Budget

Budget

Projecting a Modi return, FM Sitharaman presents poll-bound 'no disruption' unchanged tax rate Interim Budget, estimates fiscal deficit at 5.1% of GDP

Exuding confidence that the Modi government will return to power in 2024, Union Finance Minister Nirmala Sitharaman presented an interim "national election year" budget of "no disruption" keeping tax slabs unchanged, focusing on inclusivity, continued economic reforms and listing the achievements of the NDA in the past ten years while refraining from any new populist announcement.

While an interim budget is about allocating funds to keep the government functions going before a new government is installed and present a full budget (national polls are due by May in India), the FM focused on the achievements of the Modi government in the past ten years.

Emphasizing that the government is focusing on Garib, Mahila, Yuva, Annadata (poor, women, youth and farmers), the FM said the government has brought 25 crore people out of multidimensional poverty.

"The Indian economy has witnessed positive transformation in the last 10 years. People are looking towards the future with hope. In 2014, the country was facing enormous challenges. With Sabka Saath, Sabka Vikaas, the Narendra Modi-led government overcame those challenges," she said.

Photo courtesy: UNI

Photo courtesy: UNI

She said the government will target a fiscal deficit of 5.1% for the financial year 2024-25, with gross borrowings at Rs 14.13 lakh crore. “The fiscal deficit in 2024-25 is estimated to be 5.1% of GDP. The revised estimate of the fiscal deficit is 5.8% of GDP,” she said.

Announcing no change in the tax slabs, Sitharaman said, "I do not propose any changes in tax rates in direct and indirect taxes including import duties."

She also mentioned the Modi government's efforts to ensure homes for the middle-class and poor instead of living in rented accommodation or slums.

Pointing out some of the bright spots of the economy, the Finance Minister informed that the Revised Estimate of the total receipts other than borrowings is Rs 27.56 lakh crore, of which the tax receipts are Rs 23.24 lakh crore.

The Revised Estimate of the total expenditure is Rs 44.90 lakh crore.

The revenue receipts at Rs 30.03 lakh crore are expected to be higher than the Budget Estimate, reflecting strong growth momentum and formalization in the economy. Smt Sitharaman also stated that the gross and net market borrowings through dated securities during 2024-25 are estimated at Rs14.13 and 11.75 lakh crore respectively and both will be less than that in 2023-24.She announced that the FDI inflow during 2014-23 was USD 596 billion marking a golden era and this is twice the inflow during 2005-14.

Photo courtesy: UNI

Photo courtesy: UNI

"For encouraging sustained foreign investment, we are negotiating bilateral investment treaties with our foreign partners, in the spirit of ‘first develop India’," the Finance Minister added.

The FM said through rooftop solarization, one crore households will be enabled to obtain up to 300 units free electricity every month.

Financial Highlights

India's Real GDP projected to grow at 7.3% in FY 2023-24

Capital expenditure outplay for the next year is being increased by 11.1% to Rs. 11,11,111 crores, which would be 3.4% of GDP.

Fiscal deficit in 2024-25 is estimated to be 5.1% of GDP

Union Minister of @FinMinIndia and Corporate Affairs @nsitharaman along with Ministers of State Dr. Bhagwat Kishanrao Karad and Pankaj Chaudhary called on President Droupadi Murmu at @rashtrapatibhvn before presenting the Union #Budget2024#ViksitBharatBudget pic.twitter.com/6zTpQqmu5Y

— PIB India (@PIB_India) February 1, 2024

FDI inflow during 2014-23 was USD 596 Billion, which is twice the inflow during 2005-2014.

Scheme of 50 year interest free loan for Capex to States will be continued this year with a total outlay of Rs. 1.3 lakh crore.

No change proposed in tax rates in the Interim Budget.

About one crore tax payers expected to benefit from withdrawal of certain petty and disputed direct tax demands.

Photo courtesy: UNI

Photo courtesy: UNI

Highlights of Sitharaman's Budget presentation

1. Governance Development and Performance is our GDP. We focus on minimum government and maximum governance. Investments are robust, the economy is doing well. People are living and earning better. Average income increased by 50 percent.

2. GST enabled one nation, one market, one tax and widened the tax base.

3. Direct Benefit Transfer of Rs. 34 lakh crore using PM Jan Dhan accounts has led to huge savings for the government. This has been realized through avoidance of leakages, savings have helped in providing more funds for welfare of the poor

4. Global situation is one of disruption and war. The new world order is emerging after Covid pandemic. India assumed the G20 presidency in difficult times. But India successfully navigated its way.

5.Our govt will facilitate energy security in terms of accessibility and affordability. 1.4 crore youth trained under Skill India programme. Rs 43 crore loan given for startups.

Union Finance Minister @nsitharaman arrives at Parliament with the Budget tablet, to present the #InterimBudget#ViksitBharatBudget #Budget2024 pic.twitter.com/IsaDHKbqAq

— PIB India (@PIB_India) February 1, 2024

6. Making Triple Talaq illegal, one third women's reservation in Lok Sabha and state assemblies, giving over 70% houses under PM Awas Yojana in rural areas to women as sole or joint owners have enhanced their dignity.

7. Empowerment of Women through entrepreneurship, ease of living and dignity has gained momentum in the last 10 years. 30 crore MUDRA Yojana loans have been given to women entrepreneurs.

8. Lakhpati Didi Scheme which offers loans to women is extended from 2 crores to 3 crores women.

Photo courtesy: UNI

Photo courtesy: UNI

9. We aim for Atmanirbharta in oilseeds like sesame, sunflower, mustard, and others along with a comprehensive programme to support dairy farmers.

10. Vision for Viksit Bharat is that of prosperous Bharat, in harmony with nature, with modern infrastructure and providing opportunities for all to reach their potential. Next five years will be years of unprecedented development and golden moments to realize the goal of developing India by 2047.

The Trinity of democracy, demography and diversity backed up by Sabka Prayaas has the potential to fulfill the aspirations of every Indian.

11. 517 new udan routes from air travel

12. Electric Vehicle ecosystem will be improved

13. Vande Varat and Namo Bharat trains to be extended

14. FM mentions island tourism promotion like in Lakshadweep

15. Direct tax collection more than trebled

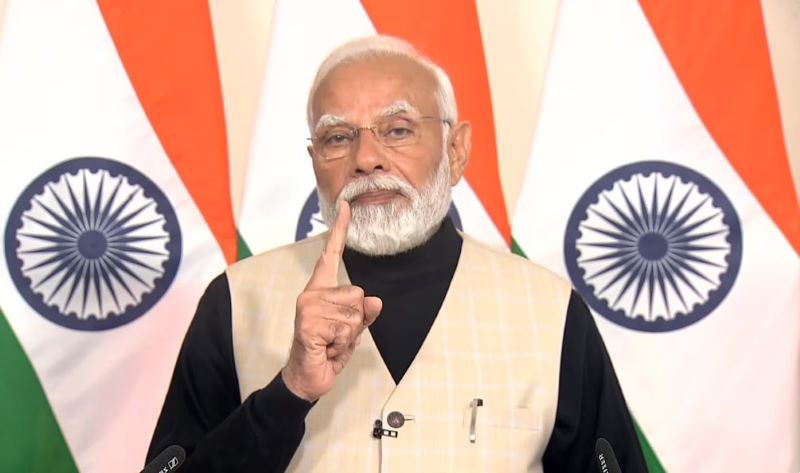

PM Modi calls Budget 2024 'innovative and inclusive'

Prime Minister Narendra Modi on Thursday termed the Union interim budget 2024–25 as "innovative and inclusive" and said it will empower all sections of society.

Photo courtesy: X/@BJP4India

Photo courtesy: X/@BJP4India

Speaking after Finance Minister Nirmala Sitharaman presented the interim budget, Prime Minister Modi said it has not only kept the fiscal deficit in check but has also given a high allocation to capital expenditure.

"This budget has focused on empowering the poor and the middle class," he said.

(All Images: UNI/BJP X handle)

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.