Govt appoints Rama Mohan Rao Amara as new MD of SBI

Dec 18, 2024, at 11:19 pm

Mumbai: Rama Mohan Rao Amara has been appointed as the new Managing Director (MD) of the State Bank of India (SBI) for a tenure of three years, according to a Reuters report, the state-owned lender informed the exchanges.

CRR cut, AI ethics push, and SORR benchmark: Experts hail RBI’s pragmatic policy moves

Dec 07, 2024, at 05:04 am

Mumbai: The Reserve Bank of India (RBI) has kept the repo rate unchanged at 6.5% while the cash reserve ratio (CRR) has been slashed by 50 basis points to 4 percent.

Bank of Bhutan inks deal with TCS to modernize digital core for enhanced customer service.

Dec 04, 2024, at 03:19 am

Thimphu/Mumbai: IT major Tata Consultancy Services TCS has announced a strategic partnership with the Bank of Bhutan to modernize the bank’s digital core for enhanced customer service.

Indian govt mulling minority stake sale in four state-owned banks: Report

Nov 20, 2024, at 04:32 am

New Delhi: The Indian government is mulling offloading a minority stake in four state-owned banks to meet the public shareholding rules mandated by the country's markets regulator SEBI, a government source told Reuters.

RBI approves appointment of Pranav Chawda as CEO of JP Morgan Chase banking unit in India

Oct 24, 2024, at 06:01 am

Mumbai: The Reserve Bank of India (RBI) has approved the appointment of Pranav Chawda as the chief executive officer of JPMorgan Chase & Co.’s local banking unit for a three-year term, Bloomberg reported, citing a statement from the US lender on Wednesday.

UBS eyes Indian wealth management expansion with 360 One WAM joint venture: Report

Sep 27, 2024, at 11:39 pm

Mumbai: UBS is in discussions to establish an Indian wealth management joint venture with Mumbai-based 360 One WAM, Reuters reported.

SBI plans to sell stake worth Rs 2.2 billion in Yes Bank by end of March 2025: Report

Aug 14, 2024, at 02:42 am

Mumbai: India’s largest lender the State Bank of India (SBI) plans to finalise a deal by the end of March to sell its 24 percent stake in Yes Bank, valued at Rs 18,420 crore (around $2.2 billion), Reuters reported.

UCO Bank Q1FY25: Net profit jumps 147.09% YoY to Rs 551 cr; NII grows 12% YoY to Rs 2,254 cr

Jul 23, 2024, at 02:44 am

Kolkata: UCO Bank Monday reported 147.09% y-o-y growth in net profit to Rs 551 crore in the first quarter of FY25, compared to Rs 223 crore in the same period last year.

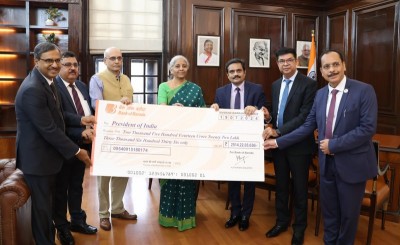

Govt receives dividend of Rs 6,481 cr from 4 PSU banks

Jul 11, 2024, at 05:05 am

New Delhi: Four public sector banks, including Canara Bank and Indian Bank, on Wednesday presented dividend cheques worth Rs 6,481 crore to Finance Minister Nirmala Sitharaman for financial year 2023-24.

Continued slowdown in bank deposit growth in June qtr: Report

Jul 06, 2024, at 05:14 am

Mumbai: Concerns about a continued slowdown in bank deposit growth persist, with several top lenders experiencing a sequential decline in deposits in the June quarter of FY25, media reports said.

SBI raises Rs 10,000 cr via infra bonds

Jun 27, 2024, at 04:19 am

Mumbai: The State Bank of India (SBI) has raised Rs 10,000 crore through 15-year infrastructure bonds to finance projects in sectors such as power and roads.

Banks flag shortage of ATMs to govt, RBI: Report

Jun 19, 2024, at 11:18 pm

New Delhi: Banks have reportedly informed the government and Reserve Bank of India (RBI) about shortage in supply of automated teller machines (ATMs), reported Economic Times.

May 31, 2024, at 10:06 pm

New Delhi: The Enforcement Directorate (ED) has seized Rs 64,920 crore related to nearly 1,105 bank fraud cases to date, Finance Minister Nirmala Sitharaman reiterated on May 31 in a series of posts on the social media platform X.

RBI approves a dividend of Rs 2.11 lakh cr to Centre, an increase of 141% YoY

May 22, 2024, at 10:43 pm

Mumbai: The Reserve Bank of India on Wednesday approved a dividend of Rs 2.11 lakh crore for the Central government for FY24, a significant increase of around 141 percent compared to FY23.

May 18, 2024, at 05:33 am

Mumbai: Private sector lender Bandhan Bank reported a steep decline of over 93 percent in its net profit, which fell to Rs 54.63 crore in the January-March quarter (Q4) of the financial year 2023-24, compared to Rs 808.29 crore in the same period of the previous fiscal year, 2022-23.

Bank of Baroda Q4FY24 net profit up 2.3% YoY to Rs 4,886.49 cr; NII up 2.3% to Rs 11,793 cr

May 10, 2024, at 09:47 pm

Mumbai: State-run lender Bank of Baroda on Friday said its standalone net profit reached Rs 4,886.49 crore in Q4FY24, up 2.3% compared to Rs 4,775.33 crore in the year-ago period.

Punjab National Bank Q4FY24 PAT soars 160% YoY to Rs 3,010 cr; NII grows 9% YoY to Rs 10,363 cr

May 10, 2024, at 06:09 am

New Delhi: Public sector lender Punjab National Bank (PNB) Thursday reported an impressive growth in net profit at 159.8% YoY to Rs 3,010.27 crore in Q4FY24 compared to Rs 1,159 crore in the corresponding period last year.

SBI Q4FY24: PAT grows 24% YoY to Rs 20,698 cr; NII grows 19% to Rs 1.11 lakh cr

May 10, 2024, at 03:27 am

Mumbai: India’s largest lest lender State Bank of India (SBI) on Thursday reported net profit of Rs 20,698 crore, marking a 24 percent year-on-year increase for the fourth quarter of FY 24.

May 08, 2024, at 10:16 pm

Mumbai: Canara Bank reported a robust performance for the March quarter, with standalone net profit increasing by 18.33% year-on-year to Rs 3,757.23 crore, compared to Rs 3,174.74 crore in the same quarter last year.

RBI slaps fines on IDFC First Bank and LIC Housing Finance for non-compliance

Apr 06, 2024, at 07:52 am

Mumbai: The Reserve Bank on Friday said that it has fined IDFC First Bank Rs 1 crore and LIC Housing Finance Rs 49.70 lakh for breaching specific regulations. The penalty on IDFC First Bank was levied due to failure to adhere to certain directives regarding 'Loans and Advances - Statutory and Other Restrictions', according to the central bank’s statement.

SBI revises yearly maintenance charges of some cards

Mar 28, 2024, at 06:07 am

Mumbai: The State Bank of India (SBI) has updated the yearly maintenance fees for specific debit cards.

All agency banks to remain open for public on March 31: RBI

Mar 21, 2024, at 08:17 am

New Delhi: All banks dealing with government receipts and payments will remain open on Sunday, March 31, to account for all the transactions in the financial year 2023-24.

NEFT witnesses highest ever daily transaction on Feb 29

Mar 02, 2024, at 04:31 am

Mumbai: The Reserve Bank of India (RBI) announced on Friday that the National Electronic Funds Transfer (NEFT) recorded its highest-ever daily transaction volume of Rs 4.10 crore on February 29, 2024.

ICICI Bank branch manager ran scam for years to meet performance targets: Report

Feb 15, 2024, at 06:40 am

Pratapgarh (Rajasthan): An ICICI Bank branch manager and his associates successfully met their business performance goals over several years by withdrawing funds from the accounts of unsuspicious customers at their branch, media reports said.

RBI calls on banks to remain vigilant against accumulation of risks

Feb 15, 2024, at 03:35 am

Mumbai: RBI Governor Shaktikanta Das cautioned banks about the accumulation of risks within the banking system during a meeting with CEOs. He underscored the importance of remaining vigilant and avoiding complacency, stressing that banks must stay alert to potential risks, media reports said.

Bandhan Bank Q3FY24: Net profit jumps 152% YoY to Rs 737 cr

Feb 10, 2024, at 08:07 am

Bandhan Bank on Friday reported impressive earnings for the quarter ended December 31, 2023, with the net profit surging by around 152% year-on-year (YoY) to Rs 737 crore compared to Rs 290.6 crore in Q3 FY23.

Govt expected to receive $2 billion in dividends from PSBs in next fiscal year

Feb 07, 2024, at 03:43 am

New Delhi: The public sector banks are reporting substantial profits and are likely to produce $2 billion in dividends for the next financial year, starting on April 1, media reports said.

State Bank of India Q3FY24: Net profit declines 35%YoY to Rs 9,164 cr; NII grows 4.59%

Feb 04, 2024, at 02:04 am

Mumbai: Public sector lender State Bank of India (SBI) reported a net profit of Rs 9,164 crores, down 35.49% year-on-year compared to Rs 14,205 crores.

Bandhan Bank appoints Santosh Nair as Head – Consumer Lending & Mortgages

Feb 02, 2024, at 07:09 am

Kolkata: Bandhan Bank appointed Santosh Nair as Head – Consumer Lending & Mortgages, a press release said.

Over 95% of Rs 2,000 currency notes back in banking system: RBI

Feb 02, 2024, at 04:36 am

Mumbai: Over 95 percent of the Rs 2,000 currency notes in circulation as of May 19, 2023, are back in the banking system, the Reserve Bank of India (RBI) said on Thursday.