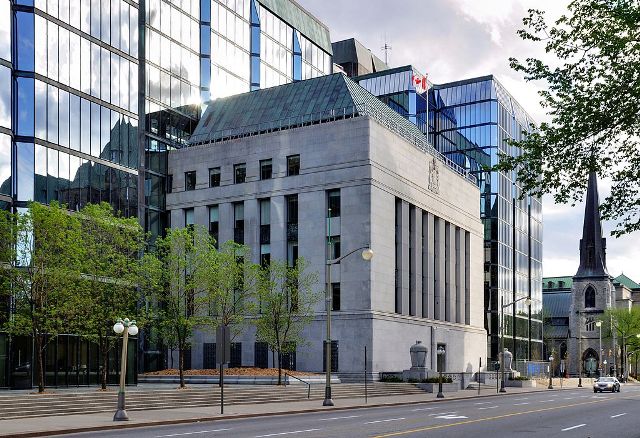

Hike in key interest rate will cost of mortgage and loans more: Bank of Canada

“Recent data have bolstered the Bank’s confidence in its outlook for above-potential growth and the absorption of excess capacity in the economy. The Bank acknowledges recent softness in inflation but judges this to be temporary. Recognizing the lag between monetary policy actions and future inflation, Governing Council considers it appropriate to raise its overnight rate target at this time,” Bank of Canada said.

At a press conference on the Monetary Policy Report on Wednesday, Stephen S. Poloz, Governor of Bank of Canada and Carolyn A. Wilkins Senior Deputy Governor of Bank of Canada said this in an opening statement.

“Today, we raised our key policy rate by 25 basis points, in the context of an economy that is approaching full capacity and with inflation expected to reach the 2 per cent target within the next year" they said.

Earlier in 2015, the Bank of Canada had cut interests rates by a quarter of a percentage point twice in that year to help the economy adjust

itself with increased oil prices.

“Growth is broadening across industries and regions and therefore becoming more sustainable. As the adjustment to lower oil prices is

largely complete, both the goods and services sectors are expanding" the bank said.

"The Bank estimates real GDP growth will moderate further over the projection horizon, from 2.8 per cent in 2017 to 2.0 per cent

in 2018 and 1.6 per cent in 2019” the bank said in a statement.

Sherry Cooper, chief economist at Dominion Lending Centres, said another rate hike was expected in the fourth quarter of this year.

"The Federal Reserve will also likely increase rates in [the fourth quarter]," Cooper said. "Look for a slow crawl upward in

interest rates from both central banks in 2018."

As a result of the rate increase, the Canadian dollar also shot up and was trading at 78.03 cents US late Wednesday morning.

The Bank of Canada said while business investment was expected to rise, it also expects increased exports in the coming quarters leading

to better contribution to growth.

The bank also expected consumer spending to be a significant contributor to the economy, but it said high levels of household debt and a slowdown in the housing market are a big burden on spending power of the people.

The Bank of Canada said its next scheduled rate announcement is set for Sept. 6.

(Reporting by Asha Bajaj)

Image of Bank of Canada: Wikipedia

Image of StephenS.Poloz: Twitter

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.