Nirmala Sitharaman to hold pre-Budget consultations with finance ministers of states

Dec 19, 2024, at 07:28 pm

Jaisalmer (Rajasthan): Finance Minister Nirmala Sitharaman is scheduled to hold pre-Budget consultations with state finance ministers on Friday in Jaisalmer, ahead of the Union Budget 2025-26 presentation, media reports said.

Dec 19, 2024, at 02:05 pm

New Delhi: Fugitive businessman Vijay Mallya on Wednesday said that banks have recovered Rs 14,131.60 crore from him "against the judgement debt of Rs 6203 crore," yet he remains "an economic offender."

Dec 17, 2024, at 06:13 pm

New Delhi: Finance Minister Nirmala Sitharaman told the Lok Sabha on Tuesday that the government views the GDP growth slowdown in Q2FY25 as "a temporary blip" and expects improvement in the upcoming quarters.

Sitharaman bats for capex over free cash transfers to boost consumption

Dec 17, 2024, at 04:53 pm

New Delhi: Finance Minister Nirmala Sitharaman on Tuesday asserted that capital expenditure (capex) is a more effective way to boost consumption than simply “putting money in the hands of the people,” media reports said.

Finance Minister Nirmala Sitharaman to start pre-Budget consultations

Dec 06, 2024, at 05:13 am

New Delhi: Finance Minister Nirmala Sitharaman will start pre-Budget consultations with various stakeholders on Friday as part of preparations for the Union Budget 2025-26.

Central government increases loan limit under Pradhan Mantri Mudra Yojana (PMMY) to Rs.20 lakh

Oct 25, 2024, at 10:29 pm

The Centre on Friday announced the limit of Mudra loans under the Pradhan Mantri Mudra Yojana (PMMY) has been enhanced from current Rs. 10 lakh to Rs. 20 lakh.

India, Uzbekistan sign Bilateral Investment Treaty in Tashkent

Sep 27, 2024, at 11:04 pm

India and Uzbekistan signed the Bilateral Investment Treaty (BIT) in Tashkent which promises to increase the confidence of investors in both the countries.

Govt to raise Rs 6.61 lakh cr via market borrowings in H2 FY 2024-25

Sep 27, 2024, at 05:33 am

New Delhi: The Central government, in collaboration with the Reserve Bank of India (RBI), announced on Thursday its plan to raise Rs 6.61 lakh crore through market borrowings during the October-March period of the current financial year 2024-25.

Sep 22, 2024, at 03:42 am

New Delhi/IBNS: Finance Minister Nirmala Sitharaman chaired a review meeting on Friday (Sept. 20) to assess the Ministry of Housing and Urban Affairs' capital expenditure for the current fiscal year, where she urged officials to fully utilize the budgeted capital expenditure of Rs 28,628 crore and meet the fiscal year’s capex targets.

Govt raises MSME lending target to Rs 27.5 lakh cr for FY25

Sep 19, 2024, at 04:39 am

New Delhi: The Union government has raised its lending target for Micro, Small, and Medium Enterprises (MSMEs) to Rs 27.5 lakh crore for FY25, marking an increase of over 10% compared to the previous year, media report said.

Big push for capex: Finance Minister Nirmala Sitharaman eases norms for expenditure over Rs 500 cr

Sep 05, 2024, at 05:39 am

New Delhi: The finance ministry has eased rules for expenditures exceeding Rs 500 crore to speed up capital expenditure, which is set at Rs 11.11 lakh crore for the current fiscal year, News agency PTI reported.

New MSME credit assessment model for PSBs likely to be launched in March 2025: Report

Sep 02, 2024, at 05:15 pm

New Delhi/IBNS: The new micro, small and medium enterprise (MSME) credit assessment model, based on digital footprints for public sector banks (PSBS), is expected to be unveiled by the end of March next year (2025), Business Standard reported, citing sources in the know.

FM Nirmala Sitharaman approves 'Navratna' status for four CPSEs

Aug 31, 2024, at 07:58 pm

New Delhi/IBNS: Union Finance Minister Nirmala Sitharaman on Friday (August 30) approved the upgradation of four Central Public Sector Enterprises (CPSEs) to a Navratna status.

GST Council meeting next month to discuss tax rate rationalization: FM

Aug 28, 2024, at 04:32 am

New Delhi: Finance Minister Nirmala Sitharaman announced on Tuesday that the GST Council will discuss the rationalization of tax rates next month though a final decision on adjusting taxes and slabs will be made later.

Bank FD rates surge to 9.5%, now 47% of FDs held by senior citizens

Aug 20, 2024, at 06:44 pm

New Delhi/IBNS: Bank fixed deposit (FD) interest rates have touched 9.5 percent, which is a significant development for the investors who believe in FDs as a critical foundation in their investment portfolio.

FM Nirmala Sitharaman asks PSBs to make 'concerted' efforts for special deposit drives

Aug 20, 2024, at 05:28 pm

New Delhi/IBNS: Union Finance Minister Nirmala Sitharaman on Monday (August 19) called for a collaborative approach between banks, the government, regulators, and security agencies, amid rising cyber threats.

Aug 10, 2024, at 10:42 pm

New Delhi/IBNS: Union Finance Minister Nirmala Sitharaman on Saturday (Aug 10) urged banks to focus on ‘core banking’ and to bring in innovative products to mobilise deposits during a meeting with members of the Reserve Bank of India’s (RBI) Central Board of Directors, reports said.

GST on health and life insurance premiums may be reduced: Report

Aug 08, 2024, at 10:44 pm

New Delhi/IBNS: The Goods and Services Tax (GST) rate on the premium paid on health and life insurance may be reduced as a proposal in this regard has been sent to the GST rate rationalisation committee, CNBC-Awaaz reported on Thursday (Aug 8) citing sources familiar with the development.

Govt to not go easy on Infosys over Rs 32,000 cr GST demand

Aug 07, 2024, at 06:15 am

New Delhi: The government is not considering any relaxation of the tax demand sent to Infosys last month, Reuters reported, citing a government source.

Govt likely to raise STCG tax above 20% in future, says official

Jul 31, 2024, at 08:26 pm

New Delhi/IBNS: The government is likely to consider further raising the short-term capital gain (STCG) tax rates in the coming years, Moneycontrol reported quoting a senior government official.

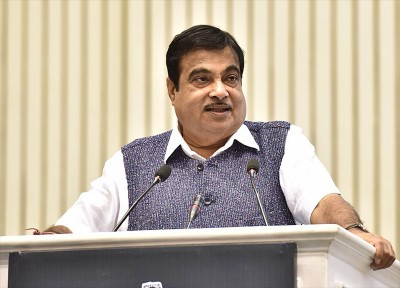

Jul 31, 2024, at 05:58 pm

New Delhi/IBNS: Nitin Gadkari, the Union road, transport and highways minister, has written to finance minister Nirmala Sitharaman, seeking withdrawal of the 18 percent Goods and Services Tax (GST) on life and medical insurance premiums, reports MoneyControl.

iPhones get cheaper by up to Rs 6,000 after customs duty relief in Budget

Jul 27, 2024, at 07:44 am

New Delhi: Apple has reduced the prices of its iPhones by 3-4% across its entire range, allowing customers to save between Rs 5,100 and Rs 6,000 on Pro or Pro Max models.

Foreign investors pull out $1.27 billion from Indian stock market after Union Budget

Jul 26, 2024, at 05:10 pm

Mumbai/IBNS: Foreign portfolio investors (FPIs) have taken out almost Rs 10,710 crore ($1.27 billion) from the Indian stock market in the last three days after the government, in the Union Budget, raised taxes on derivatives trades and on capital gains from equity investments, reports said.

Gold, silver prices plummet by Rs 4,000 after budget slashes custom duty

Jul 24, 2024, at 04:07 am

New Delhi: Finance Minister Nirmala Sitharaman announced a significant reduction in customs duties on gold and silver during her Budget presentation on Tuesday.

Real estate stocks fall after Budget removes indexation benefit on LTCG

Jul 24, 2024, at 01:01 am

Mumbai: Real estate stocks dropped following Finance Minister Nirmala Sitharaman's proposal to remove the indexation benefit for calculating long-term capital gains tax (LTCG) on real estate.

Union Budget: Government will implement 3 schemes for 'Employment Linked Incentive'

Jul 23, 2024, at 11:46 pm

The Government will implement 3 schemes for ‘Employment Linked Incentive’, as part of the Prime Minister’s package.

Union Budget: Land reform and actions to be incentivised for completion within next 3 years

Jul 23, 2024, at 11:42 pm

While presenting the Union Budget 2024-25 in Parliament on Tuesday, the Union Minister for Finance and Corporate Affairs, Nirmala Sitharaman said land-related reforms and actions, both in rural and urban areas, will be incentivized for completion within the next 3 years through appropriate fiscal support.

Jul 23, 2024, at 11:13 pm

New Delhi: Finance Minister Nirmala Sitharaman presented the 2024-25 Budget on Tuesday, her seventh consecutive budget presentation and setting a new record, surpassing former Prime Minister Morarji Desai. This budget is the first of Prime Minister Narendra Modi's third term. Sitharaman underscored the government's success in maintaining economic stability.

Jul 23, 2024, at 10:20 pm

Union Finance Minister Nirmala Sitharaman has announced several measures to step up adoption of technology towards digitalization of the economy.

Jul 23, 2024, at 10:11 pm

Union Minister for Finance & Corporate Affairs Nirmala Sitharaman announced a financial support for loans upto Rs. 10 lakh for higher education in domestic institutions for helping youth who have not been eligible for any benefit under government schemes and policies.