Will the RBI repo rate cut lead to reduced FD interest rates?

The Reserve Bank of India (RBI) announced a 40-basis point cut in the repo rate and reverse repo rate. After the rate cut, the repo rate stands at 4% and the reverse repo rate at 3.35%. This is the third time the RBI Governor Shaktikanta Das has briefed the media, on measures to boost the economy.

How repo rate affects your fixed deposit investments?

This recent spate of repo rate cuts by the Reserve Bank of India could be great news for borrowers, whose loans are linked to these repo rates. However, the repo rates are also external benchmarks, which impact the interest rates for fixed deposit, savings accounts and other fixed-income instruments.

With reduction in reverse repo rates, banks will be forced to reduce their lending rate margins to customers, instead of lending it to the RBI, offering a lower interest rate. This will result in increasing liquidity, and hence, a downward pressure will be exerted on interest rates offered by banks on deposits and other fixed-income saving instruments. In the past, any reductions in the repo rates have been followed by major reductions in FD rates by banks and financiers.

Ways to grow savings before FD interest rates fall

Fixed deposit has always been a preferred investment avenue for investors looking for guaranteed returns, especially in an underperforming economy. It is risky to invest in market-linked instruments right now, especially as the stock market is on a volatile trajectory and news about corporate defaults and liquidity issues with debt funds. However, FD interest rates have already been low and have been averaging around 4-6%, due to the repeated repo rate cuts in the recent past.

Post this announcement, FD rates in India are likely to fall further, offering very low returns. But, it is not too late to lock in to the best FD interest rates offered by financiers like Bajaj Finance Fixed Deposit. It seems to be an opportune time to invest in this Fixed Deposit that is still offering one of the best FD rates of up to 7.60%, which offer the right solution to low FD interest rates and risk mitigation.

For those worrying about corporate FD defaults, Bajaj Finance offers the assurance of highest safety, especially with the highest safety ratings of FAAA by CRISIL and MAAA by ICRA. These are the highest ratings by both these reputed credit rating agencies, which indicate that your money is safe with this deposit.

Secure your savings with a Bajaj Finance Fixed Deposit

Investing in a Bajaj Finance Fixed Deposit is a great choice for any investor, regardless of the risk type. Those who have invested heavily in equities can consider investing a portion of their savings in this FD, to diversify the risk and be assured of guaranteed returns. Additionally, Bajaj Finance FD is one of the best investment avenues for senior citizens, who are majorly dependent on interest income from fixed deposits.

Due to the reduction in interest rates by most financiers, the returns offered to senior citizens will also fall. However, Bajaj Finance Fixed Deposit offers 0.25% higher FD interest rates to senior citizens. Thus, senior citizens can easily earn one of the highest fixed deposit interest rates of 7.85% offered by Bajaj Finance FD. To plan your investments, and determine how much you can earn with this FD, you can use the Bajaj Finance FD interest rates calculator.

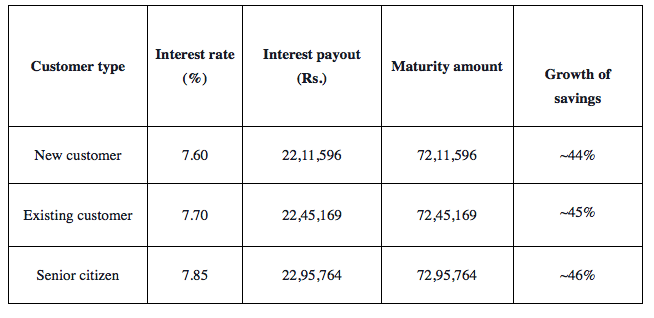

The returns and interest rates vary basis your customer type, and tenure you select. To understand this better, let’s assume an amount of Rs. 50,00,000 has been invested in a Bajaj Finance Fixed Deposit for a tenure of 5 years. Let’s see how the returns vary for different customer types.

The above values have been computed from the Bajaj Finance online FD Calculator. Using this FD calculator monthly interest and total maturity amount can also be determined. During these times of economic distress, it may be difficult to get expected returns from other investments.

However, with Bajaj Finance FD, you can easily finance your long-term and short-term goals. What’s more – existing customers can also invest in a Bajaj Finance online FD from the comfort of their homes. However, in the current regime of repeated rate cuts, it is best to lock in to the prevailing FD interest rates, and grow your savings with Bajaj Finance FD. Make a smart choice, and reap the benefits of guaranteed returns on your deposit. You can also use this FD as a contingency fund, and avail a Loan against FD during emergencies.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.