CBEC issues clarification regarding GST for restaurants

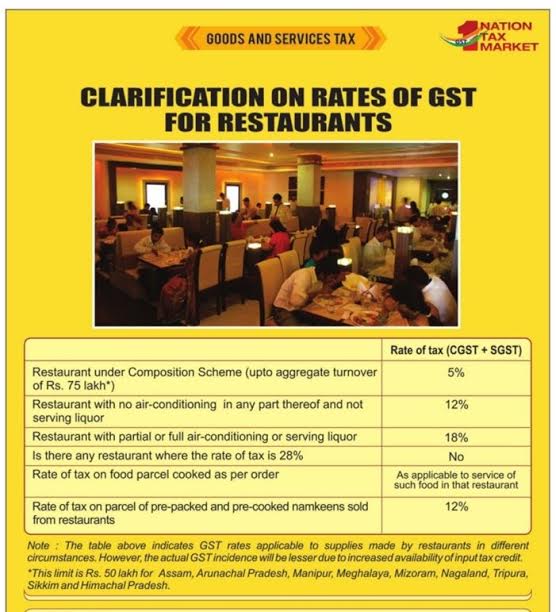

A PIB tweet indicated in a table the GST rates applicable to supplies made by restaurants under different circumstances

The clarification states that the rate of tax (CGST+SGST) for restaurants under the Composition Scheme (upto aggregate turnover of Rs 75 lakh) will be five per cent. Theaggregate turnover limit is Rs 50 lakh for Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Tripura, Sikkim and Himachal Pradesh.

That for restaurants with no air-conditioning in any part thereof and serving liquor will be 12 per cent.

GST for restaurants with partial or full air-conditioning or serving liquor will be 18 per cent.

The rate of tax on food parcel cooked as per order will be as applicable to service of such food in that restaurant.

The rate of tax on parcel of prepacked and precooked namkeens sold in restaurants will be 12 per cent.

Image: PIB India Twitter

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.