GST collections in November rise 8.5% to Rs 1.8 lakh crore

Dec 02, 2024, at 07:32 pm

New Delhi/IBNS: Goods and Services Tax (GST) collection for November rose by 8.5 percent to Rs 1,82,269 crore, marking the fourth-highest figure since the implementation of the new tax regime over seven years ago.

GST collection hits six-month high at Rs 1.87 lakh crore, up 8.9% in Oct

Nov 01, 2024, at 11:39 pm

New Delhi/IBNS: Goods and Services Tax (GST) collections reached a six-month peak of Rs 1.87 lakh crore in October, surpassing the Rs 1.7 lakh crore mark for the eighth straight month, according to data released on Friday (Nov. 1).

GoM proposes exemption of health insurance premiums, term life cover from GST

Oct 20, 2024, at 05:27 am

New Delhi: The Group of Ministers (GoM) on GST rate rationalisation said on Saturday that health insurance premiums paid by senior citizens, and premiums paid on term life insurance will be exempted from GST, media reports said.

Oct 20, 2024, at 04:59 am

New Delhi: The Group of Ministers (GoM) on GST rate rationalisation has decided to reduce tax rates on 20-litre packaged drinking water bottles, bicycles, and exercise notebooks to 5 percent, while proposing an increase in taxes on high-end wristwatches and shoes, media reports said.

SpiceJet hasn't paid Rs 427 cr in GST, TDS, and PF dues since 2020: Report

Sep 18, 2024, at 05:22 am

Mumbai: Budget airline SpiceJet announced on Tuesday that it failed to pay statutory dues amounting to Rs 427 crore between March 2020 and August 2024, citing its "constrained financial position", media reports said.

States fail to reach consensus on GST relief on health insurance premiums

Sep 04, 2024, at 11:06 pm

New Delhi: States remain divided over a proposal to exempt health insurance premiums from Goods and Services Tax (GST), with the Fitment Committee—comprising revenue officials from both state and Union governments—struggling to agree on this contentious issue, media reports said.

GST Council meeting next month to discuss tax rate rationalization: FM

Aug 28, 2024, at 04:32 am

New Delhi: Finance Minister Nirmala Sitharaman announced on Tuesday that the GST Council will discuss the rationalization of tax rates next month though a final decision on adjusting taxes and slabs will be made later.

GST Intelligence uncovers tax evasion worth Rs 1.2 trillion since 2020

Aug 22, 2024, at 03:13 am

New Delhi: The Directorate General of GST Intelligence (DGGI) has uncovered tax evasion amounting to Rs 1.2 trillion through the use of fake input tax credits (ITC) from 2020 to the present, with a focus on identifying and apprehending the masterminds behind these operations and dismantling the syndicates operating across the country, the finance ministry said in a release on Tuesday.

'Rationalise and simplify': IMF's Gita Gopinath gives tips to increase GST revenue

Aug 18, 2024, at 07:13 am

New Delhi: Emphasising that structural reforms should be continuous, Deputy Managing Director of the International Monetary Fund (IMF) Gita Gopinath said that India should continue to rationalise and simplify its Goods and Services Tax (GST) system to boost revenue, media reports said.

Bajaj Finance receives Rs 341 crore GST ’evasion’ notice from DGGI: Report

Aug 09, 2024, at 06:47 pm

Pune/IBNS: Pune-headquartered non-banking financial company Bajaj Finance has received a Rs 341 crore show-cause notice from the Directorate General of Goods and Services Tax Intelligence (DGGI) alleging tax evasion by wrongfully categorising a service charge as an interest charge in an August 3 notice, as per a report by Economic Times.

GST on health and life insurance premiums may be reduced: Report

Aug 08, 2024, at 10:44 pm

New Delhi/IBNS: The Goods and Services Tax (GST) rate on the premium paid on health and life insurance may be reduced as a proposal in this regard has been sent to the GST rate rationalisation committee, CNBC-Awaaz reported on Thursday (Aug 8) citing sources familiar with the development.

Axis Bank facilitates seamless GST payments for its commercial card clients

Aug 08, 2024, at 06:36 am

Kolkata: Axis Bank today announced its successful integration with the Goods and Service Tax portal, thereby allowing its Commercial Card Corporate customers to make GST payments seamlessly.

Govt to not go easy on Infosys over Rs 32,000 cr GST demand

Aug 07, 2024, at 06:15 am

New Delhi: The government is not considering any relaxation of the tax demand sent to Infosys last month, Reuters reported, citing a government source.

Aug 02, 2024, at 07:45 pm

Bengaluru/IBNS: Indian multinational information technology company Infosys on Thursday (Aug 1) announced in a regulatory filing to the stock exchanges that the Karnataka state Goods and Services Tax (GST) authority has withdrawn the pre-show-cause notice against the company for alleged tax evasion.

Infosys shares drop 1% after IT major slapped with Rs 32,403 crore GST notice for overseas expenses

Aug 01, 2024, at 06:41 pm

Bengaluru/IBNS: Shares of Indian multinational information technology company Infosys dropped 1 percent to the day's low of Rs 1,845.40 on BSE on Thursday (Aug 1) after the IT major was slapped with a RS 32,403 crore Goods and Services Tax (GST) notice by the Directorate General of GST Intelligence over overseas expenses, reports said.

Jul 31, 2024, at 05:58 pm

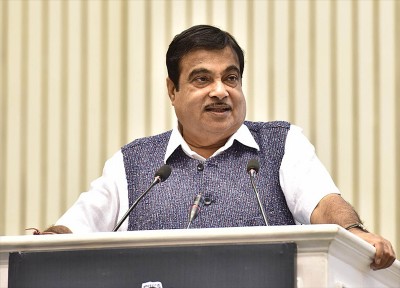

New Delhi/IBNS: Nitin Gadkari, the Union road, transport and highways minister, has written to finance minister Nirmala Sitharaman, seeking withdrawal of the 18 percent Goods and Services Tax (GST) on life and medical insurance premiums, reports MoneyControl.

Relief for industry and GST taxpayers as govt cracks down on GST demand notices: Report

Jul 06, 2024, at 08:39 pm

New Delhi: The government has decided to send any GST (Goods and Service Tax) demand notice to the taxpayers, only once there is approval from the Union Ministry of Finance in the North Block, reports CNBC TV18.

GST Council tweaks rates for range of products and services

Jun 23, 2024, at 06:51 am

New Delhi: Union Finance Minister Nirmala Sitharaman presided over preliminary discussions with finance ministers from states and Union Territories to gather their perspectives ahead of the upcoming Budget.

Google defers experiment to increase RMG apps on Play Store

Jun 22, 2024, at 05:44 am

Tech giant Google on Friday announced it is pausing its experiment to increase the number of real-money gaming (RMG) apps on its Play Store in countries without a central licensing framework, media reported.

May 07, 2024, at 04:54 am

Former Chief Justice of Jharkhand High Court, (Retd.) Justice Sanjay Kumar Mishra, has been appointed as the first President of the Goods and Services Tax Appellate Tribunal (GSTAT), clearing the decks for resolving GST-related disputes.

April GST collection hits record high at Rs 2.1 lakh crore, up 12.4% y-o-y

May 02, 2024, at 03:00 am

New Delhi: India saw a record high in Goods and Services Tax (GST) revenue for April 2024, a 12.4 percent y-o-y increase, hitting a historic peak of Rs 2.1 lakh crore in gross terms, the Finance Ministry said on Wednesday.

Gross GST revenue in March at Rs 1.78 lakh crore

Apr 01, 2024, at 11:27 pm

Indicating a rise in business activity, the Gross Goods and Services Tax (GST) revenue for the month of March 2024 witnessed the second highest collection ever at Rs 1.78 lakh crore with a 11.5 per cent year-on-year growth.

GST Revenue collection at Rs 1,68,337 cr in Feb 2024

Mar 01, 2024, at 11:23 pm

The government said on Friday that the GST collection in the month of February stood at Rs 1,68,337 crore, marking a robust growth of 12.5 percent over the same month last year.

January GST collection grows 4.4% to Rs 1.72 lakh cr

Feb 01, 2024, at 05:52 am

New Delhi: The government's Goods and Services Tax (GST) collections surged to Rs 1.72 lakh crore in January, according to the provisional data released by the Ministry of Finance on Wednesday.

Zomato says 'not liable' to pay any tax on delivery charges in response to GST notice

Dec 28, 2023, at 06:36 pm

Food delivery giant Zomato has said it is "not liable" to pay any tax on delivery charges responding to a notice served by the Directorate General of Goods and Services Tax Intelligence (DGGI).

21,791 fake GST registrations, tax evasion of over Rs 24,000 cr uncovered: Sitharaman

Dec 06, 2023, at 02:28 am

New Delhi: GST officers have identified 21,791 fraudulent GST registrations and uncovered potential tax evasion exceeding Rs 24,000 crore during a two-month-long special drive, Finance Minister Nirmala Sitharaman on Tuesday said.

GST collection surges 15% YoY to Rs 1.68 trillion in November

Dec 02, 2023, at 06:18 am

New Delhi: Highlighting the ongoing robust activity in the Indian economy, the collection of goods and services tax (GST) witnessed a substantial 15% year-on-year surge in November.

Taxman slaps GST demand of Rs 750 cr on Swiggy and Zomato

Nov 23, 2023, at 05:14 am

The Directorate General of GST Intelligence has sent Goods and Services Tax (GST) demand notices to the food aggregators Zomato and Swiggy, media reports said on Wednesday.

October GST collection tops Rs 1.72 lakh crore

Nov 01, 2023, at 10:13 pm

On the back of economic activities and anti evasion measures by the government, the Goods and Services Tax (GST) mop-up topped Rs 1.72 lakh crore in the month of October 2023 recording 13% year-on-year growth.

Fitment committee refuses industry's demand to reduce GST on EV batteries, tobacco products: Report

Oct 05, 2023, at 04:26 am

New Delhi: The Goods and Service Tax (GST) fitment committee has declined the industry's request to reduce the tax on EV batteries and tobacco products, reported Moneycontrol.