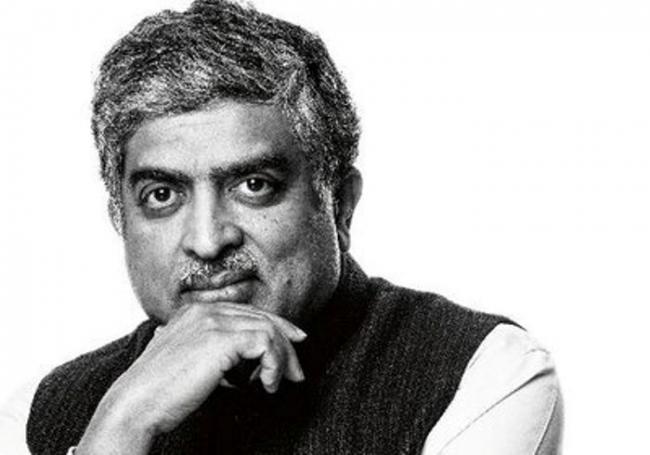

Infosys co-founder Nandan Nilekani to head Reserve Bank of India's committee on digital payments

Mumbai, Jan 8 (IBNS): In a major move, the Reserve Bank of India on Tuesday appointed Infosys co-founder Nandan Nilekani as the chairman of a committee that will assess the digitisation of payments in India.

With a view to encourage digitisation of payments and enhance financial inclusion through digitisation, the Reserve Bank of India in a statement said it has decided to constitute a High-Level Committee on Deepening of Digital Payments.

"The Committee shall submit its report within a period of 90 days from the date of its first meeting," read the statement.

While the AADHAAR card in India was his brainchild, he was the chairman of the Unique Identification Authority of India (UIDAI), the government bodh that collects the data for the 12-digit unique identity number for all Indian residdents, based on their biometric and demographic data.

He is also a member of the Congress party and had fought elections unsuccessfully, though not in active politics.

Apart from Nandan Nilekani, the committee is comprising of four other members.

H.R. Khan, former Deputy Governor, Reserve Bank of India, Kishore Sansi, former Managing Director & Chief Executive Officer, Vijaya Bank, Aruna Sharma, former Secretary, Ministry of Information Technology and Steel and Sanjay Jain, Chief Innovation Officer, Center for Innovation, Incubation & Entrepreneurship (CIIE), IIM Ahmedabad are the other members of the committee.

The Terms of Reference of the Committee are as under:

To review the existing status of digitisation of payments in the country, identify the current gaps in the ecosystem and suggest ways to bridge them;

To assess the current levels of digital payments in financial inclusion;

To undertake cross country analyses with a view to identify best practices that can be adopted in our country to accelerate digitisation of the economy and financial inclusion through greater use of digital payments;

Suggest measures to strengthen the safety and security of digital payments;

To provide a road map for increasing customer confidence and trust while accessing financial services through digital modes;

To suggest a medium-term strategy for deepening of digital payments;

Any other related item of importance.

Image: Nandan Nilekani Twitter page

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.