Lower tax incidence on entertainment services under GST

The rate of GST approved by GST Council on services by way of admission to entertainment events or cinematography films in cinema theatres is 28 per cent.

However, the entertainment tax rates in respect of exhibition of cinematography films in theaters/cinema halls, currently levied by States are as high as 100 per cent in some of the states, the ministry said in its release.

The rate of entertainment tax on cable TV and Direct-To-Home (DTH) levied by states is in the range of 10 per cent-30 per cent in many states.

Apart from this, Service tax is also leviable at the rate of 15 per cent.

As against this, the rate of GST approved by GST Council on these services is 18 per cent.

The rate of GST approved by GST Council on access to circus, theatre, Indian classical dance, including folk dance and drama is 18 per cent ad valorem.

Further, the GST Council has approved an exemption upto a consideration for admission of Rs 250 per person. These services currently attract entertainment tax levied by the states.

Thus, entertainment services shall suffer a lower tax incidence under GST.

In addition to the benefit of lower headline rates of GST, the service providers shall be eligible for full input tax credits (ITC) of GST paid in respect of inputs and input services.

Presently, such service providers are not eligible to avail of input credits in respect of VAT paid on domestically procured capital goods & inputs or of Special Additional Duty (SAD) paid on imported capital goods and inputs, the ministry said.

Thus, while GST is a value added tax, entertainment tax, presently levied by the states is like a turnover tax, the ministry added.

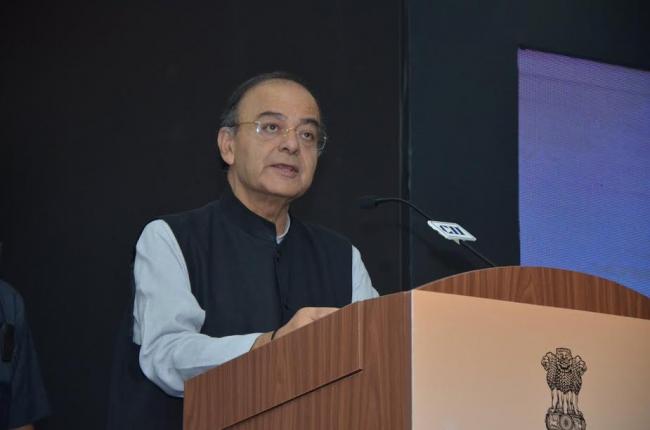

Image: Arun Jaitley Twitter

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.