Budget 2026

Budget 2026

India doubles down on manufacturing, infrastructure in Budget 2026–27 to sustain growth

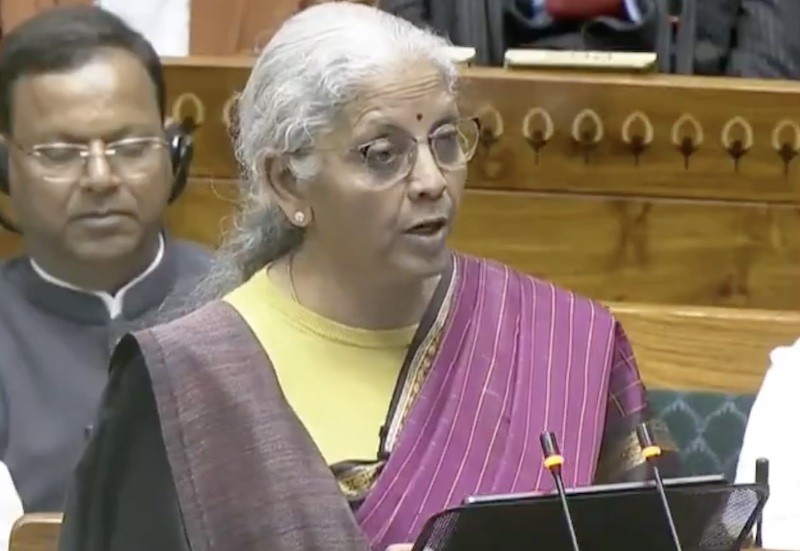

New Delhi/IBNS: India’s Union Budget for 2026–27 placed a renewed bet on manufacturing, infrastructure and technology-led growth as Finance Minister Nirmala Sitharaman sought to sustain economic momentum amid global uncertainty and tighter financial conditions.

Presenting the Budget in Parliament on Saturday, Sitharaman said the government’s priorities for Asia’s third-largest economy would centre on accelerating growth, strengthening competitiveness and building resilience against volatile global dynamics. The Budget also outlined steps to deepen reforms in the financial sector, scale up capital spending and review regulatory frameworks to support long-term expansion.

The fiscal roadmap projected a gradual consolidation, with the debt-to-GDP ratio estimated at 55.6 percent in 2026–27, lower than 56.1 percent in the revised estimates for the current year, while the fiscal deficit was pegged at 4.3 percent of GDP.

The Finance Minister said the Budget, the first to be prepared in Kartavya Bhawan, is anchored around three “kartavyas” — accelerating and sustaining economic growth, fulfilling aspirations and building capacity of people, and ensuring inclusive development aligned with the vision of Sabka Sath, Sabka Vikas.

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman along with the Ministers of State for Finance, Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance arrived for the presentation of the Union Budget-2026 at Parliament House, in New Delhi on February 01, 2026. Photo : PIB

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman along with the Ministers of State for Finance, Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance arrived for the presentation of the Union Budget-2026 at Parliament House, in New Delhi on February 01, 2026. Photo : PIB

Budget estimates and fiscal position

The government estimated non-debt receipts at ₹36.5 lakh crore and total expenditure at ₹53.5 lakh crore for 2026–27, with net tax receipts projected at ₹28.7 lakh crore. Gross market borrowings were estimated at ₹17.2 lakh crore, while net borrowings from dated securities were placed at ₹11.7 lakh crore.

Capital expenditure in the revised estimates for 2025–26 stood at around ₹11 lakh crore, underscoring the continued focus on asset creation.

First Kartavya: Accelerating and sustaining economic growth

Manufacturing push across strategic sectors

The Budget proposed scaling up manufacturing across seven strategic and frontier sectors.

A Biopharma SHAKTI programme was announced with an outlay of ₹10,000 crore over five years to position India as a global biopharma manufacturing hub. This includes setting up three new National Institutes of Pharmaceutical Education and Research, upgrading seven existing ones, and creating a network of over 1,000 accredited clinical trial sites.

India Semiconductor Mission 2.0 will be launched to develop equipment and materials, build full-stack Indian intellectual property, and strengthen supply chains, with a focus on industry-led research and workforce training.

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman along with the Ministers of State for Finance, Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance arrived for the presentation of the Union Budget-2026 at Parliament House, in New Delhi on February 01, 2026. Photo : PIB

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman along with the Ministers of State for Finance, Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance arrived for the presentation of the Union Budget-2026 at Parliament House, in New Delhi on February 01, 2026. Photo : PIB

The outlay for the Electronics Components Manufacturing Scheme was increased to ₹40,000 crore. Dedicated Rare Earth Corridors will be set up in Odisha, Kerala, Andhra Pradesh and Tamil Nadu to support mining, processing and manufacturing.

The government also announced support for three chemical parks through a challenge-based cluster model.

Strengthening capital goods and textiles

Hi-tech tool rooms will be established by CPSEs to enable local design and manufacturing of high-precision components. New schemes were announced for construction and infrastructure equipment manufacturing, as well as container manufacturing with an allocation exceeding ₹10,000 crore over five years.

An integrated programme for the textile sector includes a National Fibre Scheme, modernisation of traditional clusters, mega textile parks, and initiatives to strengthen khadi, handloom and handicrafts.

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman along with the Ministers of State for Finance, Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance arrived for the presentation of the Union Budget-2026 at Parliament House, in New Delhi on February 01, 2026. Photo : PIB

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman along with the Ministers of State for Finance, Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance arrived for the presentation of the Union Budget-2026 at Parliament House, in New Delhi on February 01, 2026. Photo : PIB

Reviving legacy industries and SMEs

A scheme to revive 200 legacy industrial clusters was announced to improve efficiency and cost competitiveness.

To support smaller enterprises, a ₹10,000 crore SME Growth Fund will be launched, while the Self-Reliant India Fund will receive an additional ₹2,000 crore. Professional institutions will help develop “Corporate Mitras” in Tier-II and Tier-III towns.

Infrastructure and logistics

Public capital expenditure will rise to ₹12.2 lakh crore in 2026–27. An Infrastructure Risk Guarantee Fund will be set up to boost private sector confidence.

New freight corridors, expansion of national waterways, coastal cargo incentives, ship repair facilities and support for seaplane operations were announced to promote sustainable transport and logistics.

Energy security and city regions

An outlay of ₹20,000 crore over five years was announced for carbon capture, utilisation and storage technologies.

City Economic Regions will receive ₹5,000 crore over five years through a challenge-based model, while seven high-speed rail corridors will be developed as growth connectors.

Financial sector and investment reforms

The government will set up a High-Level Committee on Banking for Viksit Bharat to review the financial sector. Power Finance Corporation and Rural Electrification Corporation will be restructured to improve efficiency.

Foreign investment rules under FEMA (Non-Debt Instruments) will be comprehensively reviewed to create a more contemporary and investor-friendly framework.

Municipal bond issuances of over ₹1,000 crore will be incentivised to deepen urban finance markets.

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman along with the Ministers of State for Finance, Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance arrived for the presentation of the Union Budget-2026 at Parliament House, in New Delhi on February 01, 2026. Photo : PIB

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman along with the Ministers of State for Finance, Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance arrived for the presentation of the Union Budget-2026 at Parliament House, in New Delhi on February 01, 2026. Photo : PIB

Second Kartavya: Building people’s capacity

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman departs from Kartavya Bhawan to Rashtrapati Bhavan along with the Minister of State for Finance, Shri Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance before presentation of the Union Budget-2026 at Parliament House, in New Delhi on February 01, 2026. Photo : PIB

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman departs from Kartavya Bhawan to Rashtrapati Bhavan along with the Minister of State for Finance, Shri Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance before presentation of the Union Budget-2026 at Parliament House, in New Delhi on February 01, 2026. Photo : PIB

The Budget announced a high-powered standing committee on Education to Employment and Enterprise, focusing on the services sector.

Plans include adding 100,000 allied health professionals over five years, establishing regional medical hubs, expanding AYUSH institutions, boosting veterinary infrastructure, and supporting the creative economy through AVGC labs in schools and colleges.

Tourism initiatives include upgrading hospitality institutions, training guides, creating a national digital knowledge grid, and developing archaeological sites as experiential destinations. A Khelo India Mission was also announced to transform the sports sector.

Third Kartavya: Inclusive growth and regional focus

Measures were announced to raise farmer incomes through reservoir development, high-value agriculture and the Bharat-VISTAAR AI platform.

New schemes will support Divyangjan skilling, expand mental health infrastructure including NIMHANS-2, and focus on Purvodaya and North-Eastern states through industrial corridors, tourism projects and e-mobility.

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman departs from Kartavya Bhawan to Rashtrapati Bhavan along with the Minister of State for Finance, Shri Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance before presentation of the Union Budget-2026 at Parliament House, in New Delhi on February 01, 2026. Photo : PIB

The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman departs from Kartavya Bhawan to Rashtrapati Bhavan along with the Minister of State for Finance, Shri Pankaj Chaudhary as well as her Budget Team/senior officials of the Ministry of Finance before presentation of the Union Budget-2026 at Parliament House, in New Delhi on February 01, 2026. Photo : PIB

Tax reforms and ease of living

The New Income Tax Act, 2025 will come into effect from April 2026, with simplified rules and forms.

Buybacks will be taxed as capital gains for all shareholders, with higher effective rates for promoters. TCS on scrap, minerals and alcoholic liquor will be cut to 2 percent, while STT on derivatives will be raised.

Minimum Alternate Tax will be made a final tax from April 2026, with the rate reduced to 14 percent. Several measures were announced to simplify compliance, rationalise penalties and improve ease of living for taxpayers.

Trade, customs and exports

The Budget proposed tariff simplification, exemptions for critical minerals, electronics, aviation and clean energy, and a trust-based customs framework with faster clearances.

Courier export limits will be removed, baggage rules simplified and new export opportunities opened for fisheries and small businesses.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.