CRR cut, AI ethics push, and SORR benchmark: Experts hail RBI’s pragmatic policy moves

Dec 07, 2024, at 05:04 am

Mumbai: The Reserve Bank of India (RBI) has kept the repo rate unchanged at 6.5% while the cash reserve ratio (CRR) has been slashed by 50 basis points to 4 percent.

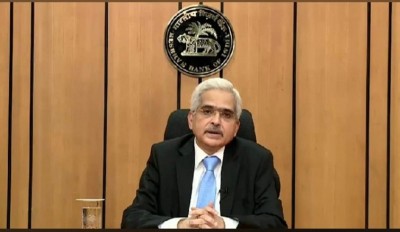

De-dollarisation not on India's agenda; derisking domestic trade is: RBI Governor Shaktikanta Das

Dec 06, 2024, at 11:30 pm

Mumbai: India has not initiated any steps towards de-dollarisation and is solely focused on mitigating risks to domestic trade from geopolitical uncertainties, Reserve Bank of India (RBI) Governor Shaktikanta Das clarified on Friday, media reports said.

RBI keeps repo rate unchanged at 6.5%, slashes CRR to 4 percent

Dec 06, 2024, at 04:47 pm

New Delhi/IBNS: The Reserve Bank of India (RBI) has kept the repo rate unchanged at 6.5% while the cash reserve ratio (CRR) has been slashed by 50 basis points to 4 percent, media reports said.

RBI to announce key interest rate decision tomorrow morning as 3-day MPC ends

Dec 06, 2024, at 04:37 am

Mumbai: The Reserve Bank of India (RBI) is set to announce its interest rate decision on Friday morning following the conclusion of a three-day meeting of the Monetary Policy Committee (MPC), amid persistent inflation and sluggish GDP growth.

RBI's MPC meeting begins amid inflation worries

Dec 04, 2024, at 10:59 pm

Mumbai: The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) began its three-day meeting in Mumbai today to review the country's policy rate.

Oct 10, 2024, at 02:02 am

Mumbai: The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC), in its meeting held from October 7 to 9, announced on Wednesday that the benchmark repo rate will remain steady at 6.5 percent.

RBI MPC meeting: Central bank keeps repo rate unchanged at 6.5%, stance changed to 'neutral'

Oct 09, 2024, at 06:43 pm

New Delhi/IBNS: The Reserve Bank of India's (RBI) reconstituted Monetary Policy Committee (MPC), which met from October 7 to 9, announced on Wednesday (Oct. 9) that it would keep the benchmark repo rate unchanged at 6.5 percent.

RBI keeps repo rate unchanged at 6.5% for ninth time in a row

Aug 08, 2024, at 06:55 pm

Mumbai/IBNS: The Reserve Bank of India (RBI) on Thursday (Aug 8) kept the repo rate — the central bank's rate for short-term loans to banks — unchanged at 6.5 percent by 4:2 majority, maintaining withdrawal of accommodation.

Nifty Realty Index rises 1.55% as RBI keeps repo rate unchanged

Jun 07, 2024, at 07:42 pm

Mumbai/IBNS: The rate-sensitive Nifty Realty Index on Friday surged over 1.55 percent as the Reserve Bank of India (RBI) kept the repo rate and liquidity stance unchanged during the June 2024 monetary policy review.

RBI keeps repo rate unchanged in line with market expectations

Apr 06, 2024, at 04:54 am

Mumbai: The Reserve Bank of India on Friday kept the key interest rates unchanged at 6.50 percent, in line with the market expectations.

Market experts divided on RBI's choice to maintain key policy rate

Feb 09, 2024, at 06:12 am

New Delhi: As widely anticipated by financial markets and policy observers, the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) opted to maintain the policy repo rate at its current level of 6.50 percent during its meeting on Thursday.

RBI keeps repo rate unchanged at 6.5%, pegs FY25 GDP growth at 7 percent

Feb 08, 2024, at 05:10 pm

Mumbai/UNI: As widely expected by markets and policy-watchers, the Reserve Bank of India (RBI)'s Monetary Policy Committee (MPC) on Thursday decided to keep the policy repo rate unchanged at 6.50 per cent.

RBI likely to keep policy repo rate unchanged in the next MPC meet: Quantum AMC

Feb 08, 2024, at 04:56 am

Mumbai: The Reserve Bank of India (RBI) is likely to keep the policy repo rate unchanged in the upcoming monetary policy review meet, according to Quantum Asset Management.

RBI MPC keeps repo rate unchanged, raises FY24 growth forecast to 7%; Industry reacts

Dec 09, 2023, at 03:37 am

Mumbai: The Reserve Bank of India's Monetary Policy Committee (RBI MPC) kept the repo rate unchanged at 6.5 percent for the fifth time in a row on Friday, thus maintaining the status quo.

RBI raises UPI transaction limit for hospitals, educational institutions to Rs. 5 lakh

Dec 08, 2023, at 05:44 pm

New Delhi/IBNS/UNI: In a significant step, the Reserve Bank of India (RBI) on Friday announced the raise of the Unified Payments Interface (UPI) transaction limit for hospitals and educational institutions to Rs. 5 lakh, media reports said.

RBI's MPC meeting starts amid anticipations of status quo on key interest rate

Dec 07, 2023, at 06:34 am

Mumbai: As the Reserve Bank of India (RBI) commenced its three-day Monetary Policy Committee (MPC) on Wednesday, expectations are high that the Central bank will adhere to the current state of affairs regarding the repo rate, opting to retain it at 6.5%.

Oct 07, 2023, at 06:05 am

Mumbai: The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Friday announced it will maintain the repo rate at 6.5 percent for the fourth consecutive time.

RBI's Monetary Policy Committee likely to keep repo rate steady at 6.50%: Report

Oct 04, 2023, at 06:33 am

Mumbai: Experts are anticipating that the Monetary Policy Committee (MPC) will keep the repo rate steady at 6.50 percent and sustain a stance of 'Withdrawal of Accommodation' in the forthcoming October monetary policy.

RBI’s policy hawkish to the rising inflationary risks: HDFC treasury research

Aug 10, 2023, at 11:51 pm

Mumbai: The RBI kept its policy rate unchanged at 6.5% in line with expectations. Moreover, it continued with its stance of “withdrawal of accommodation” with a 5:1 vote.

RBI maintains status quo, policy repo rate unchanged at 6.50%

Aug 10, 2023, at 05:05 pm

Mumbai/UNI/IBNS: As widely expected by economists and market watchers, Reserve Bank of India (RBI) on Thursday kept the policy repo rate unchanged at 6.50%.

RBI keeps repo rate unchanged: Here’s what the banking and finance industry has to say

Jun 09, 2023, at 07:46 am

Mumbai: As expected, the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI), after three days of deliberation, on Thursday kept the repo rate unchanged at 6.5%.

RBI keeps repo rate unchanged at 6.5%

Jun 08, 2023, at 04:46 pm

Mumbai/UNI: Amid downward trend in retail inflation and staying in its target range, the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Thursday kept the repo rate unchanged at 6.5%.

RBI's MPC panel likely to maintain status quo on key policy rate in June meeting

Jun 05, 2023, at 05:30 am

Mumbai: The Reserve Bank of India is likely to maintain a status quo over the policy stance in the June policy review as well, opine experts.

Banks and financial institutions welcome RBI's 'surprise' move to pause repo rate hike for now

Apr 07, 2023, at 05:22 am

Mumbai/IBNS: The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) on Thursday decided to keep the repo rate unchanged at 6.5%. This came as a big relief as most experts had opined that the apex bank should take a pause amid global economic uncertainties and the economy has reached a saturation point beyond which it may be difficult to absorb any more rate hikes.

RBI MPC meet: Rate setting panel to announce decision on key lending rates on Thursday

Apr 06, 2023, at 05:57 am

Mumbai: The Reserve Bank of India is expected to declare another increase in interest rates on Thursday, as part of its bi-monthly review of monetary policy, said reports.

RBI should stop hiking the key lending rate further: Assocham Prez Ajay Singh

Apr 05, 2023, at 05:04 am

Mumbai: The Reserve Bank of India (RBI) should stop hiking the key lending rate in view of the current uncertainties in the global business environment, Assocham President and SpiceJet CEO Ajay Singh said on Tuesday.

RBI injects Rs 1.1 trillion in largest infusion since Apr 2019

Mar 18, 2023, at 03:57 am

Mumbai: The Reserve Bank of India injected Rs 1.1 trillion into the system on Thursday, marking the largest single-day liquidity infusion since April 24, 2019. This comes amid onset of corporate advance taxes leading to significant outflows from the banking system

RBI hikes repo rate by 25 bps to 6.5 %, pegs FY24 inflation at 5.6%: Experts react

Feb 09, 2023, at 03:04 am

Mumbai/IBNS: The Reserve Bank of India on Wednesday hiked the repo rate by 25 basis points to 6.50 percent in line with the expectations of the experts. However, it didn’t indicate an end to tightening its stance contrary to the market expectations.

RBI increases repo rate to 6.5 pct

Feb 08, 2023, at 03:50 pm

Mumbai: RBI Governor Shaktikanta Das on Wednesday announced the decision to hike repo rate by 25 basis points to 6.5 percent.

RBI raises repo rate by 35 bps, lowers GDP growth forecast to 6.8%

Dec 07, 2022, at 07:08 pm

Mumbai/UNI: The Reserve Bank of India (RBI) on Wednesday raised policy repo rate by 35 basis points (bps) to contain inflation which has been above its tolerance level.