Repo Rate

Repo Rate

RBI keeps repo rate unchanged at 6.5%, slashes CRR to 4 percent

New Delhi/IBNS: The Reserve Bank of India (RBI) has kept the repo rate unchanged at 6.5% while the cash reserve ratio (CRR) has been slashed by 50 basis points to 4 percent, media reports said.

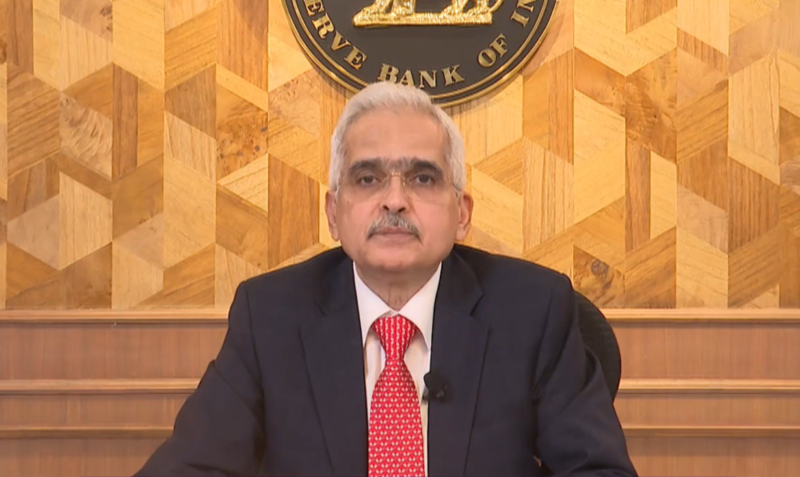

RBI governor Shaktikanta Das made the announcement on Friday.

This is the 11th consecutive time when the repo rate has been kept unchanged.

The RBI has kept the repo rate unchanged at 6.5% since February 2023, when it last increased the rate to its current level.

The central bank is tasked with maintaining consumer price index (CPI)-based inflation at 4%, with a 2% margin on either side.

Monetary Policy Statement by Shri Shaktikanta Das, RBI Governor - December 06, 2024, at 10 am https://t.co/ffu20k9GVl

— ReserveBankOfIndia (@RBI) December 6, 2024

In an off-cycle meeting in May 2022, the MPC raised the repo rate by 40 basis points, followed by additional hikes through February 2023, cumulatively increasing the rate by 250 basis points during this period.

The MPC comprises Nagesh Kumar, Director and Chief Executive at the Institute for Studies in Industrial Development; Saugata Bhattacharya, Economist; Ram Singh, Director at Delhi School of Economics; Rajiv Ranjan, RBI Executive Director; Michael Debabrata Patra, RBI Deputy Governor; and Shaktikanta Das, RBI Governor.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.