Personal Finance I Fixed Deposits

Personal Finance I Fixed Deposits

Fixed Deposits: On A Rebound

Fixed deposits are once again gaining primacy, thanks to factors that are working in tandem in their favour, prompting an influential section of investors to consider these fixed-income options in addition to market-linked securities.

Deposits now provide higher rates of interest, thanks to the transmission policies lately pursued by deposit mobilisers, especially financial services companies, following the central bank’s latest policy on rates.

The Reserve Bank of India has lately increased the repo rate in line with strong inflationary trends, evident in India for the past few quarters. Corporate deposits (as well as the administered-rate small savings schemes offered by the post office) are now offering more than they did a quarter ago. Postal deposits have selectively increased their rates by up to 30 basis points.

.png)

A section of the market, particularly those who do not wish to adhere to market-determined returns provided by competitive asset classes, is now opting for superior guaranteed performance. Deposits are being viewed as a reliable category of assets – the schemes offered by financial services companies in particular are gaining ground at this moment.

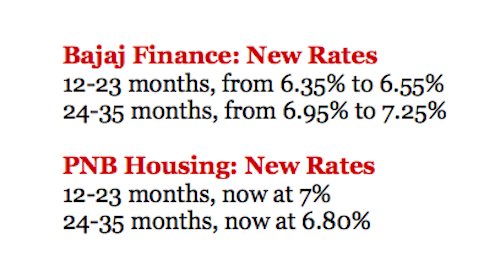

Among the popular players that have announced higher rates are Bajaj Finance and PNB Housing Finance. These have increased rates by up to 30 basis points, effectively from October 7. Other players in the same domain, including Shriram and Mahindra, are said to be looking at similar announcements. It may be mentioned here that the central bank has recently marked a number of large players (including the likes we have discussed here) as part of a perceived “Upper Layer”.

Rates such as these will compare quite favourably with those offered by public sector banks. The latter have not been able to promptly execute transmission policies; the investor fraternity has criticised their tardy moves, especially in the context of inflation. Their post-tax yield, on an average, is rather low, it is pointed out.

Corporate deposits are right now in a better position compared to small savings schemes. The latter do not compare favourably except in select cases like Senior Citizen Savings Scheme. SCSS, incidentally, will now offer the subscriber 7.6% (up from 7.4%). As for the competing National Savings Scheme, there is no change.

In the context of deposits, a few key points are worth remembering:

- Taxation is a major consideration. Deposits will provide interest – the latter is taxable at the hand of the investor.

- Mutual funds will stand a better chance. In terms of returns, funds are in a better position; these can offer greater value than assured-returns assets.

- Market-determined products (such as funds) will be subject to volatility. This will deter some investors – fresh allocations will be directed towards deposits, at least partially.

- There is “guarantee” (read: insurance) on deposits only to a limited extent. Relevant legislation entails a provision of Rs 5 lakhs (subject to strict conditions).

- Insofar as inflation-proofing is concerned, neither deposits nor funds will stand the test of time. Post-tax (and inflation-adjusted) returns will hold the key to investor satisfaction.

- The cost of holding is a vital factor too. Despite all the higher returns that contemporary deposits may provide, an ordinary investor must compare costs on a case-to-case basis.

- Factors like credit ratings are also critical, especially if the investor has to choose deposits and debt funds.

(Nilanjan Dey is Director, Wishlist Capital and author of No Room For Less. The views expressed in the column are of the writer. He can be reached on nildey@yahoo.com)

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.