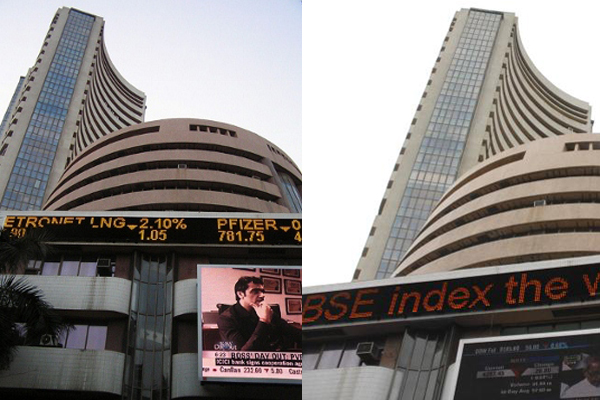

Sensex slumps 400 points, Hindustan Unilever share price falls by 2.32 pc

Mumbai, Dec 27 (IBNS) : A day after the National Anti-Profiteering Auhority, (NAA) slapped a Rs. 383-crore fine on the grounds of not passing benefits of GST rate cuts to consumers, shares of Hindustan Unilever Ltd fell as much as 2.32 per cent to Rs 1,742 per share on Wednesday as Indian benchmark indices BSE Sensex and NSE’s Nifty 50 declined over 1 per cent for the fourth consecutive session with global stock market remaining under pressure over global political uncertainties, reports said.

An order from the NAA posted on its website said that after allowing for certain deductions, the confirmed amount of tax benefit that the company has not passed on to consumers was assessed at ₹383 crore. NAA asked HUL to deposit ₹223 crore in central and state consumer welfare funds as the company had proactively deposited ₹160 crore with the central consumer welfare fund, set up under the anti-profiteering laws.

The company had earlier this year voluntarily submitted Rs 160 crore - an amount significantly lower than the government's calculation - as the profiteering amount to the government.

As per GST rules, 50 percent of the amount profiteered or Rs 191.68 crore is required to be deposited by the company in the central consumer welfare fund (CWF), while the balance amount is to be deposited in the CWF of concerned states where the company sold its products.

NAA has also asked HUL to explain why the penalty should not be imposed on the company.

Under the GST-related laws, the government has introduced an anti-profiteering clause to ensure businesses transfer the benefit of input tax credit to the consumers by 'commensurate reduction in prices'.

As the market volatility over the political uncertainties in the US and worries of global economic slowdown continued, the Indian rupee on Wednesday gained against the US dollar after Brent crude dropped below $50 a barrel. Asian equities were shaky following a Christmas eve plunge in US stocks. Japanese stocks pared early gains. Korean shares fell after a holiday, and Shanghai stocks were little changed. Australia and Hong Kong were closed. Oil prices were mixed in thin trading as US oil rebounded from steep losses in the previous session, while international Brent benchmark traded lower. Indian markets were closed on Tuesday on account of Christmas Day. Here are the latest updates from the markets:

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.