India on the threshold of unveiling GST, the momentous one tax regime, on Friday midnight

GST will be rolled out from July 1.

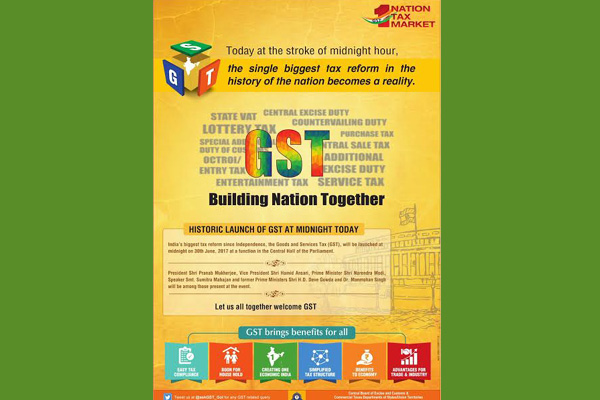

" #GST Single biggest tax reform in the history of nation would become reality today at the stroke of midnight hour," tweeted the official GST handle of the Central government, on Friday.

President Pranab Mukherjee along with Prime Minister Narendra Modi will be present for the GST celebration at the Parliament on June 30 midnight.

However, some of the key opposition parties, including the Congress and the TMC, have said they will not participate in the gala midnight celebration that will mark the unveiling of the GST, according to media reports.

Samajwadi Party, Rashtriya Janata Dal and the Left are also not likely to attend the celebration, media reported.

However, Bihar Chief Minister Nitish Kumar, is expected to attend the celebration, according to media reports.

On Thursday, President Mukherjee reminisced that he was the Union Finance Minister when the Constitution Amendment Bill of 2011, which facilitated the introduction of GST, was formulated.

However, GST could not be introduced at that time.

While speaking at the inaugural session of the global summit on ‘Academics & Economic Reforms-Role of Cost and Management Accountants’ organised by the Institute of Cost Accountants of India on Thursday, the President Mukherjee said that GST is an appreciable measure taken up by the Union Government.

Union Finance Minister Arun Jaitley, who met the representatives of the trade and industry houses on Thursday said that the Central government has held consultations with all stakeholders including political parties leading to broad consensus on GST.

He asked the representatives of trade and industry to inform, educate and explain to their distributors, retailers and consumers at large about the positive impact of GST especially on the price front.

At the meeting, the minister asked the traders to pass on the benefits of GST to consumers at large, according to media reports.

He said, "Overall incidence of tax after implementation of GST will be less, pass these benefits to consumers."

"I'm sure that GST will not have any inflationary impact," the minister said.

The Finance Minister further said that now large number of traders have registered themselves and the GST Network and other official machinery is fully ready for smooth roll-out of GST from 1st July, 2017.

The representatives of trade and industry on the other hand assured the Government that benefit of price reduction would be passed on the consumers.

They also put forward their concerns and asked the Government to issue certain clarifications to remove any doubt or confusion among the traders.

Image: GST Twitter

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.