RBI imposes business restrictions on Edelweiss Group and ECL Finance Ltd

May 30, 2024, at 03:15 am

Mumbai: The Reserve Bank on Wednesday imposed business restrictions on the lending and asset reconstruction arms of the Edelweiss Group due to concerns over loan evergreening.

RBI introduces PRAVAAH portal, Retail Direct mobile app and FinTech Repository

May 29, 2024, at 04:39 am

Mumbai: The Reserve Bank of India (RBI) introduced three important initiatives on Tuesday: the PRAVAAH portal, the RBI Retail Direct mobile application, and the FinTech Repository, previously announced in April 2023, April 2024, and December 2023, respectively.

RBI imposes Rs. 1 crore penalty on ICICI Bank, fines Yes Bank Rs. 91 lakhs for non-compliance

May 28, 2024, at 09:10 pm

Reserve Bank of India has fined private lenders Yes Bank and ICICI Bank over non-compliance.

Paytm CEO expects near-term financial impact due to disruptions in Q4, hints at AI-driven job cuts

May 23, 2024, at 05:43 pm

New Delhi/IBNS: Hinting at the likelihood of Artificial Intelligence (AI)-driven layoffs in the future, Paytm CEO Vijay Shekhar Sharma, in a letter to shareholders on Wednesday (May 22), said that the fintech company will focus on its core businesses and improve cost efficiencies to create a leaner organization.

RBI approves a dividend of Rs 2.11 lakh cr to Centre, an increase of 141% YoY

May 22, 2024, at 10:43 pm

Mumbai: The Reserve Bank of India on Wednesday approved a dividend of Rs 2.11 lakh crore for the Central government for FY24, a significant increase of around 141 percent compared to FY23.

Alignment with 4% inflation target may occur in latter part of the year: RBI report

May 22, 2024, at 04:32 am

Mumbai: The Reserve Bank of India's (RBI) latest monthly bulletin, released on Thursday, indicates that achieving a sustained alignment of inflation with the 4 percent target may occur in the latter half of the year.

India to again delay caps on UPI payments market share, reports Reuters

May 10, 2024, at 11:38 pm

Mumbai/IBNS: India will again delay caps on market share for a popular digital payments method, benefiting Google Pay and Walmart-backed PhonePe as the authorities prioritise growth over concerns about market concentration, Reuters reported quoting its sources.

May 09, 2024, at 08:40 pm

Mumbai/IBNS: The Reserve Bank of India (RBI) has allowed Bank of Baroda (BOB) to onboard customers via its 'BOB World' mobile application, following which shares of the public sector bank surged 3.4 percent to Rs 271 per share on Thursday (May 9).

RBI asks NBFCs to disburse cash loans only up to Rs 20,000: Report

May 09, 2024, at 02:16 am

Mumbai: The Reserve Bank of India (RBI) cautioned non-bank finance companies (NBFC) on Wednesday, advising them against providing cash loans exceeding the permitted threshold of Rs 20,000 ($240), media reported.

PSU Bank shares drop as new RBI norms for infra project financing spoil mood

May 07, 2024, at 02:02 am

Mumbai/IBNS: The shares of state-run lenders of India, including State Bank of India (SBI), Punjab National Bank (PNB), Union Bank of India, Bank of Baroda (BOB), and Maharashtra Bank, tumbled up to 6 percent on Monday after the Reserve Bank of India (RBI) published a draft proposing tighter rules for lending and heightened monitoring for under-construction infrastructure projects, reports said.

JP Morgan upgrades Kotak Mahindra Bank to overweight

May 06, 2024, at 07:24 pm

JP Morgan has upgraded private sector lender Kotak Mahindra Bank from neutral to overweight, media reports said.

RBI permits SPDs to borrow in foreign currency

May 04, 2024, at 05:40 am

Mumbai: The Reserve Bank of India (RBI) on Friday granted standalone primary dealers (SPDs) permission to borrow in foreign currency from their parent companies and authorised entities.

Small Finance Banks can now apply to become universal banks under the on-tap licesning norms: RBI

Apr 27, 2024, at 05:50 am

Mumbai: The Reserve Bank of India (RBI) on Friday said that small finance banks (SFBs) meeting certain criteria can now seek approval from the regulator to transition into universal banks under the on-tap licesning norms.

RBI issues new norms for LSPs to facilitate informed decisions by borrowers

Apr 27, 2024, at 04:45 am

Mumbai: The Reserve Bank of India (RBI) on Friday said that lending service providers (LSPs), operating as representatives of banks should disclose all available loan offers to borrowers to facilitate informed decision-making.

Stock market opens in red, Kotak Mahindra Bank shares plunge 10% on RBI curbs

Apr 25, 2024, at 04:28 pm

Mumbai/IBNS: The Indian benchmark indices opened on a negative note on Thursday (Apr 25), following global peers down as a rout in tech stocks dragged the US benchmark indices down after disappointing forecasts by Facebook's parent Meta.

Credit card spending grows 27% YoY to Rs 18.26 trillion in FY24: RBI

Apr 25, 2024, at 07:36 am

Mumbai: Credit card spending increased by 27% year-on-year to Rs 18.26 trillion in the financial year 2023-24 (FY24), up from around Rs 14 trillion in the previous year, according to the latest data from RBI.

PayU gets RBI's in-principle approval to operate as Payment Aggregator

Apr 24, 2024, at 03:40 am

Mumbai: After a wait of nearly 15 months, the Reserve Bank of India (RBI) has granted initial approval to PayU, a fintech firm backed by Prosus, to operate as a Payment Aggregator (PA) and resume the process of onboarding new merchants.

Cred gets RBI's in-principle approval to operate as payment aggregator

Apr 20, 2024, at 06:25 am

Mumbai: Bengaluru headquartered firm Cred, a top third-party app for credit card bill settlements in India, has received in-principle approval from the Reserve Bank of India (RBI) to operate as a payment app, said media reports.

RBI conducts 2-day VRRR auctions as liquidity in banking system nears Rs 1 trillion

Apr 17, 2024, at 04:42 am

Mumbai: The Reserve Bank of India on Tuesday held a two-day variable rate reverse repo (VRRR) auction due to the nearing Rs 1 trillion liquidity surplus in the banking system.

Apr 16, 2024, at 08:44 pm

The Reserve Bank of India on Monday (April 15, 2024) directed all banks and regulated entities not to levy additional fees on loans that were not previously disclosed in the Key Fact Statement (KFS).

RBI launches survey of manufacturing companies

Apr 10, 2024, at 08:28 am

Mumbai: The Reserve Bank has started the latest cycle of its quarterly survey on order books, inventories, and capacity utilization of manufacturing firms, which serves as a crucial component for shaping monetary policy.

Paytm Payments Bank MD & CEO Surinder Chawla resigns due to 'personal reasons'

Apr 10, 2024, at 05:01 am

New Delhi: In a fresh development, Paytm Payments Bank’s Managing Director and CEO, Surinder Chawla, has stepped down due to personal reasons, its parent company One97 Communications Limited said in a filing with the stock exchanges.

RBI slaps fines on IDFC First Bank and LIC Housing Finance for non-compliance

Apr 06, 2024, at 07:52 am

Mumbai: The Reserve Bank on Friday said that it has fined IDFC First Bank Rs 1 crore and LIC Housing Finance Rs 49.70 lakh for breaching specific regulations. The penalty on IDFC First Bank was levied due to failure to adhere to certain directives regarding 'Loans and Advances - Statutory and Other Restrictions', according to the central bank’s statement.

RBI keeps repo rate unchanged in line with market expectations

Apr 06, 2024, at 04:54 am

Mumbai: The Reserve Bank of India on Friday kept the key interest rates unchanged at 6.50 percent, in line with the market expectations.

Rupee most stable compared to peers due to strong fundamentals of Indian economy: RBI

Apr 05, 2024, at 06:55 pm

New Delhi/UNI: The Indian currency (INR) was the most stable among major currencies during the past three years and this reflects sound economic fundamentals of the Indian economy, says the Reserve Bank of India.

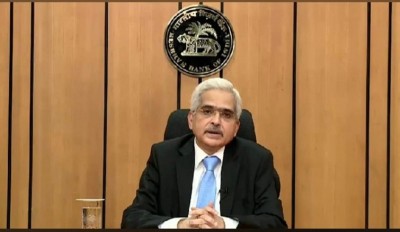

RBI keeps repo rate unchanged at 6.5%, projects 7% growth for FY25

Apr 05, 2024, at 05:23 pm

New Delhi/UNI/IBNS: Considering various factors both in the domestic and global markets, the Reserve Bank of India Friday projected 7 percent growth for Indian economy for FY25. RBI governor Shaktikanta Das said after three days of deliberations, the Monetary Policy Committee unanimously decided to keep the key interest rates unchanged at 6.50 per cent.

RBI's 3-day MPC meeting starts

Apr 04, 2024, at 06:40 am

Mumbai: The Reserve Bank of India's Monetary Policy Committee has started its three-day meeting on Wednesday to deliberate on interest rates and analyze the state of the economy.

RBI won't accept or exchange Rs. 2000 currency notes on April 1

Mar 29, 2024, at 08:42 pm

The Reserve Bank of India on Friday announced Rs. 2000 currency note will not be exchanged or accepted on April 1 due to operations associated with the Annual Closing of Accounts.

RBI to temporarily stop exchange/ deposit of 2,000 banknotes on Apr 1

Mar 29, 2024, at 02:12 am

Mumbai: The Reserve Bank of India (RBI) has announced that the exchange or deposit of Rs 2,000 banknotes will not be available on Monday, April 1, 2024, at its 19 issue offices nationwide.

India's foreign exchange reserves grow by $6.396 billion to $642.492

Mar 23, 2024, at 02:00 am

Mumbai: India's foreign exchange kitty fattened by $6.396 billion to $642.492 billion for the week ending on March 15, as per the statement from the Reserve Bank on Friday.