Axis Mutual Fund

Axis Mutual Fund

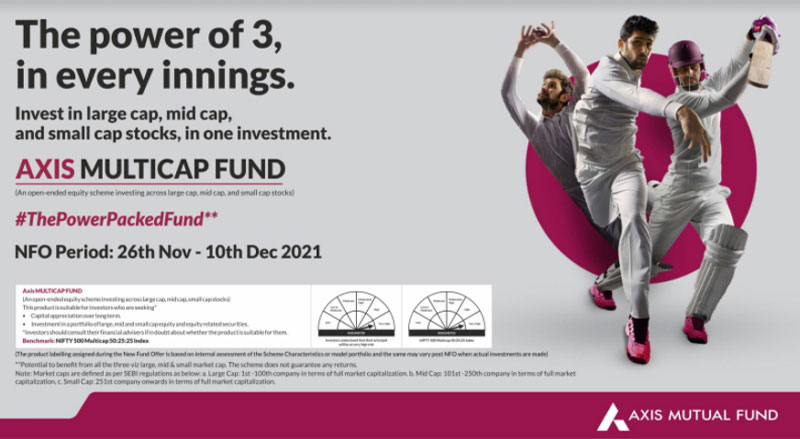

Axis Mutual Fund launches ‘Axis Multicap Fund’

Mumbai: Axis Mutual Fund on Tuesday announced the launch of their new fund offer named ‘Axis Multicap Fund’.

The power packed fund is all set to open on Nov 26, 2021 and close on Dec 10.

The NFO will provide investors with an opportunity to invest in large, mid, and small cap stocks with minimum equal exposure across each category.

The scheme will be managed by Anupam Tiwari and Sachin Jain, Fund Manager, Axis Asset Management Company Limited.

As per the SEBI Regulation, Multi-cap funds need to have a minimum 25 percent exposure under each market cap, ensuring that the portfolio is not overtly concentrated towards a particular market cap.

Due to its large and varied investment universe, Multi-cap funds offer the dual benefit of growth and risk-adjusted returns to the investors, making them one of the ideal solution for long-term investment objectives and wealth creation.

Indian capital markets offer a multitude of investment opportunities across the market cap spectrum.

The large & mid cap cut-off has almost doubled in the last 5 years.

While large caps provide cushion during tough market conditions, mid and small caps help drive alpha.

Axis Multicap Fund, as its name stands, packages a consistent mix across segments and is suitable for investors looking for a stable, conscious allocation across market capitalizations.

Investors who aim to achieve long-term financial goals with minimum volatility, and are moderate risk takers should consider investing in a multi-cap fund.

Axis Multicap Fund will leverage the bottom-up stock selection process, focusing on appreciation potential of individual stocks from a fundamental perspective.

The allocation will be managed actively with an emphasis of identifying best ideas within each market cap bucket. Since different market cap work in different phases, the multi-cap category aims to:

· Target leaders in all market cap bucket: Capture the larger organized markets and capable companies which have the potential to become leaders

· Manage risk and aim for stable returns

· Allow capturing potential companies and stipulating balanced allocation in all 3 market cap

· Endeavour to capture best ideas regardless of size and life cycle of the company

The fund will aspire to capture potential opportunities throughout the lifecycle of the company’s progression from Small cap all the way to a Large cap.

Through this approach, the fund will aim to achieve a quality centric long term portfolio with an improved risk-reward profile.

On the launch of the NFO, Chandresh Nigam, MD & CEO, Axis AMC, said “At Axis AMC, we believe in being relevant and responsible for the sake of our investors and changing market conditions. Our long-term focus is to not only protect capital but also returns. Keeping this strategy in mind, we have launched the ‘Axis Multicap Fund’. This fund will help our investors package large, mid and small-cap stocks in one single portfolio and steer through volatile market cycles. Our fundamentals rely on quality, and it has helped us sail through tough market conditions. I am confident that our market-wide allocation strategy and our philosophy will help us deliver sustainable growth over the long run.”

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.