Govt withdraws Income Tax Bill, 2025; revised version to be tabled on Aug 11

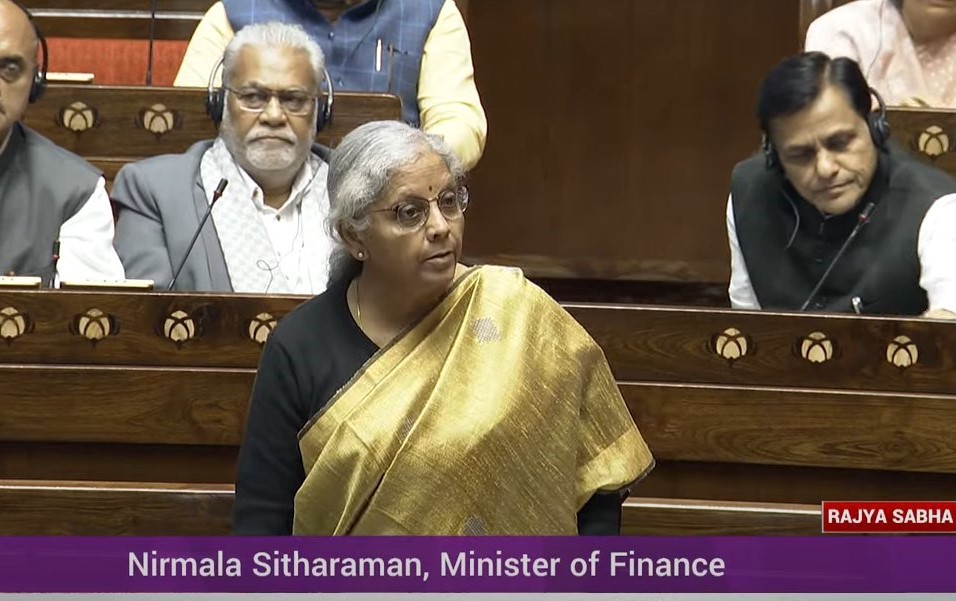

New Delhi: Finance Minister Nirmala Sitharaman on Friday withdrew the Income Tax Bill, 2025, from the Lok Sabha, with the government set to bring in a revised version incorporating recommendations of the Select Committee.

The new draft will be tabled in the Lower House on August 11 and will replace the six-decade-old Income Tax Act, 1961, news agency PTI reported.

Sources said the updated version will integrate most suggestions made by the Select Committee to ensure “clarity and avoid confusion” from having multiple versions of the Bill, according to the report.

The Income Tax Bill was originally introduced on February 13 this year and referred to the 31-member Select Committee, chaired by Baijayant Panda, for detailed scrutiny.

The panel proposed several amendments, including retaining the tax exemption on anonymous donations to purely religious trusts, and allowing taxpayers to claim TDS refunds even after the ITR filing deadline without penalty.

As per the revised provisions, non-profit organisations will remain exempt from paying tax on anonymous donations if they are purely religious in nature.

However, religious trusts engaged in other charitable activities—such as running hospitals or educational institutions—will continue to be taxed on such donations under the law.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.