Adani Crisis

Adani Crisis

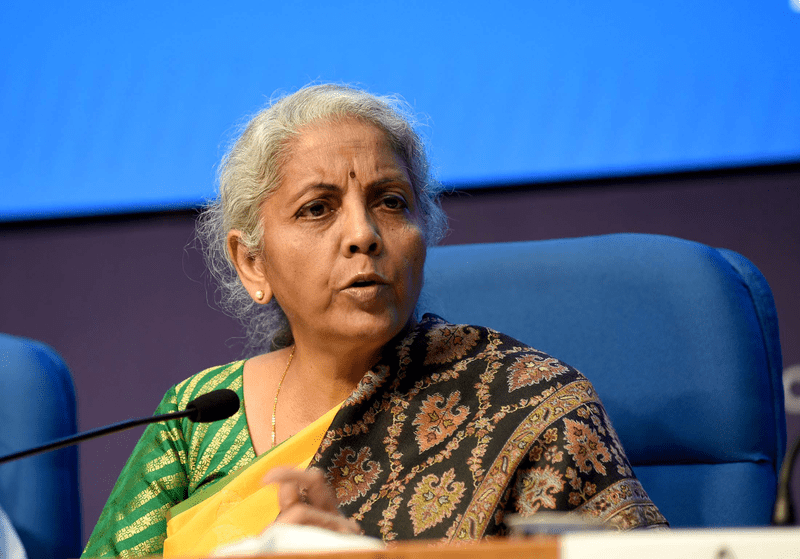

FM Sitharaman says LIC, SBI exposure to Adani Group within permissible limits: Report

Mumbai: Finance Minister Nirmala Sitharaman Friday said the exposure of big lenders such as LIC and State Bank of India (SBI) to the crisis-hit Adani Group is well within the permissible limits as stated by these lenders, according to media reports.

In an exclusive interview with Network18, Sitharaman said the government-owned behemoths are not overexposed.

Last week, ahead of the Adani Enterprises follow on public offer, US short-seller Hindenburg Research published a report raising concerns about high debt at the group and accused it of improper use of entities set up in offshore tax havens - a charge the group denies, according to Reuters.

The report alleged corporate misgovernance, stock price manipulation, and high leverage of the group.

Despite Adani Group Chairman Gautam Adani’s efforts to calm investors, the stocks of the listed companies of the conglomerate shed value with the group losing nearly $100 billion as of Thursday.

After the crisis surfaced, concerns have been raised over the banks’ exposure to Gautam Adani’s ports-to-power business empire.

According to Bloomberg, SBI has an exposure of Rs 21,000 crore to the Adani Group.

Earlier, LIC managing director and chief executive officer Siddhartha Mohanty had said that the insurance company is positive on the investments in the Adani group, and “within our prudent norms,” Moneycontrol reported.

Meanwhile, RBI has sought the current status of banks’ exposure to Adani Group, the report said.

In the interview with Network18, Sitharaman said in general, the Indian banking system has significantly improved health in terms of Gross Non-Performing Assets and recoveries.

“Having gone through the twin balance sheet problem, the Indian banking sector is at a comfortable level with NPAs coming down to absolute low levels and recovery happening,” the FM told News18.

The GNPA ratio of scheduled commercial banks (SCBs) declined to 5 percent in September 2022, the lowest in seven years, the RBI said in its financial stability report (FSR) on December 29.

The net non-performing assets (NNPA) shrank to a 10-year low of 1.3 percent in September 2022, the FSR report said.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.