Dun & Bradstreet India MSME survey: GST a game-changer; implementation a challenge

Speaking about the survey findings, Preeta Misra, Director, Learning & Economic Insights Group - India, Dun & Bradstreet, said “MSMEs are understandably excited and anxious on the eve of the rollout of GST. Though there are challenges in terms of readiness, we believe and our survey points out that this game-changing initiative will receive overwhelming support from MSMEs. GST will definitely lay the foundation for a double digit economic growth in the country.”

The Survey touched six critical areas for implementation of GST and probed MSMEs for their inputs on 37 questions.

The Survey touched six critical areas for implementation of GST and probed MSMEs for their inputs on 37 questions.

When probed about the impact on business in India 72% MSMEs believed GST will have high impact on simplification of Indirect Tax structure, while 53% saw a low impact on reduction in compliance requirements.

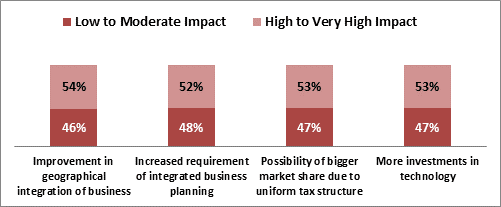

When asked about the impact of GST on their business, 53% were of the opinion that it will increase the technology cost whereas the same number of respondents saw a potential to increase market share due to uniform tax structure.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.