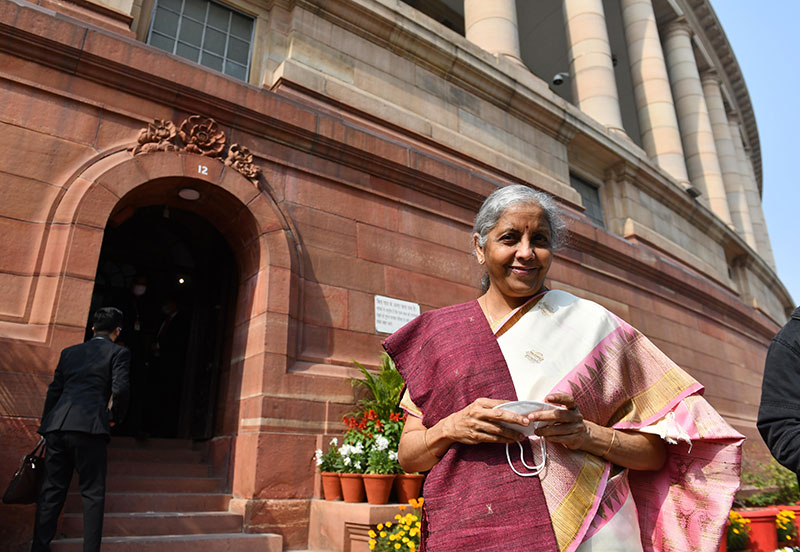

Nirmala Sitharaman

Nirmala Sitharaman

Health and education cess not allowed as business expenditure: Nirmala Sitharaman

‘Health and Education Cess’ is not allowed as business expenditure, clarified by Nirmala Sitharaman, Union Minister of Finance while presenting the Union Budget in the Parliament on Tuesday.

The Union Finance Minister stated that the income-tax is not an allowable expenditure for computation of business income.

This includes tax as well as surcharges.

The ‘Health and Education Cess’ is imposed as an additional surcharge on the taxpayer for funding specific government welfare programs, she explained.

Noting that some courts have allowed ‘Health and Education Cess’ as business expenditure, which is against the legislative intent, the Union Finance Minister reiterated that any surcharge or cess on income and profits is not allowable as business expenditure.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.