SBI reduces charges for non-maintenance of average minimum balance, says will benefit 25 crore bank customers

Mumbai, Mar 13 (IBNS): India's largest lender, the State Bank of India (SBI), announced on Tuesday that it has reduced the charges for non-maintenance of minimum balance by upto 75 per cent.

The revised charges will be effective from April 1, 2018.

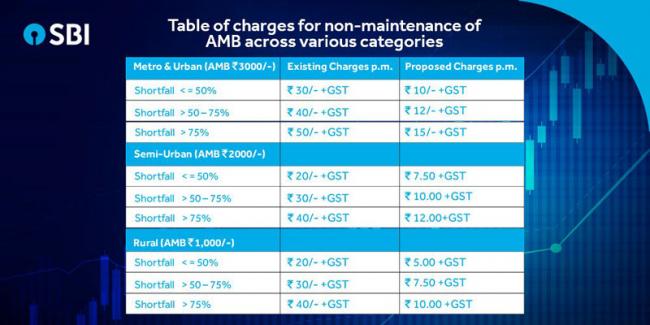

For customers in Metro and Urban centres, the charges for non-maintenance of AMB have been reduced from a maximum of Rs 50 per month to Rs 15 per month; for Semi-Urban and Rural centres, the charges have been reduced from Rs 40 every month to Rs 12 and Rs 10.

GST charges will be applicable over and above the rates mentioned above.

According to media reports, this decision was taken following some criticism that the bank earned Rs 1,771 crore in just eight months from depositors who failed to maintain balance.

However, SBI in its official release said, "This step is taken keeping in view the feedback from various stakeholders."

P K Gupta, MD – Retail & Digital Banking, SBI said, “We have reduced these charges taking into account the feedbacks and sentiments of our customers. Bank has always focused on keeping the interests of its customers first and this is one of our many efforts towards fulfilling customer expectations. Bank also offers its customers to shift from regular savings bank account to BSBD account on which no charges are levied.”

According to the release, the reduced rates will benefit 25 crore customers.

The bank has a very strong deposit franchise having 41 crores Savings Bank accounts out of which 16 crore accounts under PMJDY / BSBD and of pensioner/minors/social security benefit holders were already exempted. In addition, students upto the age of 21 years are also exempted, it said in the release.

The bank also clarified that customers always have the option of converting the regular savings bank account to Basic Savings Bank Account (BSBD account), free of charge, in case they desire to avail basic savings bank facilities without being subject to maintenance of AMB.

SBI is the largest commercial bank in India in terms of assets, deposits, profits, branches, customers and employees.

Image: SBI/Twitter

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.