RBI cuts lending rate by 0.25%, banks and corporates react positively

New Delhi, Feb 7 (IBNS): The Reserve Bank of India (RBI) on Thursday cut repo rate- the rate at which the central bank lends money to commercial banks- by 25 basis points from 6.5 per cent to 6.25 per cent with immediate effect, evoking some positive responses from the corporate sector.

Lending rates and home loans could become cheaper with the Reserve Bank of India on Thursday reducing the repo rate.

The repo rate is the key interest rate at which the central bank lends short-term funds to commercial banks. This rate now stands at 6.25 per cent.

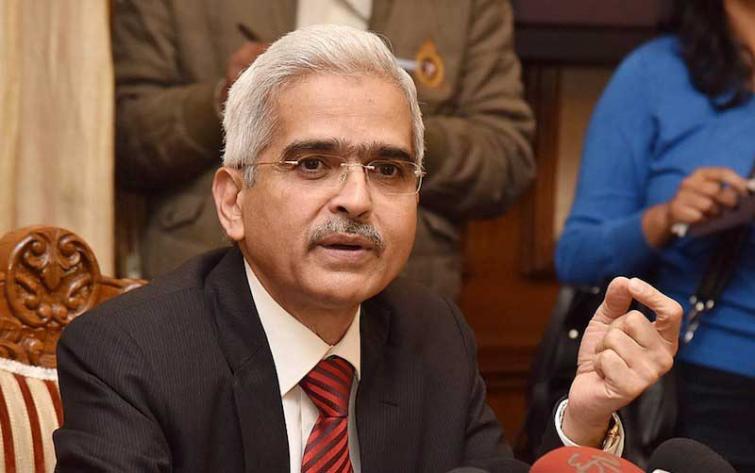

The decisions came after the RBI's monetary policy committee (MPC) meeting, the first since Shaktikanta Das took charge as the central bank's governor.

Consequently, the reverse repo rate under the LAF stands adjusted to 6.0 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 6.5 per cent.

The MPC also decided to change the monetary policy stance from calibrated tightening to neutral.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

Das in his statement said: "It is noteworthy that the path of inflation has moved downwards significantly, and over the period of the next one year, headline inflation is expected to remain contained below or at the target of 4 per cent."

"This has opened up space for policy action. Meanwhile investment activity is recovering but supported mainly by public spending on infrastructure. The need is to strengthen private investment activity. Private consumption also needs to be buttressed. While bank credit flows have picked up and overall flows to the commercial sector have picked up, they are yet to become broad-based," he said.

Interim Finance Minister Piyush Goyal said the RBI’s decision to reduce the repo rate by 25 basis point from 6.5% to 6.25% and change of stance to ‘Neutral’ will give a boost to the economy, lead to affordable credit for small businesses, homebuyers etc. and further boost employment opportunities.

RBI’s decision to reduce the repo rate by 25 basis point from 6.5% to 6.25% and change of stance to ‘Neutral’ will give a boost to the economy, lead to affordable credit for small businesses, homebuyers etc. and further boost employment opportunities

— Piyush Goyal (@PiyushGoyal) February 7, 2019

Corporate Reactions:

B Prasanna – Head Global Markets Group, ICICI Bank: The Monetary Policy Committee (MPC) delivered a dovish policy, both in rate action and in stance, while sounding sanguine on low inflation expectations. The sharp lowering of inflation forecasts could enable further policy easing in April. In a significant departure from previous commentaries, there was an emphasis on the need to support growth if inflation objectives are achieved and the MPC noted that the slack in the economy is rising.

The RBI has also introduced some welcome regulatory changes. The list includes withdrawal of concentration limits in corporate bonds that will promote participation of Foreign Portfolio Investors, rationalization of interest rate derivatives guidelines which will boost depth and liquidity of derivative markets, and the task force on offshore rupee markets that will foster greater participation in Indian assets. The change in risk-weighting of rated exposure to NBFCs, will help strong NBFCs to get credit thereby easing some of the strain being felt currently.

Mayur Shah, Managing Director, Marathon group: The apex bank’s decision to reduce repo rate by 25 basis points augurs well for the realty sector. The RBI’s move comes at an appropriate time and is aimed at supporting growth amidst a scenario where inflation seems to be coming under control. We expect banks to pass on the benefits to customers. The realty industry clearly needs policy interventions to improve the liquidity in the sector. The amalgamation of lower interest rates coupled with various consumption-boosting measures initiated by the government in the just-announced interim budget will hopefully help home buyers. Easing procedural bottlenecks, speedier project clearances and reviving credit flows for realty industry are critical for the economy.”

Mr. Jaikishan Parmar (Sr. Equity Research Analyst - BFSI, Angel Broking): In his first Monetary Policy Announcement, the RBI governor, Dr. Shaktikanta Das gave a double dovish whammy. The repo rates were cut by 25 bps from 6.50% to 6.25% with immediate effect. In addition, the stance of the monetary policy was also shifted from "Calibrated Tightening" to "Neutral", leaving the door open for further cuts if the data warranted. This cut effectively took the reverse repo rate under LAF to 6.00% and the Bank rate lower to 6.50%.

The rate cut was triggered by 3 key factors. Firstly, the RBI observed that the CPI inflation at 2.2% had shown a trend to stay lower. They have reduced their fourth quarter targeted inflation to 2.6%. It needs to be also noted that the RBI has consciously chosen to focus on headline inflation rather than core inflation (which is still in the 5.5-6% range). Secondly, the RBI also sees the rate cut as a growth response to the weak IIP numbers and the core sector numbers over the last few months. Das also underlined that too much of GDP growth was being driven by public spending rather than by private investment. Lastly, the rate cut was also a follow up to the dovish approach adopted by the US Fed in its January meeting.”

Kuldip Maity, MD & CEO, Village Financial Services Ltd.- a leading MFI from Kolkata: Reduction in repo rate and recalibration of monetary policy outlook to neutral will improve sentiments. It was a right step to take when headline inflation is ruling at record low. It should lead to reduction in cost of borrowing as banks expected to reduce MCLR, thus leading to reduction in microfinance lending rates to borrowers.”

EEPC India Chairman Ravi Sehgal: The banks must be asked to ensure transmission of the reduction in interest rates to the borrowers, particularly exporters, who are facing several global challenges besides the rising cost of output. The Monetary Policy Committee itself, in its resolution ,has highlighted the global challenges and uncertainties like trade tensions and slowdown in several key economies. Under these circumstances ,the rate of borrowing must come down especially when bank credit to exporters has declined considerably.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.