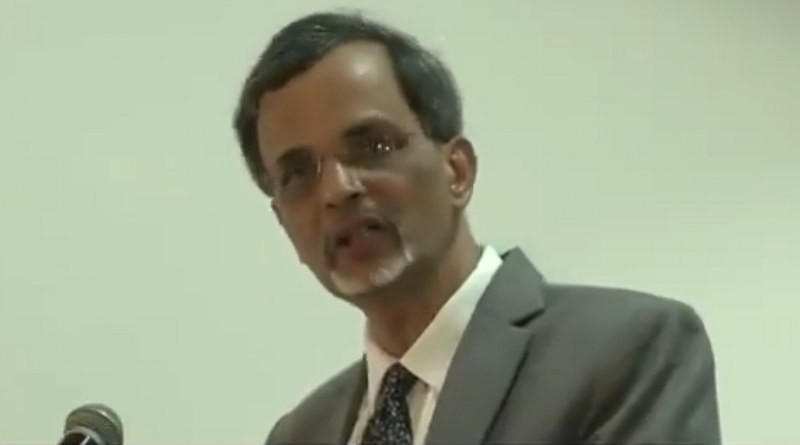

CEA Nageswaran calls out increased overseas investment by Indian private sector despite global uncertainties: Report

New Delhi: Chief Economic Advisor V. Anantha Nageswaran has urged India's private sector to increase domestic investments as companies continue to expand abroad despite global uncertainties, according to a Mint report.

He pointed out that India’s economic performance is outpacing several major economies and presents a compelling case for investment.

On Friday, the statistics ministry released its second advance estimates for 2024-25, raising the GDP growth projection to 6.5% from the earlier estimate of 6.4% in January.

In nominal terms, the economy is expected to grow by 9.9% this fiscal year, slightly higher than the previous forecast of 9.8%.

Speaking after the report’s release, Nageswaran emphasised that India offers a strong economic foundation for private sector investment.

Citing Reserve Bank of India data, he noted that outbound foreign direct investment by Indian firms increased between April and December.

According to the RBI, outward FDI in equity reached $11.3 billion between April and January, up from $7.7 billion during the same period a year ago, excluding loans and guarantees.

Nageswaran said it was paradoxical that despite global uncertainties, Indian businesses continued expanding overseas.

This, he argued, made an even stronger case for increased domestic investment, as India’s growth is currently outpacing many economies and is expected to sustain a minimum rate of 6.5%.

He also stressed the need for higher capital formation within the country, suggesting that the investment-to-GDP ratio should rise from the current 30% to the mid-30s.

The statistics ministry also revised its provisional GDP growth estimate for 2023-24 to 9.2%, up from the earlier projection of 8.3%, marking the highest growth rate in 12 years, barring the post-Covid financial year of 2021-22.

For the December quarter, GDP growth was estimated at 6.2%, while the final figures for FY23 were revised up to 7.6% from the previously reported 7%.

Addressing the media virtually from Cape Town, where G20 finance and central bank officials were meeting, Nageswaran said these figures reinforced expectations that India would sustain 6.5% GDP growth for the current fiscal year and beyond.

He noted that achieving a 7.6% growth rate in the March quarter was realistic, provided certain key factors supported the economy.

These included strong merchandise exports, sustained government capital expenditure, and spending associated with the recently concluded Maha Kumbh Mela.

Elaborating on these factors, he said non-petroleum, non-gems, and jewellery merchandise exports rose nearly 10% between April and January.

Government capital expenditure remained on track, with about 75% of the budgeted amount spent by the end of January, in line with the previous year.

The Maha Kumbh Mela drove significant spending in January and February, which could substantially contribute to GDP growth from the expenditure side.

Nageswaran noted that after a slow start to FY25 due to election-related uncertainties in the April-June quarter, the government accelerated capital expenditure.

Private sector investment also gained momentum in the second and third quarters, as indicated by new project announcements.

While growth in the October-December quarter was lower compared to previous years, India continued to outperform many peer economies, he added.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.