US Fed

US Fed

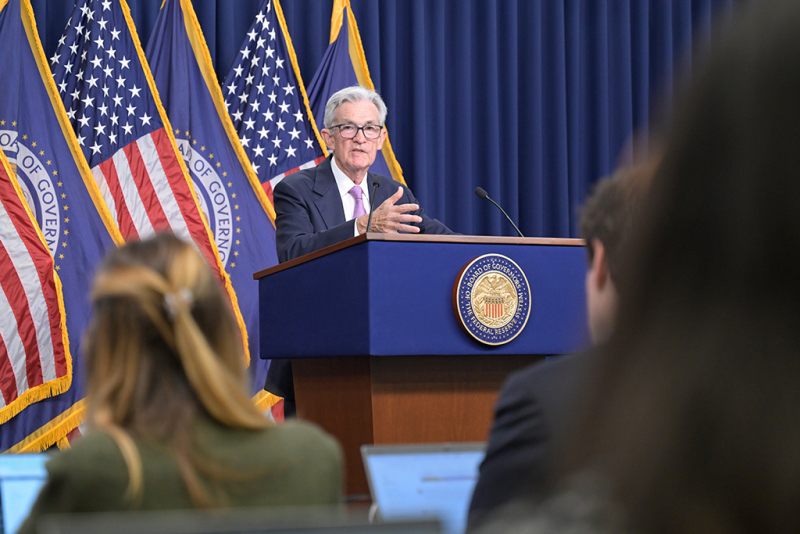

US Fed cuts interest rates by 50 bps, first reduction since 2020

Washington/IBNS: The US Federal Reserve, popularly known as the Fed, has reduced its key lending rate by half a percentage point, marking the first cut since the Covid-19 pandemic in 2020, just weeks ahead of November’s presidential election.

The decision, made by a vote of 11-to-1, lowers the benchmark lending rate to a range of 4.75 to 5.00 percent, as announced in a statement from the Fed.

Additionally, the Fed signaled plans for another half-point reduction before the year’s end, with a further one percentage point decrease expected in 2025.

This move is likely to reduce borrowing costs for consumers and businesses, impacting interest rates on mortgages, credit cards, and other loans just as the election approaches, according to reports.

The Fed stated that its rate-setting committee "has gained greater confidence that inflation is moving sustainably toward 2 percent" and believes that the risks to achieving both employment and inflation targets are balanced.

Stating that the US economy is in good shape, Fed Chair Jerome Powell said, "It's growing at a solid pace, inflation is coming down, and the labour market is in a strong place. We want to keep it there."

With its dual mandate from Congress, the central bank is tasked with managing inflation and employment.

In updated economic projections, the Fed anticipates an average unemployment rate of 4.4 percent in the fourth quarter of this year, up from the 4.0 percent projected in June.

The annual inflation rate is now forecast to be 2.3 percent, slightly below previous estimates.

However, the rate cut will lower borrowing costs by reducing the interest rates at which commercial banks lend to businesses and consumers, making home loans, auto loans, and other types of credit more affordable.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.