family: In the case of sudden demise of the policyholder, the insurer offers death benefits to the nominee. If we talk about ICICI Pru Easy Retirement, the nominee gets guaranteed death benefits or the fund value, whichever is higher.

- Easy to buy: All you need is a good internet connection, and you can purchase ULIP retirement plans online from the comfort of your home, working in an office or while travelling. It makes the entire buying process hassle-free and fast.

“Retire from Work, but not from Life”- M.K Soni

Retirement is a happy phase of life when there are no project deadlines to meet, no fear for Mondays and no nasty boss. You can simply set your work schedule, take long vacations and pursue your hobbies. However, as it is said, “The early bird catches the worm,” the planning for retirement is a long-term process, and earlier you start it, better returns you get. Further,life expectancy has also increased by five years in a decade. Therefore, it becomes important to plan well if you want to have a financially secured life after retirement.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.