UPI

UPI

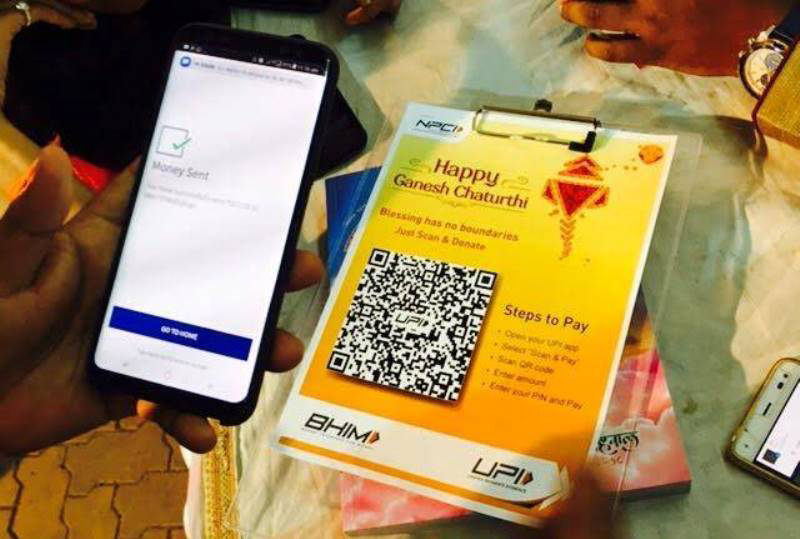

New Delhi/IBNS: The Unified Payments Interface (UPI) transaction values surpassed Rs 20 trillion for the third successive month in July 2024, according to data released by the National Payments Corporation of India (NPCI) — a state-owned organization that operates retail payments and settlement systems in the country — on Thursday (Aug 1).

As per reports, the total transaction value reached Rs 20.64 trillion, up from Rs 20.07 trillion in June, while the average daily transaction volume increased to 465 million from 463 million, though the average daily transaction value declined slightly to Rs 66,590 crore from Rs 66,903 crore in the previous month.

UPI transactions reportedly saw a 45 percent year-on-year rise in volume, reaching 14.44 billion transactions in July, while the value of these transactions grew by 35 percent year-on-year, totaling Rs 20.64 trillion, reports said.

UPI transaction volume sequentially increased by 3.95 percent in July, while the value rose by 2.84 percent.

Meanwhile, transactions through other payment systems such as Aadhaar-enabled Payment System (AePS), FASTag and Immediate Payment Service (IMPS) saw a decline.

The UPI recorded 55.66 billion transactions worth Rs 80.79 trillion in FY25, and for FY24, UPI crossed 100 billion transactions for the first time, ending the year at 131 billion, compared to 8 billion in the previous fiscal year (FY23), as per reports.

A recent report by the Reserve Bank of India (RBI) highlighted a tenfold rise in UPI transaction volume of the past four years — from 12.5 billion in 2019-20 to 131 billion in 2023-24.

The UPI now accounts for 80 percent of all digital payment volumes, said the RBI report, adding that UPI transactions for peer-to-merchant (P2M) transactions have crossed those for peer-to-peer (P2P) transactions, indicating high usage for small-value transaction categories.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.