Interest rate cut

Interest rate cut

Govt slashes interest rates on small savings, PPF down from 7.1 pct to 6.4 pct

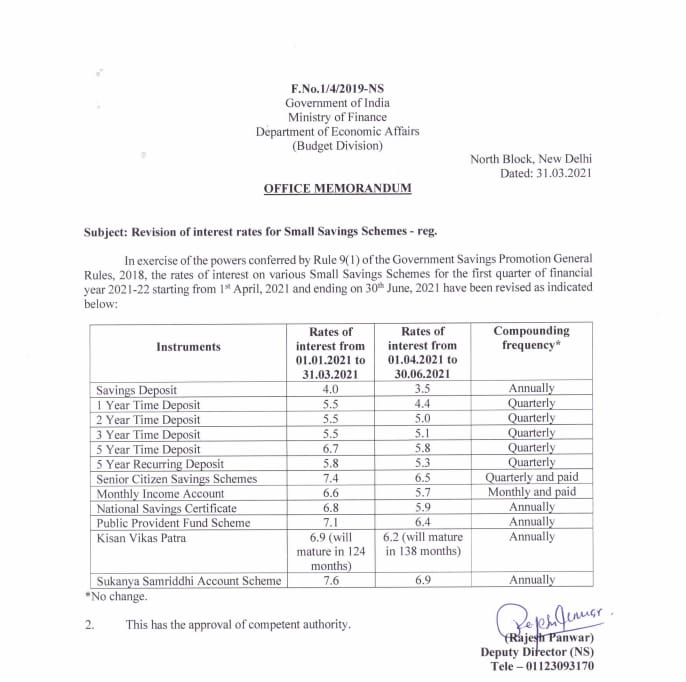

New Delhi/IBNS: The Indian Government on Wednesday slashed the interest rate on small savings from 4 per cent to 3.5 per cent annually, while Public Provident Fund (PPF) will be down from 7.1 per cent to 6.4 per cent.

From April 1, which marks the beginning of the new financial year, National Savings Certificate (NSC) will get an interest of 5.9 per cent and the Sukanya Samriddhi Yojana will guarantee an interest rate of 6.9 per cent.

The Centre has cut the interest rate for the five-year Senior Citizens Savings Scheme, paid quarterly, to 6.5 per cent.

The interest rate on Kisan Vikas Patra (KVP) has also been lowered to 6.2 per cent.

The interest rate on post office savings deposits has been struck down to 3.5 per cent while term deposits of one-to-five years will fetch interest rate in the range of 4.4-5.1 per cent, to be paid quarterly, as per the revised guideline.

Meanwhile, the interest rate on a five-year recurring deposit will be 5.8 per cent.

This is the second time the Centre has cut interest rates on small savings schemes in a span of one year.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.