Home Loan Vs. Mortgage Loan: Know The Difference

Aug 27, 2024, at 11:48 pm

When navigating the world of property financing, understanding the distinction between a home loan and a mortgage loan is crucial. Though often used interchangeably, these terms have specific differences that can impact your financial planning. This guide will help you distinguish between them, ensuring you make informed decisions.

Home Loan Balance Transfer: Unlocking the Path to Savings

Apr 18, 2024, at 12:12 am

In the realm of managing home loan finances, a balance transfer facility emerges as a strategic tool for homeowners seeking to optimize their finances. Through home loan refinancing, you can transfer your outstanding loan amount from the existing lender to a new lender, typically to avail of a lower home loan interest rate.

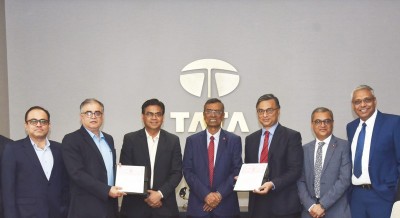

Bandhan Bank and Tata Motors sign MoU to offer attractive commercial vehicle financing solutions

Feb 14, 2024, at 02:06 am

Kolkata: Private sector lender Bandhan Bank has signed a Memorandum of Understanding (MoU) with Tata Motors to offer convenient financing solutions to its commercial vehicle customers.

Borrowing for consumer durables on the rise; EMI cards remain popular medium of credit: Survey

Dec 20, 2023, at 04:51 am

Mumbai: The trend in borrowing, in the last three years, has shifted from running the household to buying consumer durable such as smartphones and home appliances, according to a study.

Yes Bank looks for buyers to sell its portfolio of distressed corporate and retail loans

Dec 13, 2023, at 04:16 am

Mumbai: Yes Bank is planning to sell another portfolio worth a little over Rs 4,200 crore, ET reported.

Top banks ask fintech partners to limit small ticket loans

Dec 08, 2023, at 06:31 am

Mumbai: Leading banks and non-banking financial institutions in India have reportedly asked their fintech partners to limit the issuance of small personal loans, as disclosed by three banking sources and one industry insider on Thursday, Reuters reported.

RBI cracks whip on peer-to-peer lenders over violation of rules and misselling: Report

Dec 06, 2023, at 07:42 am

Mumbai: The Reserve Bank of India has instructed peer-to-peer lending platforms to halt certain activities after inspections revealed violations of rules and deceptive sales practices, Reuters reported.

How Does Loan Against Property Help A Borrower?

Sep 27, 2023, at 04:41 pm

A loan can be a feasible option when someone is facing a financial crisis or needs funds for personal reasons such as medical expenses or expanding a business. A loan against property is a sensible option for those who have property in their name and need substantial funds. This secured loan, as implied by its name, involves using the property as collateral to secure funds provided to the borrower. The lender extends the loan because the borrower pledges their property as security throughout the repayment period.

Things To Keep in Mind Before Taking a Two-wheeler Loan

Aug 26, 2023, at 11:33 pm

Owning a two-wheeler in India isn't just a mode of transport; it's a symbol of convenience, freedom, and empowerment. However, the costs associated with purchasing a two-wheeler can often be a financial hurdle. This is where taking a bike loan comes into play, offering a practical solution to help you ride away with your dream vehicle. In this comprehensive guide, we'll unravel the concept of bike loans, walk you through the factors to consider before acquiring one, and empower you to make an informed decision.

RBI issues guidelines to recalibrate floating rate loan EMI

Aug 19, 2023, at 02:56 am

Mumbai: The Reserve Bank of India (RBI) on Friday released comprehensive guidelines for the recalibration of interest rates for equated monthly installments (EMIs) in floating interest loans.

Flipkart partners with Axis Bank to facilitate personal loans for customers

Jul 08, 2023, at 02:56 am

Bengaluru: E-commerce marketplace Flipkart has entered into a strategic partnership with private sector lender Axis Bank to facilitate personal loans for its valued customers, adding additional convenience and enhanced benefits to its 450 million customers.

Tips for a Smooth Home Loan Balance Transfer: Dos and Don'ts

Jul 07, 2023, at 11:04 pm

In the case of home loans, the rate of interest offered plays a crucial role in determining the affordability of the loan. High home loan interest rates can easily push one's EMIs into the unaffordable range and amplify the burden of loan repayment.

The Role of Home Loan Tax Benefits in Affordable Housing Initiatives

Jun 30, 2023, at 11:45 pm

Homeownership is a dream for many individuals and families, and governments around the world have recognized the importance of making housing more affordable. In an effort to support affordable housing initiatives, governments often provide tax benefits specifically targeted towards home loans. These home loan tax benefits play a significant role in making homeownership more accessible and financially viable for individuals. In this blog post, we will explore the crucial role of home loan tax benefits in affordable housing initiatives, shedding light on how they can positively impact aspiring homeowners.

7 Ways to Improve Your Credit Score to Get a Good Bike Loan Offer

Jun 23, 2023, at 05:41 pm

When you apply for a bike loan, your credit score is one of the most critical factors lenders assess. This is because a credit score numerically represents your credit profile and ranges between 300 - 900. The closer it is to 900, the better your chances of a better offer.

6 Key Points to Consider When Searching for Online Loan Providers

Apr 28, 2023, at 11:51 pm

A personal loan can help you tackle any planned or unplanned expenses. One of the biggest advantages of a personal loan is that a personal loan is an unsecured loan. This means that you needn’t furnish any documents or securities as a collateral for your loan. This also means that the turnaround time for a personal loan is much lesser than the turnaround time for secured loans.

Vendanta repays $100 mn loan to Standard Chartered Bank

Mar 16, 2023, at 03:37 am

Mumbai: Vedanta Resources Ltd said on Wednesday it prepaid $100 million to Standard Chartered Bank via release of encumbrance on March 10.

How can I get a Two Wheeler Loan at a lower interest rate?

Feb 24, 2023, at 05:09 pm

Getting a two-wheeler can be a costly affair. However, if you fund it correctly, it can lower the immediate burden of payment on you. One way to do this is to get a two wheeler loan. This option is attractive as it allows you to spread your payments over a longer time frame. You can make it even more beneficial by securing the loan at a lower interest rate. Let us understand how you can do this.

How Long Will It Take for Me to Receive My Personal Loan?

Nov 30, 2022, at 09:36 pm

Nowadays, a Personal Loan is in huge demand as there is no end-use restriction on its usage. Right from renovating a home and planning a wedding to higher education and medical emergencies, a Personal Loan can be used to meet all your financial requirements. A lot of lenders offer easy and affordable Personal Loan solutions to customers. However, there remains confusion when it comes to approval and disbursement timeline.

Smart Tips to Avail Best Rates on Your Two-Wheeler Loan

Sep 28, 2022, at 04:59 pm

When buses are always overcrowded and auto rickshaws deny you a ride, your daily commute can become a nightmare. Then, it's time to consider buying a new two-wheeler. Two-wheelers are not only convenient and fuel-efficient; they have now become much more affordable, thanks to easy access to two-wheeler loans.

Have these documents in hand before applying for a two-wheeler loan!

Sep 23, 2022, at 07:11 pm

The growing demand for two-wheelers in the country has been met with equally significant growth in bike loan financing options. While buying a dream bike may be high on one’s priority list, one cannot hope to bypass already existing financial responsibilities with such a substantial one-time investment. This is where two-wheeler loans come in handy. With up to 100% financing options, they allow you to buy your dream bike and pay for the same in EMIs over a customised tenor without compromising on your existing financial responsibilities. To make the application process easier, lenders have instituted a minimum documentation policy, whereby you can avail of a two-wheeler loan by submitting just a few basic documents. Let’s take a look at this list of basic documents required for a bike loan.

How to Apply for Touchless Personal Loans Online?

May 14, 2022, at 08:57 pm

Muthoot Finance plans to expand Gold Loan@Home services

May 05, 2022, at 05:03 am

Gold loan company Muthoot Finance Ltd is planning to rapidly expand its offering of Gold Loan@Home from 100+ locations to across 5400+ pan-India branches.

Get Quick Disbursal on Your Loan with Fullerton Loan App

Feb 23, 2022, at 05:43 pm

Personal loans are collateral-free financial instruments that help when you need money to achieve your goals or dreams. When there is an emergency, and you do not have time to visit the lender's office and complete the formalities, you can apply for a personal loan through the Fullerton India Personal Loan App from your smartphone itself. Launched and operated under the brand name of Fullerton India, the personal loan app gives you access to the needed funds at the right time without much ado.

How Does an EMI Loan Calculator Work? What are The Main Features?

Nov 23, 2021, at 05:14 pm

Personal loans are a versatile financing option. It can help you cater to urgent cash needs like a medical emergency or a business crisis. You can also use the funds to meet high-end expenses like an international trip, home renovation or a foreign degree. The loans are usually unsecured. You do not have to provide collateral. All you have to ensure is a good credit score to get the loan application approved. But, before getting a personal loan, have a clear idea of the EMI. Here’s why:

5 reasons why a Personal Loan is a great way to manage your wedding expenses

Nov 01, 2021, at 08:29 pm

A wedding is one of life’s most memorable events. So much so that families leave no stone unturned to ensure that a marriage is celebrated with grandeur. Indians are known for their grand wedding celebrations, and now with the restrictions easing, the season for weddings is back. Some prefer an awe-inspiring and traditional wedding with all customs included. Others opt for a personalised, intimate wedding, ensuring they fulfil their special day's desires. Despite what you choose, organising the wedding of your dreams requires ample finances.

Major factors to focus on when opting for a personal loan

Oct 18, 2021, at 06:34 pm

What is a loan on a Credit Card? How does it work?

Oct 05, 2021, at 07:57 pm

Using your credit card is the best way to meet your short-term financial requirements. Banks and financial institutions offer credit cards with a credit limit based on your credit history. You can use your credit limit to pay for expenses, such as groceries, rents, etc. You can use a credit card for almost anything, provided you are not crossing the credit limit.

Get Instant Digital Home Loan Sanction Letter with Bajaj Finserv

Feb 09, 2021, at 12:46 am

The popularity of online banking and transactions has paved the way for accelerated growth of fintech companies. The fast-paced lifestyle of most individuals is a major proponent for such online service providers. Among the services offered by fintech organisations, alongside online credit disbursal facilities, digital home loan sanction letter issuance has also gained ground in recent years. Bajaj Finserv is one such HFC, which has incorporated such digitisation seamlessly into its financial products.

Paying High Interest on Home loan? Here is How to Reduce Your EMI

Jan 23, 2021, at 01:26 am

India’s lendingmarket is enjoying a 15-year low home loan interest rates, thanks to multiple repo rate cuts introduced in 2020. Some lenders are offering such housing credit at rates lower than 7% per annum.

Things to Keep in Mind While Choosing the Right Lender for Two Wheeler Finance

Dec 25, 2020, at 08:41 pm

Digitisation of financial services has drastically changed the way lenders work with and perceive customers. Those days when a high wall existed between lenders and customers, and applying for a loan involved a lot of paperwork and hassle, is now over. Today, lenders act as facilitators and as solution providers while engaging with customers, to build a good relationship. You, the customer, is indeed the king, and you can make a choice from a variety of lenders for your two wheeler finance. If you are availing a credit line to finance it, you are inadvertently entering a long-term agreement with your lender and you want to be sure you do not get any unpleasant surprises later on. So here are some tips to help you choose the right lender for financing your two wheeler.