Trinidad and Tobago

Trinidad and Tobago

India to develop UPI-like real-time payments platform for Trinidad and Tobago

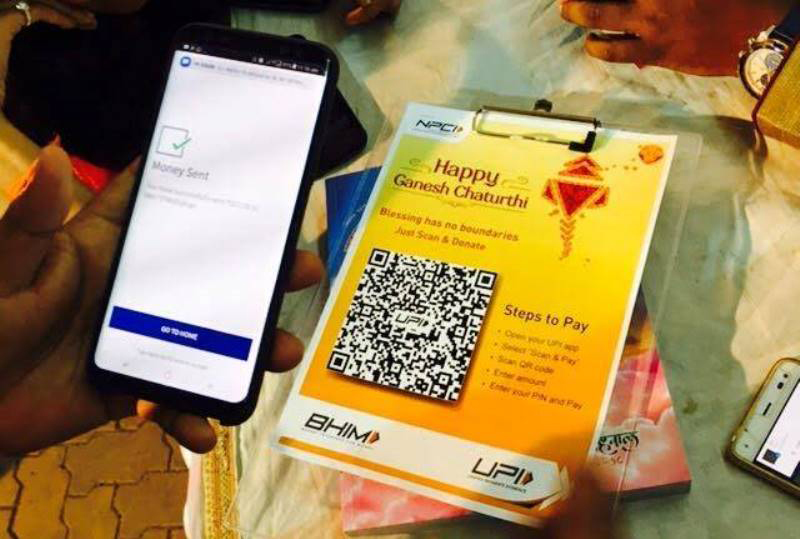

NPCI International Payments Limited (NIPL) has entered into a strategic partnership with the Ministry of Digital Transformation (MDT) of Trinidad and Tobago to develop a real-time payments platform similar to India’s ‘Unified Payments Interface’ (UPI).

This collaboration marks a significant milestone, making Trinidad and Tobago the first Caribbean nation to adopt the globally renowned UPI.

"This builds on the strong, longstanding bilateral ties between the two countries," read a statement issued by NPCI.

This strategic partnership aims to empower Trinidad and Tobago to establish a reliable and efficient real-time payments platform for both person-to-person (P2P) and person-to-merchant (P2M) transactions, expanding digital payments in the country and fostering financial inclusion.

By leveraging technology and experiences from India’s UPI, the partnership seeks to assist Trinidad and Tobago in modernising its financial ecosystem.

This involves enhancing accessibility, affordability, and connectivity with domestic and international payment networks in the times to come and ensuring interoperability.

UPI has emerged as a transformative force in India’s financial landscape, registering nearly 15 billion transactions in August 2024 with an estimated value of USD 245 billion.

Through strategic collaborations with foreign central banks and governments, NIPL is committed to advancing India’s digital public goods across the globe.

Speaking on the development, Ritesh Shukla, CEO, NPCI International, said, “Trinidad and Tobago is taking significant steps towards advancing its financial infrastructure, and we are proud to support them in building a secure, sovereign, and scalable payments platform. Our experience with UPI in India has demonstrated how real-time payments can transform economies by improving access to essential financial services and reducing reliance on cash. We look forward to working closely with the Ministry of Digital Transformation and the Central Bank in Trinidad and Tobago.”

A Spokesperson of Ministry of Digital Transformation, Trinidad and Tobago, said, “It is with great anticipation that the Ministry of Digital Transformation and the Ministry of Finance embark on this significant engagement with NIPL to implement a digital payment system for Trinidad and Tobago. Fashioned on India’s UPI, the digital payment platform will facilitate innovation in the Fintech sector, enhance the technical resiliency of the current payment infrastructure by providing a complementary, non-competing digital payments platform with increased security through the reduced use of cash. Moreover, successful implementation will contribute to the financial inclusion of our unbanked citizens. We extend sincere thanks to the Central Bank of Trinidad and Tobago which continues to be a strategic partner and stakeholder in this important initiative. We look forward to the partnership with NPCI International as we actively seek to transform the existing payments landscape and establish a modern digital payments ecosystem.”

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.